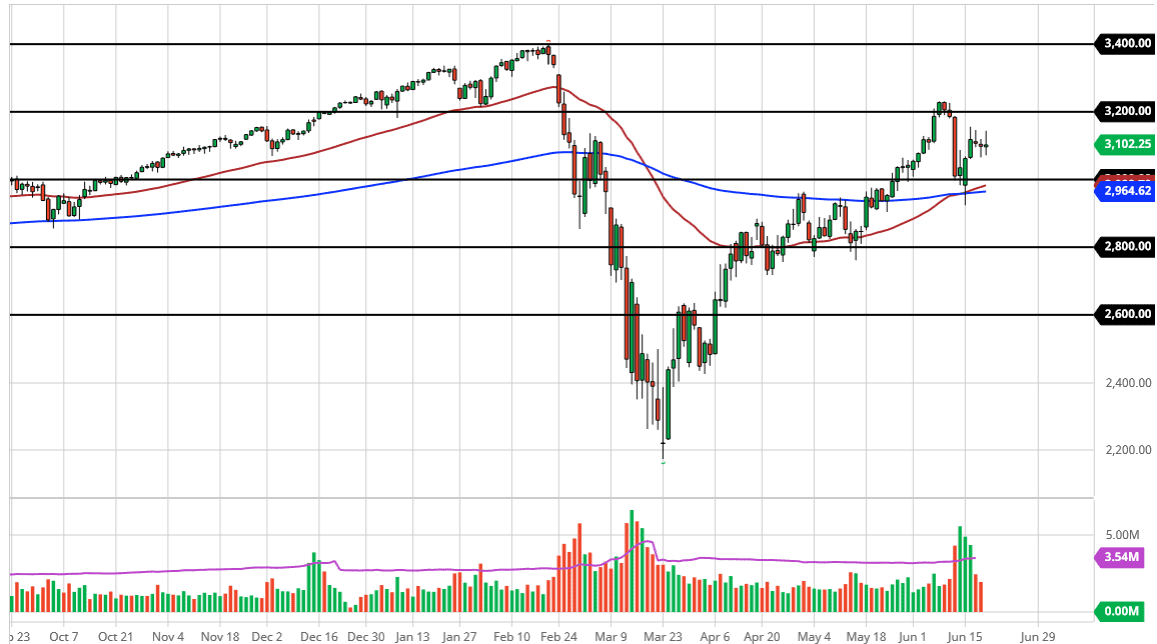

The S&P 500 has gone back and forth during the trading session on Friday as the quadruple witching session always causes mass chaos. This is when options expire for the quarterly options market in four different flavors. This causes mass chaos, so the fact that we swung back and forth should not be a huge surprise. Most professional traders will simply step to the sidelines and stay as far away as possible. Looking at the candlestick, this shows that we just went back and forth and caused chaos as we hovered around the 3100 level.

The 3200 level above has been resistance as of late, and I think that is the target for the buyers. On the other hand, the 3000 level underneath should continue to show signs of support. In general, I think we are simply going to bounce around in this 200 point range until we find some type of catalyst to go higher or lower. The biggest thing that you should be paying attention to is liquidity because that is the only thing that seems to matter to Wall Street for the longer term.

With this, the market is likely to see a lot of choppy behavior but overall, there is still a bit of a “floor” in the market just below. The 50 day EMA is testing the 3000 level, and therefore I think it is only a matter of time before we would have buyers jump in if we do get down there. The 3200 level on the top being broken to the upside opens up the possibility of going to the absolute highs. Ultimately, it is a market that has been trading in somewhat of a channel, and now we are simply sliding sideways. Overall, this is a market that I think looks for a certain amount of Federal Reserve safety going forward to lift it. You cannot look me in the eye and suggest that the stock market is reflecting anything remotely close to the economy. With the quadruple witching, you cannot read too much into the candlestick from the Friday session, but one thing I can tell is that we have been grinding higher for quite some time. The “golden cross” has just happened, so that of course is a bullish sign as well.