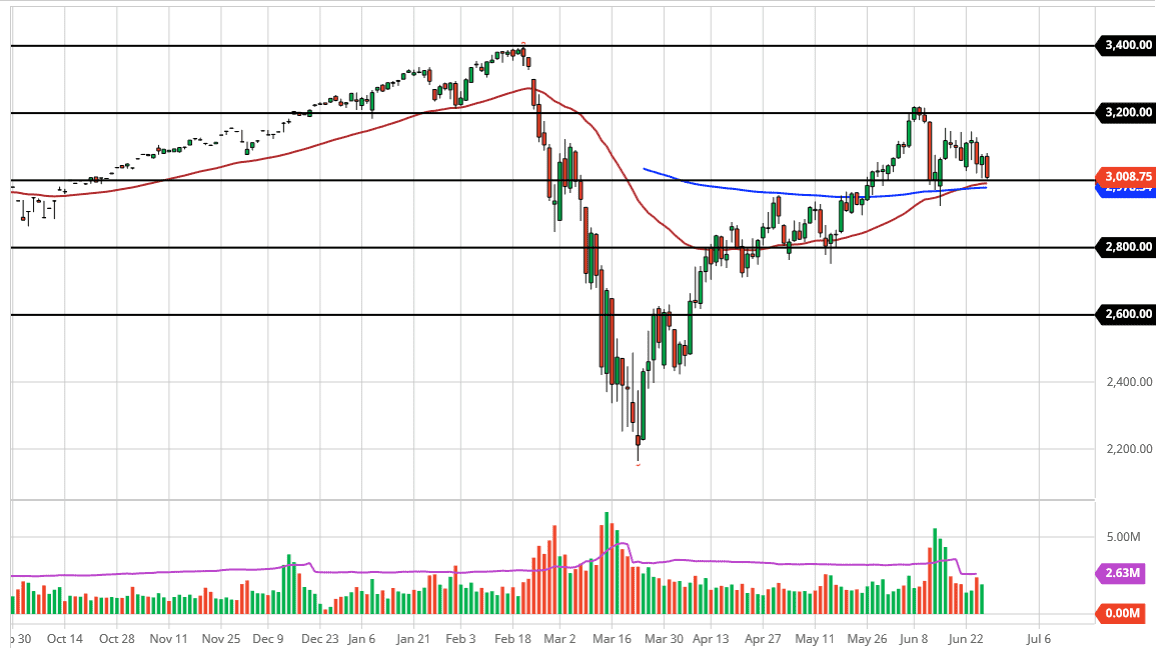

The S&P 500 fell hard during the day on Friday, but the 3000 level is still a hot zone for both buyers and sellers. The fact that we are sitting on top of the 50 day EMA is something that should be paid attention to but I would be remiss to ignore the fact that we are closing towards the bottom of the range. In other words, it is very likely that Monday is going to be a very noisy session.

I do think that this is a market that will eventually find some type of footing, but right now it seems to be reacting to the headlines coming out of the western part of the United States and the coronavirus numbers. Florida is also a hotspot, and right now is a factor in the marketplace that continues to cause issues. The states of Texas and Florida have closed bars again, rolling back some of the relaxations of restrictions. That has traders a bit concerned, but I think if this was the beginning of the end of the rally, we would have had a much more massive selloff at the first hint of trouble. In other words, I think we may have a little bit of a grind but longer-term it looks like we are going to see the market eventually find its footing.

The 3150 level above would be a decent target, and I think if it can break above there we will more than likely go looking to 3200, assuming that we get buyers back into the marketplace. However, if we see more fear enter the market, we could drop down to the 200 day EMA which is closer to the 2900 level. After that, it opens up the possibility of a move down to the 2800 level. I think we probably have a few days of trouble ahead of us, but eventually, the buyers will come back and push this market higher as we have so much Federal Reserve liquidity out there. Quite frankly, fundamentals do not matter and when they do the Fed comes in and squashes them anyways. Be cautious about your trading positions, but I would be looking for value underneath, especially somewhere right around the 200 day EMA.