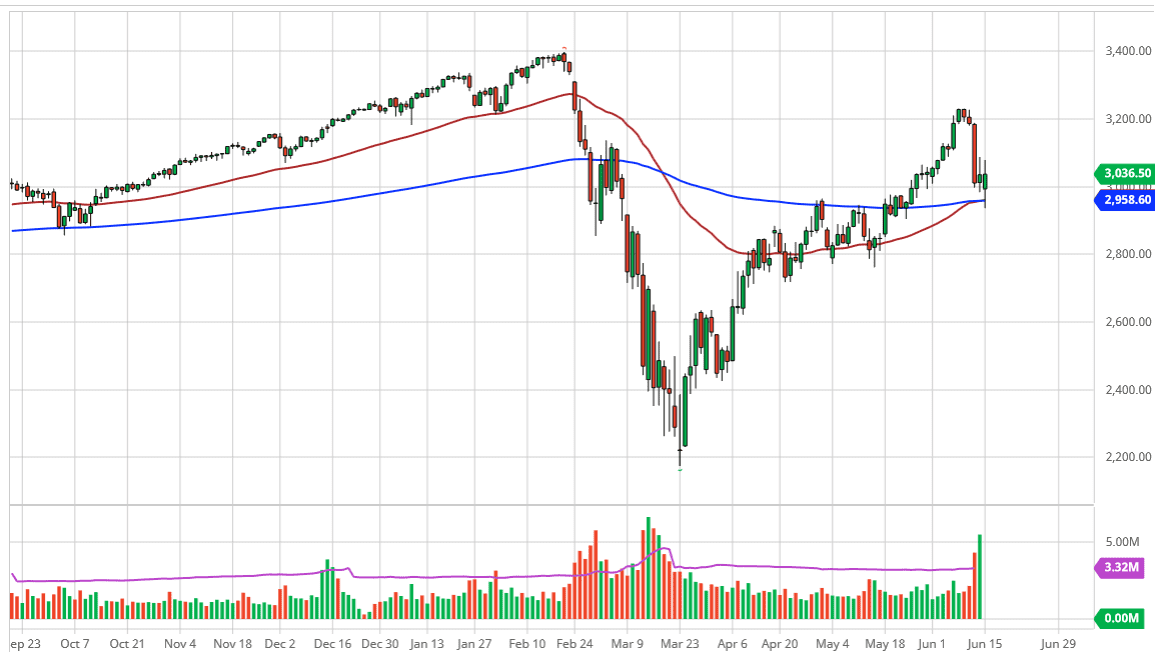

The S&P 500 has gone back and forth rather violently during the trading session on Monday, as we had initially fallen and broken below the 200 day EMA. However, it is an area where you would expect to see a significant amount of support based upon the structural grind sideways, which means that there is a lot of order flow between the 2800 level and the 3000 level. The 50 day EMA and the 200 day EMA both offer support there as well. Ultimately, if we break above the top of the candlestick for the trading session, and especially if we can break above the Friday candlestick, there is not much that is going to keep this market from going much higher, with the initial stop being the 3200 level.

If the Federal Reserve continues to come out and by corporate bonds, that obviously is strong for the S&P 500 because it is just one more step towards the buying of stocks, which several central banks around the world do. Granted, we are not there yet but it does appear that the Federal Reserve is starting to inch towards that direction. It was not that long ago that the idea of the Federal Reserve buying corporate bonds was unthinkable.

In this scenario, they are forcing trading capital into stocks, because bonds do not pay any type of yield these days. With this being the case, there has been a chase for liquidity, and therefore the market has been seen the US dollar strengthening, at least until recently, bonds strengthening and therefore driving down yields, and then of course stocks offering the idea of capital appreciation. I wish I could tell you another reason to buy stocks, but it is simply a matter of following the Federal Reserve and has absolutely nothing to do with economic reality. There are a handful of companies, roughly 6, that drive most of the S&P 500 gains. They are all the usual household names that everybody knows, and therefore this has more or less become an ETF of the biggest companies in the United States. After all, almost nobody can name who the number 20 company in the S&P 500 is, let alone the 400th. With all that being said, it looks like we will continue to pump liquidity into the marketplace, and therefore grind higher.