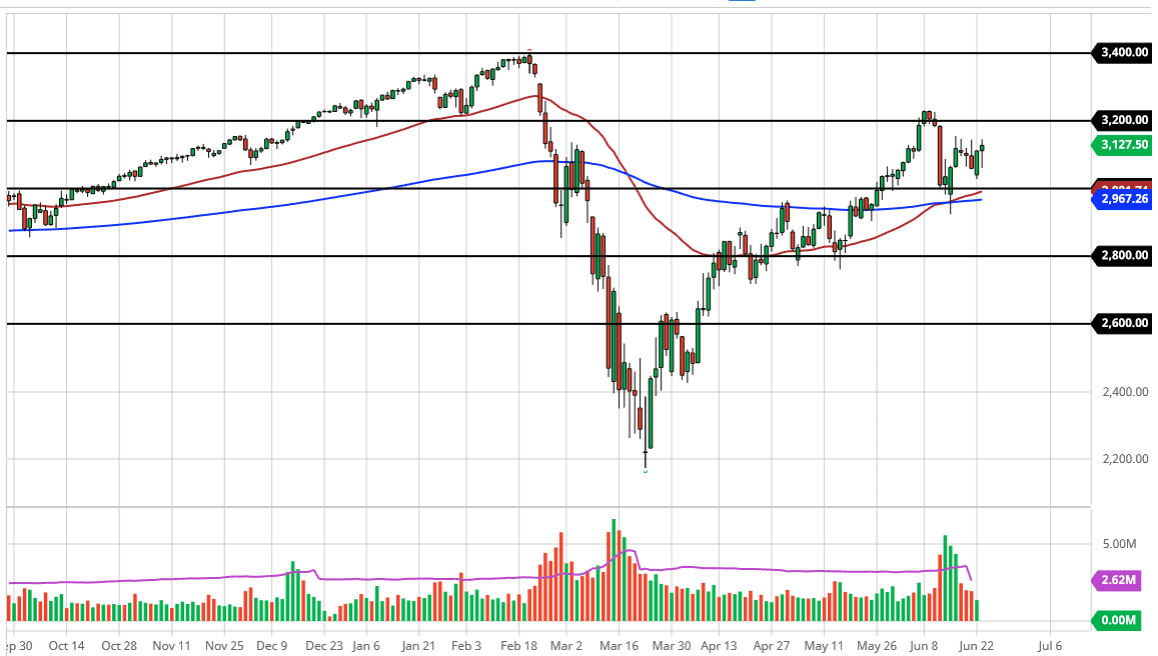

The S&P 500 broke down a bit during the trading session on Tuesday, reaching down towards the 3050 handle before finding buyers to form a bit of a hammer. If we can break above the top of that hammer, then it opens up the possibility of a move towards the 3200 level. That is an area where we have seen a lot of resistance previously and had seen the market selloff.

What I do think that we will see going forward is an eventual break out, because when I look at the candlestick for the day it looks incredibly positive. The fact that the sellers could not break it down tells me that the S&P 500 should continue to find value hunters. It is a hammer, and it is in the middle of consolidation, meaning that the market is trying to figure out what to do next. We are simply consolidating at this point, and therefore it is likely what we are trying to do is grinding the profits away, getting the market comfortable with these higher levels.

If we break above the 3200 level on a daily close, then it opens up the possibility towards the all-time highs at the 3400 level. I do think that we get there, and the market’s ability to simply ignore bad news is quite astonishing. The Federal Reserve adding liquidity to the markets is obviously the only thing that matters, so at this point it is the only thing you need to pay attention to. The 50 day EMA sits below at the 3000 level, so I think that is essentially the “floor” in the market. Furthermore, it is only a matter of time before we get to the upside, and at pullbacks I think there will be plenty of buyers as we have in the past. In fact, I do not really have a scenario in which I am willing to start selling quite yet, but I do recognize that if we broke down below the 200 day EMA it is likely that we go down to the 2800 level where I think there is even more support. At this point, we would need some type of significant event to cause the market crash like that. I think range bound choppy trading is probably going to be the way we go through most of the summer.