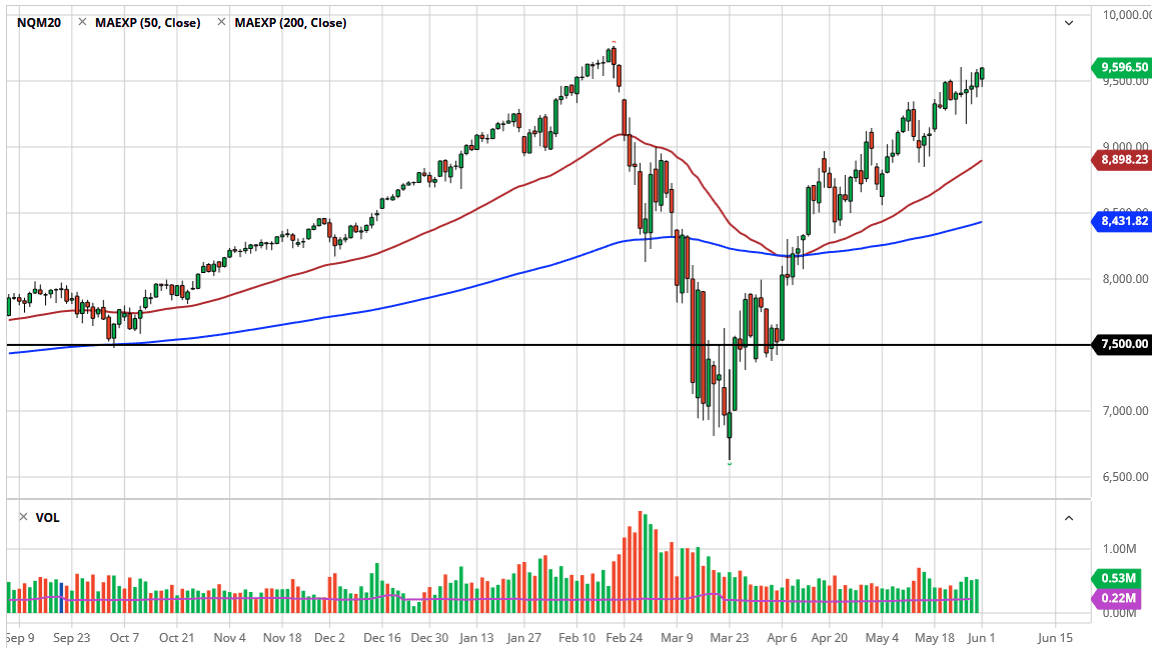

The NASDAQ 100 had pulled back a bit during the trading session on Monday, but as it is so heavily weighted by the favorite stocks on Wall Street, it is likely that the market will continue to go higher. At this point in time it is likely that we will continue to see markets grind their way towards that 9775 area, and then break through there and go looking towards the 10,000 level. In the meantime, it looks like buyers will continue to come in on short-term dips, as we have seen for months now.

The question now is whether or not this market ever gets a serious pullback? Clearly, we have not had that yet, but whether or not you can come up with some type of economic reason for the market to break down, the reality is that it will not. It is obvious that money continues to chase certain tech stocks, and that of course are the top five or so in this index. In other words, it is difficult to imagine a scenario where we can simply short this market based upon the fact that the economy is slowing down. Obviously, Wall Street does not care, and we have seen a nice up trending channel hold for quite some time. Price is truth, and at this point it is likely to continue to act the same way it has.

To the downside, I believe that the 9000 level will offer quite a bit of support, not only due to the fact that it is large, round, psychologically significant figure, but it is also the 50 day EMA roughly, and it certainly will be there by the time we get down to that area even if we break down. Because of this, I believe that the market does find reasons to go higher, mainly because nobody has any other ideas. With that being the case, the market certainly has a lot of FOMO built into it, and that makes it difficult to fight the crowd. The candlestick looks incredibly positive for the session, so I would anticipate more of the same. Ultimately, that is all you can do is follow the trend until it stops the trend that it is in. I think there is nothing more to say other than this is simply momentum that people will be chasing for the foreseeable future.