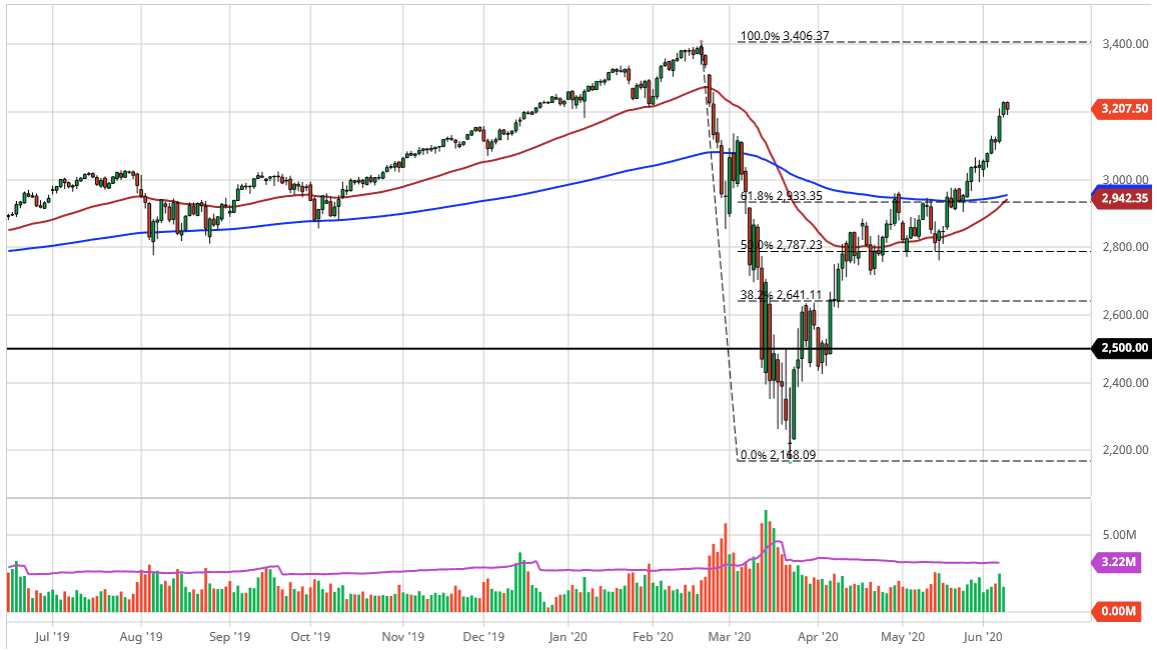

We may have found some exhaustion in a market that has been overdone. The 3200 level is psychologically important, and it does seem as if we are trying to give up some of the gains as we may have gotten a bit too far ahead of ourselves. Ultimately, I believe that the market will find buyers underneath, but we have gotten parabolic. Now that we are starting to see a lot of the retail traders out there get overly enthusiastic, that is almost always a sign that you are getting close to a top.

I do think we go higher from here, but we need some type of pullback in order to make it feasible and palatable for longer-term traders. When you look at the trajectory of the last month, it has essentially been straight up in the air and therefore one has to think that it is only a matter of time before we get that pullback. If nothing else, people will need to take profits in a market that has been overdone. One thing is for sure, if you have not gotten long of the US stock market yet, now will not be the time to jump in and chase the trade. This does not mean that we cannot go straight up to the all-time highs of 3400, just that the ions most certainly favor some type of pullback from here before it happens. Markets do not move like this very often and although there are a lot of major forces out there pushing stocks higher, not the least of which is liquidity, this just screams of a situation that could hurt a lot of traders if they are not careful.

If for some reason the Federal Reserve drops the ball during the statement on Wednesday, that could be the death knell for the stock market, at least in the short term. However, Jerome Powell has been trained to say the right things over the last several years, so it is likely that he will talk about accommodating in order for Wall Street to continue to make the money it has been. Anything remotely hawkish would probably throw this market into a temper tantrum.