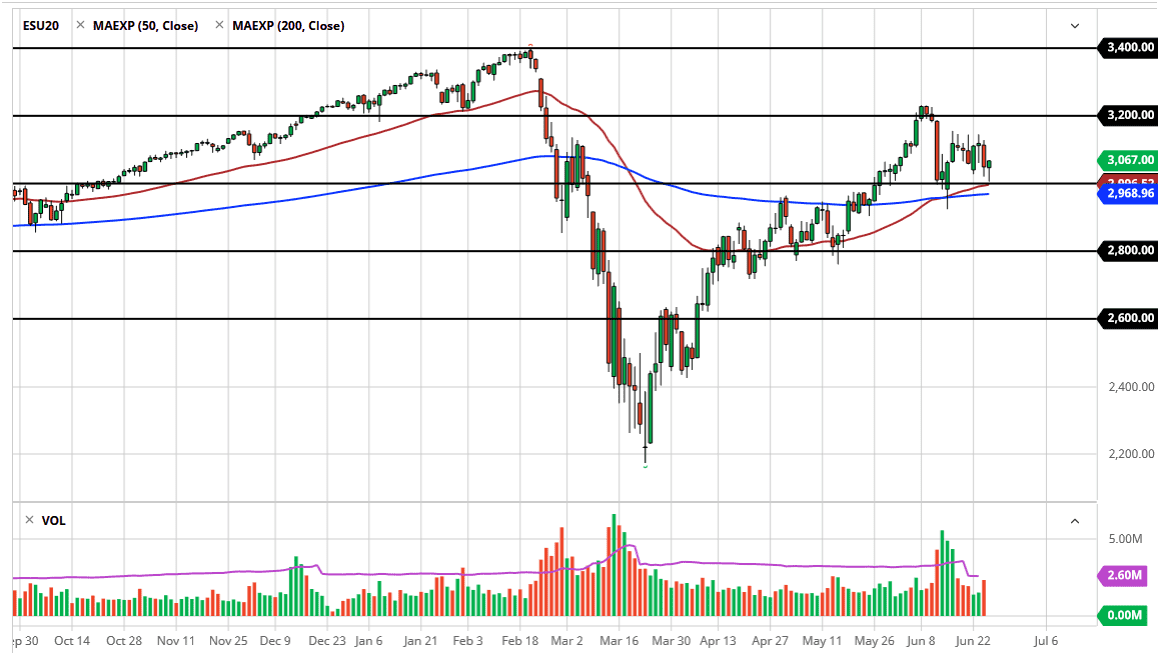

The S&P 500 broke down significantly during the trading session on Thursday, reaching down towards the crucial 3000 level during the Globex session. The resulting candlestick was a hammer, which of course is a very bullish sign and that suggests that we are going to see more “risk on” when it comes to the indices, as we are seeing the same type of price action everywhere. The market breaking above the top of the candlestick should open up the possibility of a move towards the 3100 level. That is an area where we have seen a lot of resistance, so I think this is a market that continues to be back and forth in this general vicinity. In fact, I think that we are looking at an opportunity to trade in a 100 point range.

Beyond the 3000 level, we also have the 50 day EMA which of course is something that attracts a lot of attention, as you can see on the chart. The 50 day EMA sits just below there and it makes quite a bit of sense of the buyers could come in and support that level furthermore. If we can break above the 3100 level, then it is likely we go looking towards the 3200 level above, which was the recent high. If we can break above there, then the market is likely to go looking towards the 3300 level, followed by the 3400 level. The reason I mention the 3300 level, it is an area that the market gapped lower from, so that does suggest that it could be a bit of a target.

If the market were to break down below the hammer for the trading session on Thursday, I think at that point you simply should sit on the sidelines and wait for a buying opportunity. In fact, I think there are a lot of buyers underneath there and therefore a little bit of patience might be the best way going forward. The 2800 level underneath is the “floor” in this market, so if we were to break down below there the S&P 500 will probably unwind somewhat drastically. The hammer of course is a candlestick that a lot of people pay attention to, so therefore I think Friday will probably end up being a slightly bullish session, although I am not necessarily expecting some type of major breakout during the day.