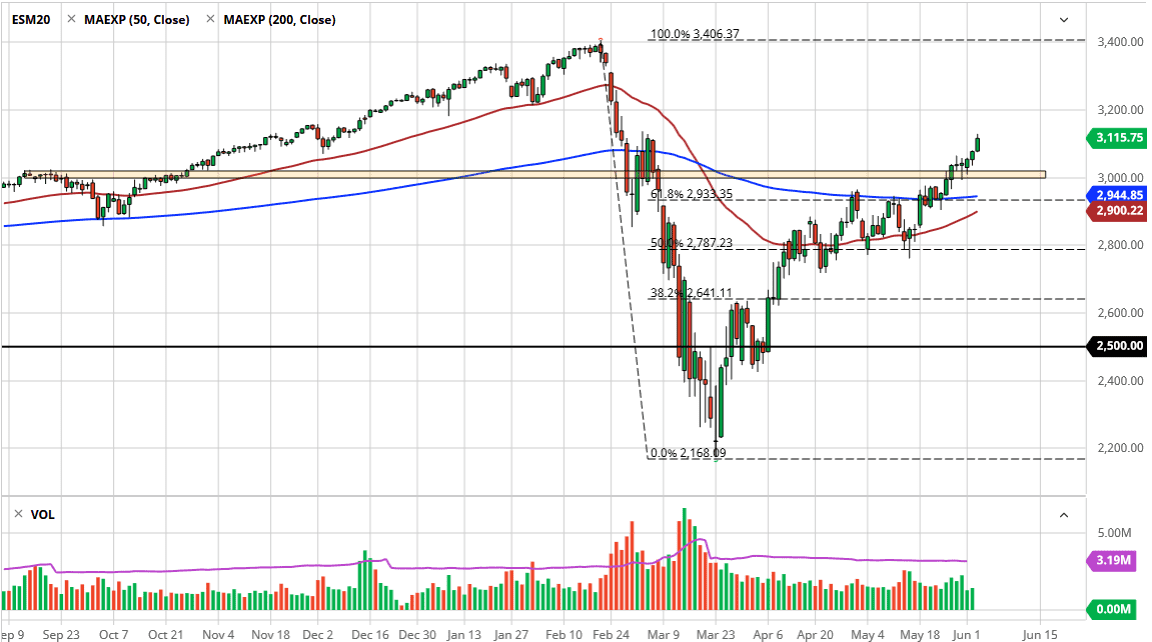

The S&P 500 has rallied above the 3100 level, which of course is a very bullish sign. There is a little bit of noise up until we get to the top of the range for the session on Wednesday, and if we can break above there it is likely we go looking towards the 3400 level. Ultimately, this is a market that is overextended but at the end of the day it is a market that is trading based upon liquidity and of course the idea of “FOMO.”

This is a dangerous market to be jumping in and shorting, even though fundamental analysis certainly negative to say the least. The candlestick for the day finish towards the top of the range, so that of course suggests that we have plenty of buyers. Once we break above the little bit of resistance at the top of the daily candlestick, the S&P 500 will almost certainly go towards the 3200 level, and then eventually the 3400 level. The 3400 level has been an area that has been massive resistance in the past, so I think it is only a matter of time before the sellers would return in that general vicinity.

If we break down, I think that there is plenty of support to be found down at the 3000 handle, so if we were to break down below there then we could see a little bit of a move lower. I think at this point the market is simply chasing the momentum, and therefore traders have no idea what to do beyond buy. However, this is a market that I think continues to see itself as “whistling past the graveyard”, and as a result it makes quite a bit of sense that we would have to worry about potential trouble, and quite frankly I think the one major issue is going to be a potential break down of US/China trade relations. If that really starts to break down, then it is likely we would see markets give up quite a bit against. In fact, I believe that is the biggest threat at this point. As long as the Federal Reserve is willing to bail everybody out, it is highly likely that the market simply goes higher based upon euphoria and momentum. As far as fundamentals are concerned, they have been taken out and shot.