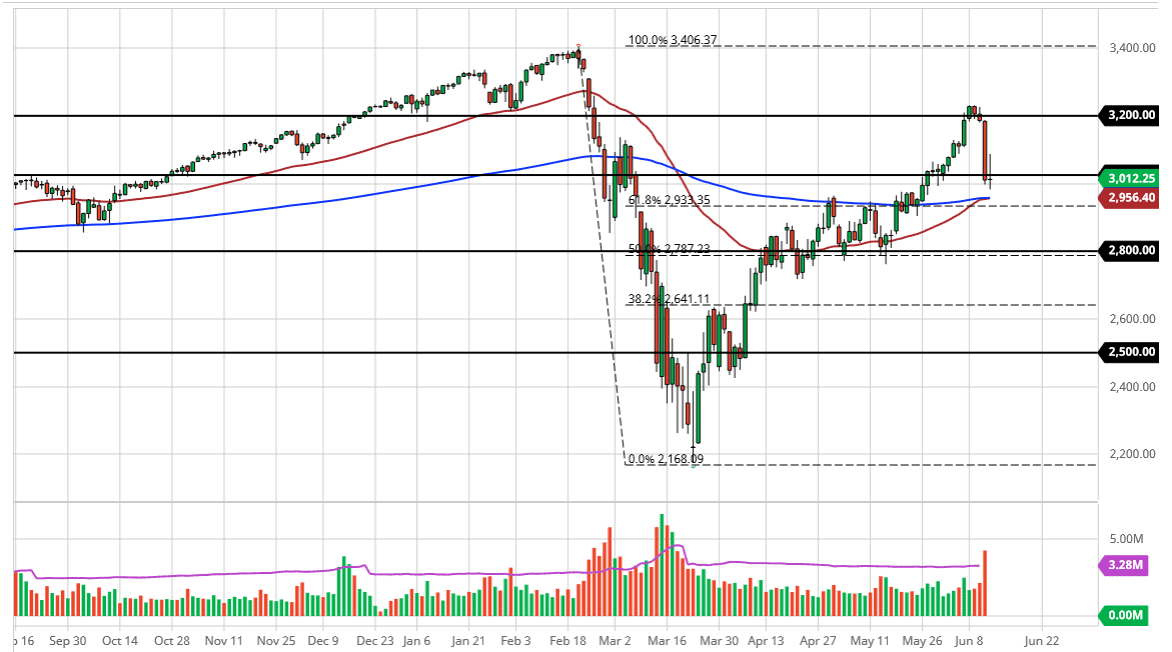

The S&P 500 went back and forth during the trading session on Friday, as traders trying to stabilize the markets after the massive rout on Thursday. The candlestick was closing at basically unchanged, so at this point, I think this sets up for a significant move. If we can break to the upside, then it is highly likely that the market goes looking towards the 3200 level. That is where the market pulls back from, so reaching back towards there does make some sense on a break above the range for the day. On the other hand, if we break down below the candlestick, then we will probably test the 200 day EMA. Breaking below there would be a negative sign.

The S&P 500 has been a bit overdone, but I think the fact that we had that rip lower was exactly what the market needed. It needed to take out a lot of the weak hands and offer a bit of value. It will be interesting to see how the market reacts on Monday, but we also have to pay attention to the headlines over the weekend, which could have a great influence on where we go next. At this point, one thing you can count on is a lot of choppy volatility, and that it is a market that I think is on pins and needles, so it doesn’t take much to get people spooked again. However, there is a lot of noise underneath extending all the way down to the 2800 level.

The 2800 level of course is an area that has been important support in the past and if we were to break down below there, it would be an extraordinarily negative move, opening up the door down to the 2500 level.

The next couple of weeks will be crucial, so it is worth paying attention to what happens in the next few sessions. I like the idea of paying close attention to how we break from the candlestick on Friday and following that direction. I do think that the Federal Reserve liquefying the markets and holding an easy monetary policy probably favors the upside eventually. This is why I think that even if we get a break down from here, it will be short-term, and buyers will be looking to pick up value.