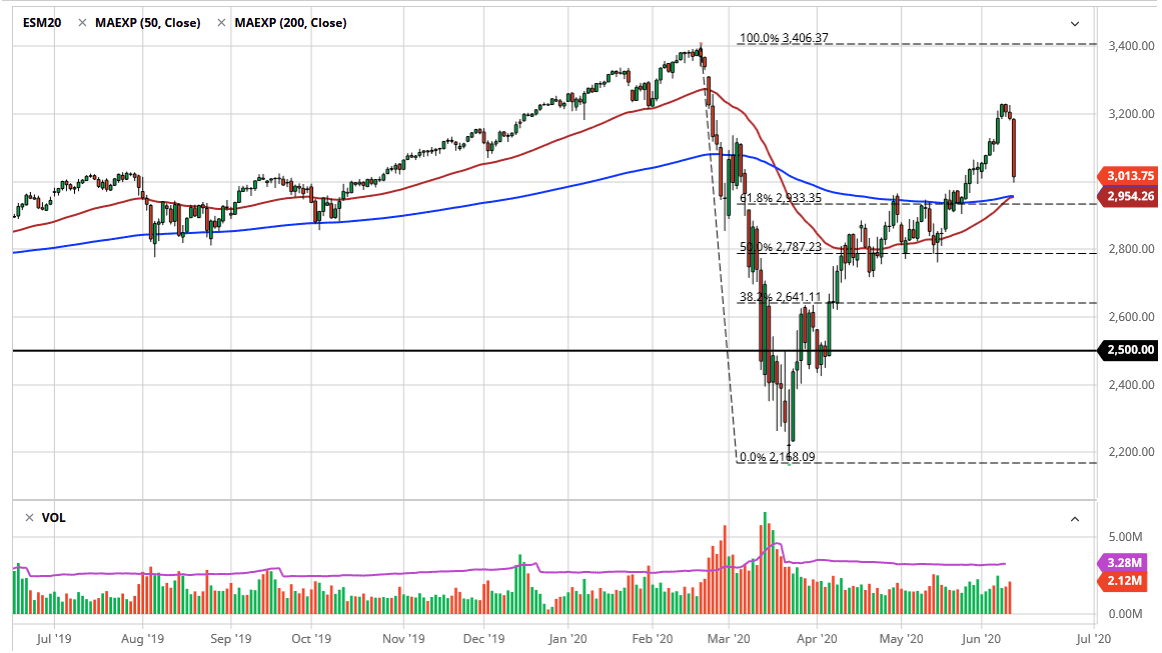

The S&P 500 has gotten absolutely crushed during the trading session on Thursday as we continue to see a lot of negativity. That being said, it is still likely to find support underneath, as we are just above the 3000 level after a particularly violent day to the downside. Furthermore, the 50 day EMA and the 200 day EMA are both just below there, so I think it is only a matter of time before we get some type of buying pressure. A bounce from that level makes quite a bit of sense, even though we may initially pierce this level. In other words, I am not looking to just jump in and short the market, I am looking for a daily close that tells me this is going to continue. I see a ton of noise between here and 2800, so I anticipate that the buyers will return.

However, if the market were to form another candlestick like this one would have to start look for shorting opportunities. Friday is going to be crucial and tell me where we are going from here. After a massive candlestick like this it is rather difficult to jump in and start buying the entire market like you do with the S&P 500, as you need to be much more selective with asset allocation. Because of this, you are probably going to be better off trying to find value in individual stocks, at least until we get some type of supportive looking candlestick here.

I would not be a seller at this point, because the market has fallen so far and so fast. The market has fallen enough that you would be “chasing the trade” at this point which is a great way to lose money. Overall, this is a market that I think eventually will find buyers, but if it is going to break down, you should have plenty of time to take advantage of this move. You need to be extraordinarily cautious during these times, so I suspect that staying out of the market on Friday is probably the best way to go. You do not have to be a hero, just simply need to know what the market is going to do. Furthermore, there could be a lot of volatility going into the weekend because a lot of people do not like putting on risk in holding onto it over the course of the weekend.