The S&P 500 broke above the 3100 level during the trading session on Thursday, and now it looks as if the market is trying to break above the 3200 level. The market has rallied based upon all kinds of reasons, but the most recent one was the fact that the employment numbers ended up being an addition of 2 million jobs, as opposed to the 7 million jobs that were supposed to be lost. Ultimately, this is a market that should continue to see an uptake of trading, as a lot of people have missed out on this rally.

It is interesting to note that the correlation between the S&P 500 and the US dollar over the last couple of weeks is somewhere near -0.95, which means that it moves almost perfectly inverse to the stock market. It seems as if the dollars is trying to make a comeback. The market is being flooded with liquidity, and probably not much more than that. However, if the jobs situation is better than initially thought, that gives a fundamental reason for the market to go higher, which is another reason to think that buyers will be interested.

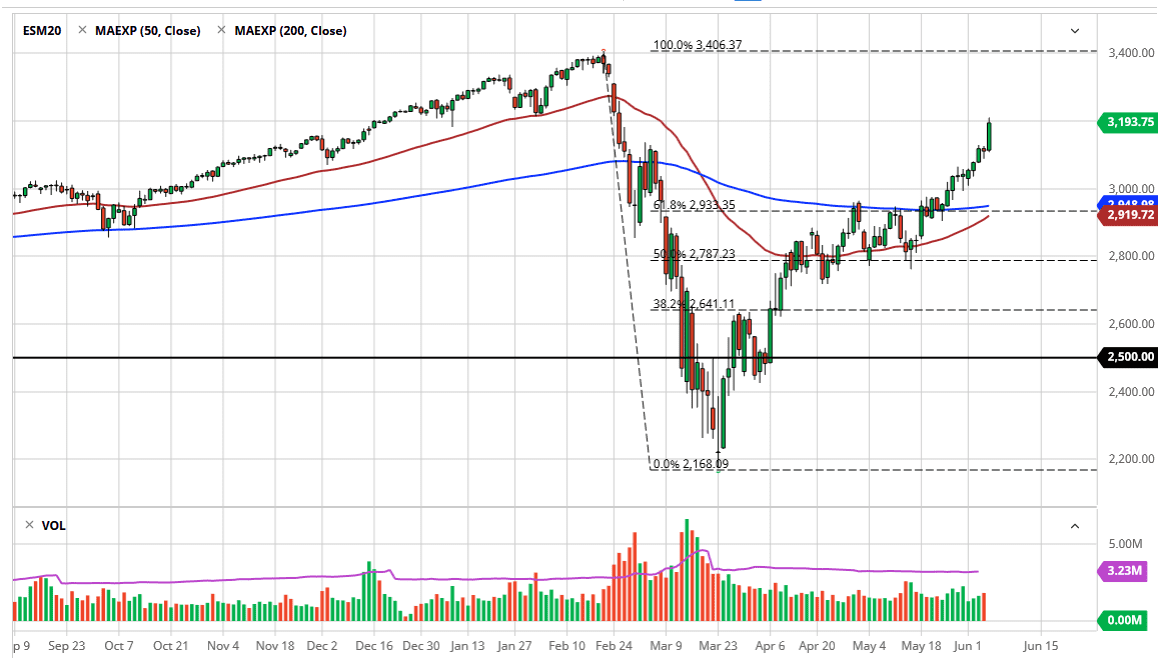

Looking at the chart below, you can see that the 3200 level has caused a little bit of resistance, but I think it is only a matter of time before we rise above. Short-term pullback should be thought of as potential buying opportunities, and I think that the 3100 level could be an area of support based upon the fact that it was previous resistance. If we were to break down below there, then it is likely that we could be looking towards the 3000 level.

The 3000 level is somewhat trending the findings, but I do not even know if I would go that far with it. It has a lot of psychological importance built into it as well, so I think that any correction down to that level would probably attract a lot of attention. We are obviously in a bullish run, but the volatility is extraordinarily high in this market, and therefore you need to be very cautious about how much money you put into the market at one time, because it is time for some type of significant pullback.