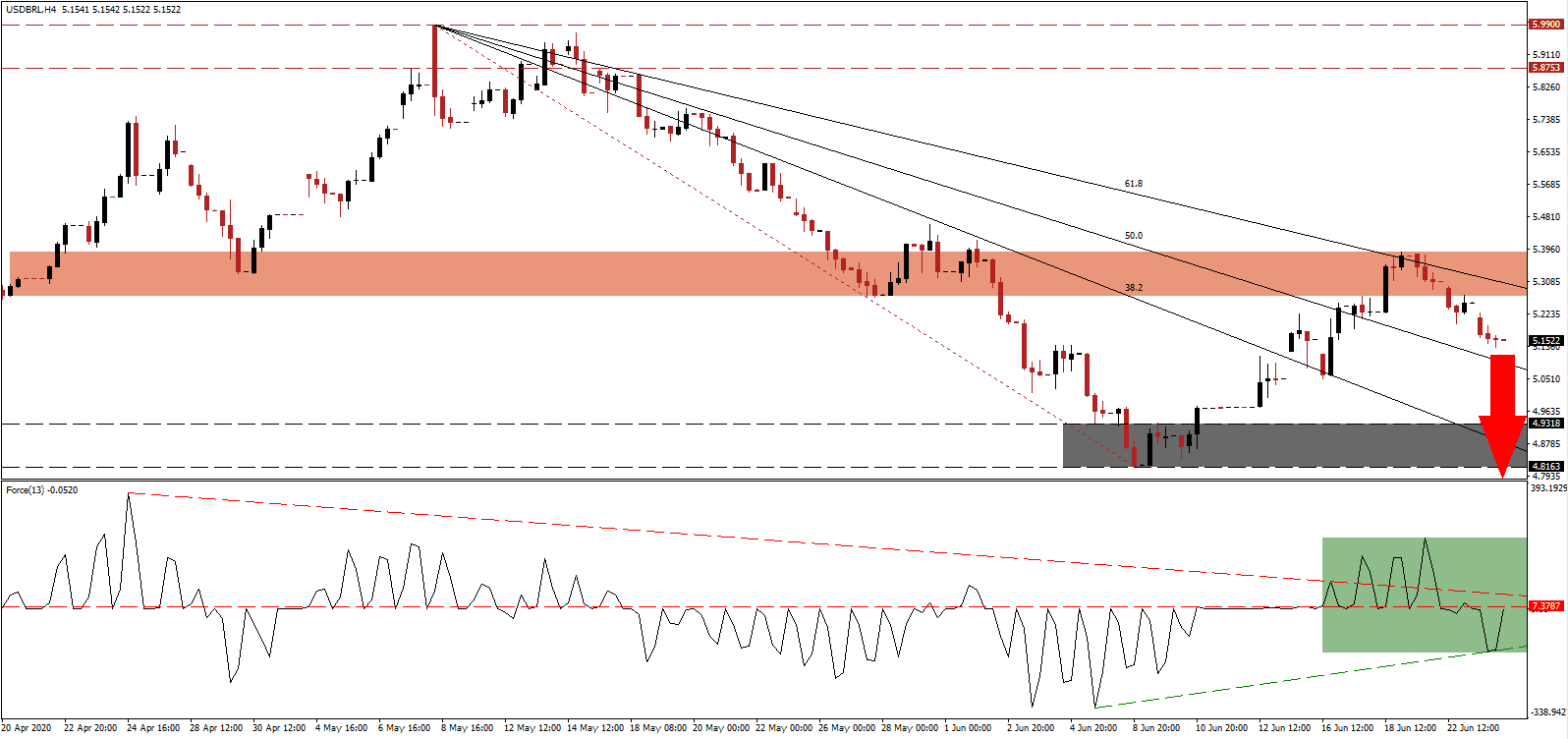

Brazil became the second country to register over 50,000 deaths related to the Covid-19 pandemic behind the US. It also confirmed more than 1,000,000 infections, but healthcare officials suggest that actual data is significantly higher. The lack of testing, estimated at just 5% of the requirement, is primarily blamed for it. In contrast, at least one report published claimed several states overreporting cases. After President Bolsonaro fired health minister Luiz Mandetta in April, his successor Nelson Teich resigned amid disagreements with the president. The USD/BRL was unfazed by the rising turmoil, completing a breakdown below its short-term resistance zone, from where more selling is favored.

The Force Index, a next-generation technical indicator, confirmed the breakdown in this currency pair by correcting from a higher high below its descending resistance level. It led to the conversion of its horizontal support level into resistance, as marked by the green rectangle. A reversal is now challenging this level, and the higher low allowed for a redrawn ascending support level. Bears remain in control of the USD/BRL with this technical indicator in negative territory.

In Brazil, the Covid-19 pandemic turned political. Protests by groups for and against the government of President Bolsonaro are ongoing. It adds to concerns over the government response to the virus, which the president dismissed as a minor cold in the early stages. He continues to oppose lockdown measures, claiming the economic damage will cost more lives than the virus itself. Following the breakdown in the USD/BRL below its short-term resistance zone located between 5.2695 and 5.3865, as marked by the red rectangle, a more massive sell-off is expected, driven by US Dollar weakness.

US White House advisor on the coronavirus and the Director of the National Institute of Allergy and Infectious Diseases (NIAID) since 1984 warned Congress over a disturbing surge in new infections. He believes a total lockdown as implemented in March may not be necessary, but a rollback of the economic reopening process should be considered if the trend persists. It added to selling pressure in the US Dollar, likely to accelerate. The descending 61.8 Fibonacci Retracement Fan Resistance Level is favored to pressure the USD/BRL into its support zone located between 4.8163 and 4.9318, as identified by the grey rectangle. A continuation of the breakdown sequence is probable.

USD/BRL Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 5.1525

Take Profit @ 4.8100

Stop Loss @ 5.2625

Downside Potential: 3,425 pips

Upside Risk: 1,100 pips

Risk/Reward Ratio: 3.11

In case the Force Index spikes above its descending resistance level, the USD/BRL may reverse into its short-term resistance zone. Given the ongoing negative progress in the US and widespread dismissal of warnings by healthcare officials, any breakout attempt should be considered as a selling opportunity by Forex traders. The upside potential is reduced to its intra-day high of 5.4611, the peak of the previously reversed breakout attempt above its short-term resistance zone.

USD/BRL Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 5.3200

Take Profit @ 5.4600

Stop Loss @ 5.2600

Upside Potential: 1,400 pips

Downside Risk: 600 pips

Risk/Reward Ratio: 2.33