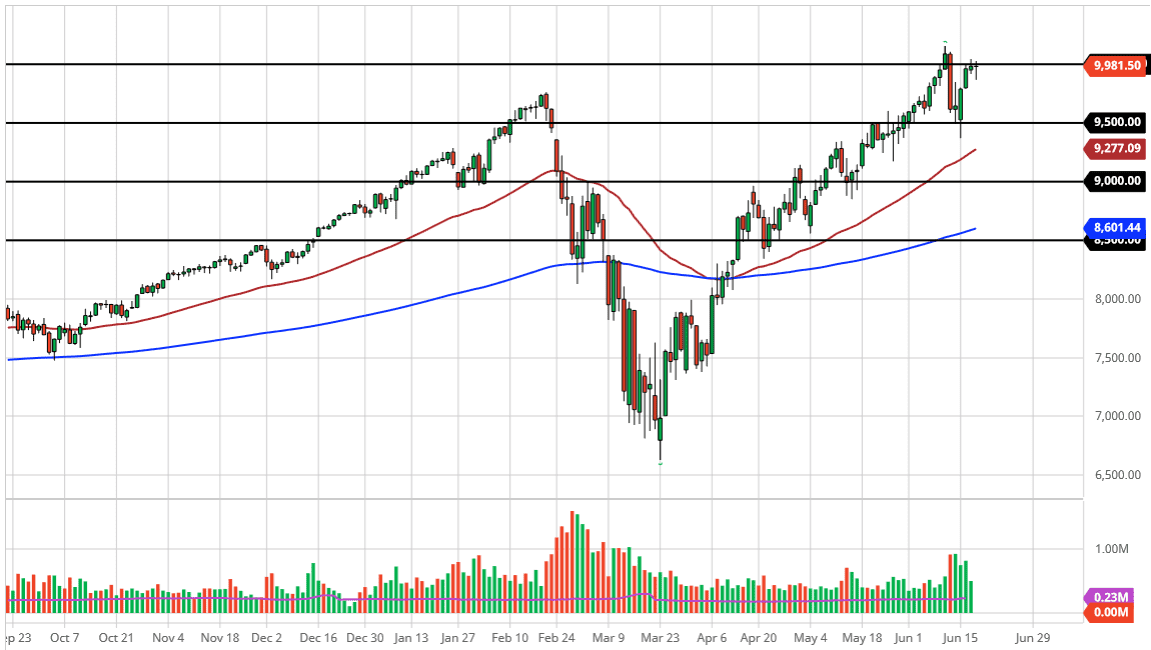

The NASDAQ 100 initially fell during the trading session on Thursday before finding buyers below at the 9865 region. The NASDAQ 100 continues to lead the rest of Wall Street, because it is comprised of a handful of the largest stocks at the top and in an extreme shift of weighting. After all, it is only a handful of stocks that move this thing. Pay attention to the handful of stocks that everybody on Wall Street loves, such as Netflix, Microsoft, Facebook, Alphabet, Tesla, and the like. In other words, those handful stocks makeup over 33% of the index so if they rally it is difficult to imagine a scenario where the NASDAQ 100 does not break out to the upside.

To the downside, if we were to break down below the bottom of the candlestick for the trading session on Thursday that could open up a little bit more selling, but I think it just simply looks for the market to test the 9500 level which was previous support and resistance. That is an area that I think we should start looking for buyers, and if we were to break down below there then the next thing would be the 50 day EMA which is about 250 points below there.

To the upside, if we can clear the highs that were made last week, then we should continue to shoot up into the air. Keep in mind that this is quadruple witching on Friday, which means that options on individual stocks, stock indices, stock futures, and index futures all expire during the session. In other words, there is going to be movement in the market without any real driving force other than people trying to cover their situation or perhaps collect profits. In other words, the price action on one of these sessions can be exceedingly difficult. That being said, by the time we finished the day we may see a little bit in the way of clarity, but it is obvious that the NASDAQ 100 is in a bullish trend, and therefore it is likely that we will continue to see more of the same. After all, trends tend to continue and therefore there is no reason to think this 11, at least not yet. After all, the Federal Reserve continues to inflate the bubble, and Wall Street is more than willing to jump into it.