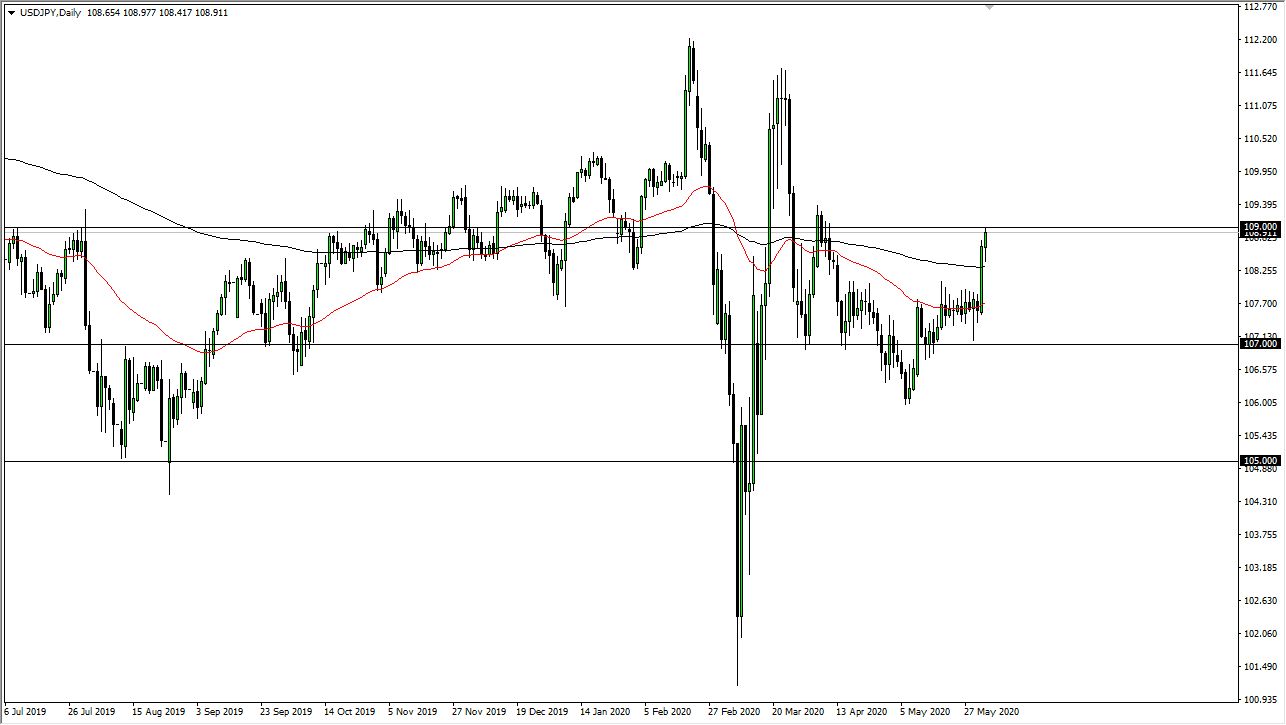

The US dollar rallied a bit after initially pulling back on Wednesday against the Japanese yen. We found the 200 day EMA to be supportive enough to turn the market back around, but we still have to deal with the ¥109 level, which is an area that will continue to be trouble. Signs of exhaustion or failure here would be a nice selling opportunity, but currently it looks as if the Japanese yen is being sold off against almost everything.

This is in theory “a risk off trade”, and therefore it makes sense that the US dollar would rally against the Japanese yen, and we have seen the Japanese yen get hit against several other currencies. However, the ¥109 level has been difficult, and we have seen the market has pulled back from this region more than once. If we break down from here, then the 200 day EMA will offer support, if we break down below that level, then it is likely that the market goes looking towards the ¥107.75 level. Below there, then the market could go to the ¥107 level. A breakdown below that level then opens up the door to the 160 and level, but it looks less likely after the action over the last 48 hours.

This is a market that runs a bit counter to other currency markets, as the US dollar has got absolutely crushed against almost everything else. As long as that is going to be the case, this might be the one place you can buy the US dollar, but as we get overextended everywhere else, that may help the market pull back a bit from here as well. A breakout to the upside would probably signify some type of major “blow off top” in the stock market. Ultimately, the ¥109 level on a daily close is going to continue to be crucial, so that is essentially what I am watching more than anything else. For the most part, I like using this pair as a relative strength meter for the Japanese yen in general, and apply that other pairs such as the NZD/JPY pair, the AUD/JPY pair, and etc. In general, I believe this is a market that will continue to be noisy, but somewhat well contained considering how many different levels there are that could come into offer both support and resistance. All things being equal, this is a pair that is more of a day trading market.