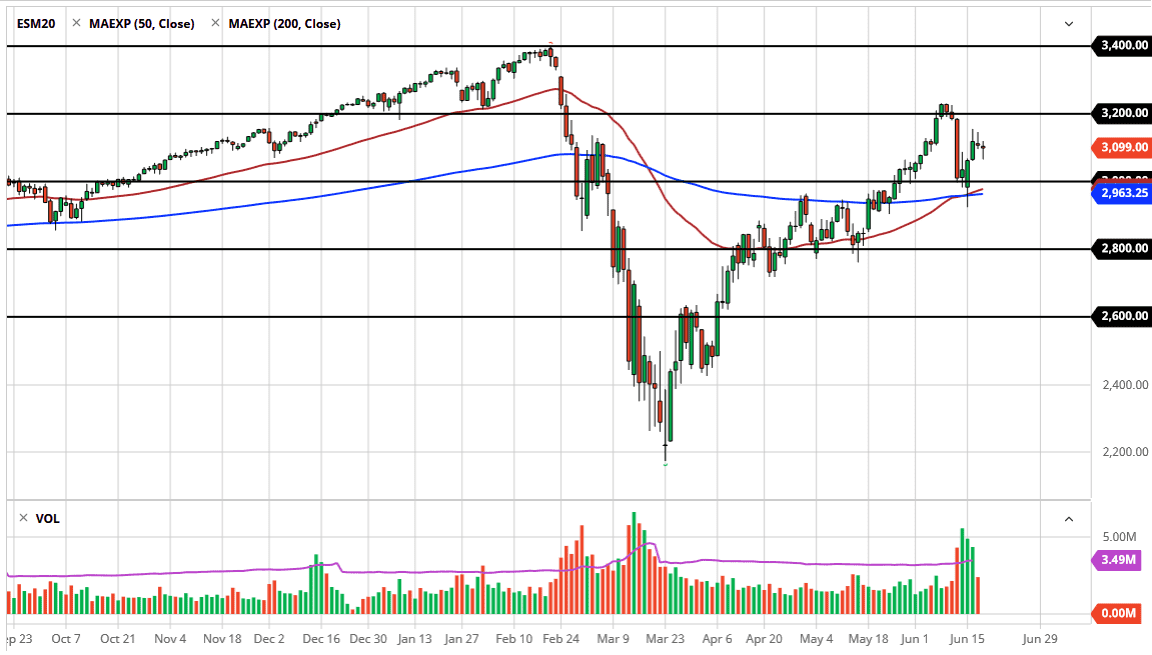

The S&P 500 went back and forth during the trading session on Thursday as we are hanging around the 3100 level. Ultimately, this is a market that will continue to be very noisy, because quite frankly Wall Street is running on a motion now more than anything else. It is a complete mess, and this is a market that has no business being where it is. However, the reality is that “price is truth.” I unfortunately have a lot of friends who have lost tons of money during this most recent rally because the “fundamentals do not line up with pricing.” Unfortunately, that is the fact and that has been the case for most of the last 12 years. It is not going to change now.

This is not to say that we cannot break down from here, most certainly we can. However, there is a ton of support at the 3000 level and again at the 2800 level. It is not that we break through all that that I would truly begin to consider a longer-term move to the downside. I have been listening to a lot of people who tell me that we are on the verge of a Great Depression, and I cannot argue with that. However, that does not seem to be on the minds of traders at Wall Street firms and therefore prices will fall until they do. In the meantime, you are better off simply trading price action as it appears.

At this point, it looks like there is a significant amount of resistance near the 3150 handle, as well as massive support down at the 3000 level. I think the closer we get to one of those two levels then you can start to play those levels as support or resistance. If we break above the highs of the last couple of sessions, then we will almost certainly go looking towards the 3200 level. One thing that you should notice is that we are seen volume pick up, and a lot of times this means that we are getting closer to a move. Perhaps the most important thing to notice on Friday as the fact that it is quadruple witching. This is when multiple options markets expire, so we get a lot of really bizarre moves in the market, especially later in the day.