The NASDAQ 100 fell pretty significantly during the trading session on Friday as traders began to worry about the United States’ situation as there are multiple states showing signs of a spike of the coronavirus. In fact, both Florida and Texas have closed bars back down and delayed the full reopening of the economy is due to the infection increase. Traders on Wall Street were also a bit spooked.

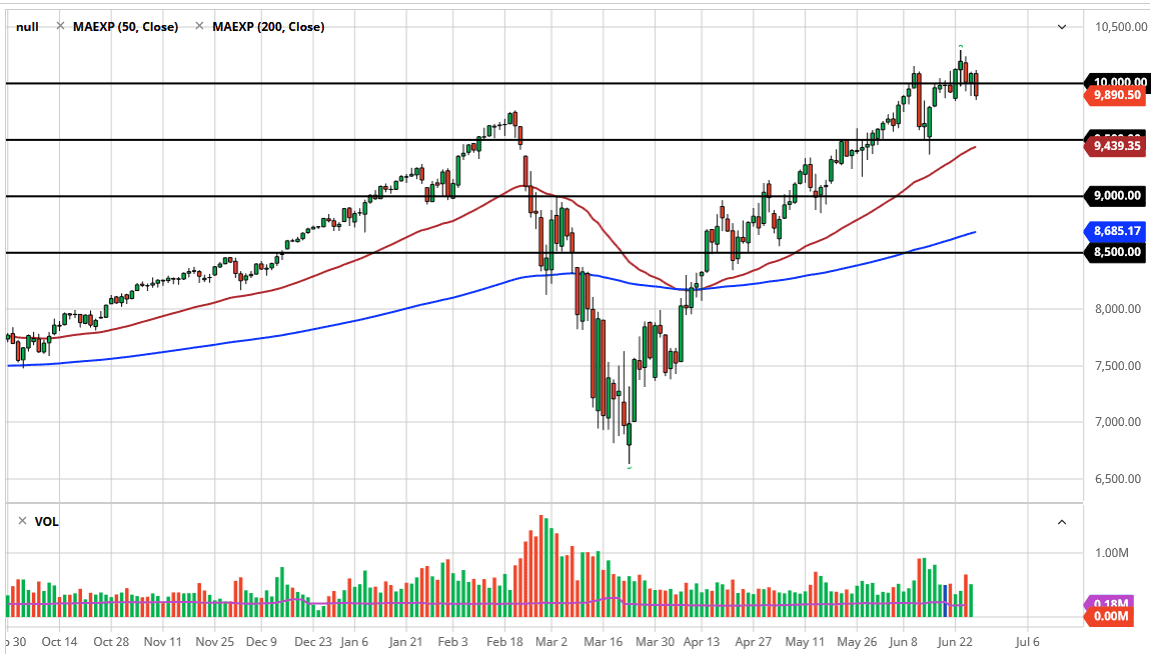

That being said, there is still plenty of support underneath, not only at the 9800 level, but also at the 9500 level which is extraordinarily important. If you squint, you can see that there is an up-trending channel that coincides quite nicely with that level and we have the 50 day EMA in that same general vicinity. Remember, this is a market that is highly levered to Amazon, Alphabet, Facebook, Netflix, and Microsoft. In other words, it is highly levered to the stocks that everybody on Wall Street always runs to. In fact, those stocks alone make up about 33% of the index, so that is why the NASDAQ 100 typically outperforms most of the other indices on Wall Street.

The 9500 level is crucial for support, but even if we break down below there you could see a move down to the 9000 level which would essentially be a 10% correction that people would be looking at as potential buying opportunity. I think if you are patient enough, you should continue to have plenty of buying opportunities in this index. Yes, we may be looking at the beginning of some type of negativity, but at the end of the day it is obvious that this is a market is in an uptrend, and as long as the Federal Reserve is willing to bail out everybody on Wall Street, it is a bit difficult to imagine how it will break down anytime soon. Remember, we have just recently broken above the 10,000 level so it does not surprise me too much that we have struggled in this general vicinity. Eventually, the market will get used to the large levels like this and have less of a psychological effect on trading. It will simply become yet another area that we breakthrough. Therefore, I have no interest in shorting the market, and every time it falls, I look at it as a potential buying opportunity.