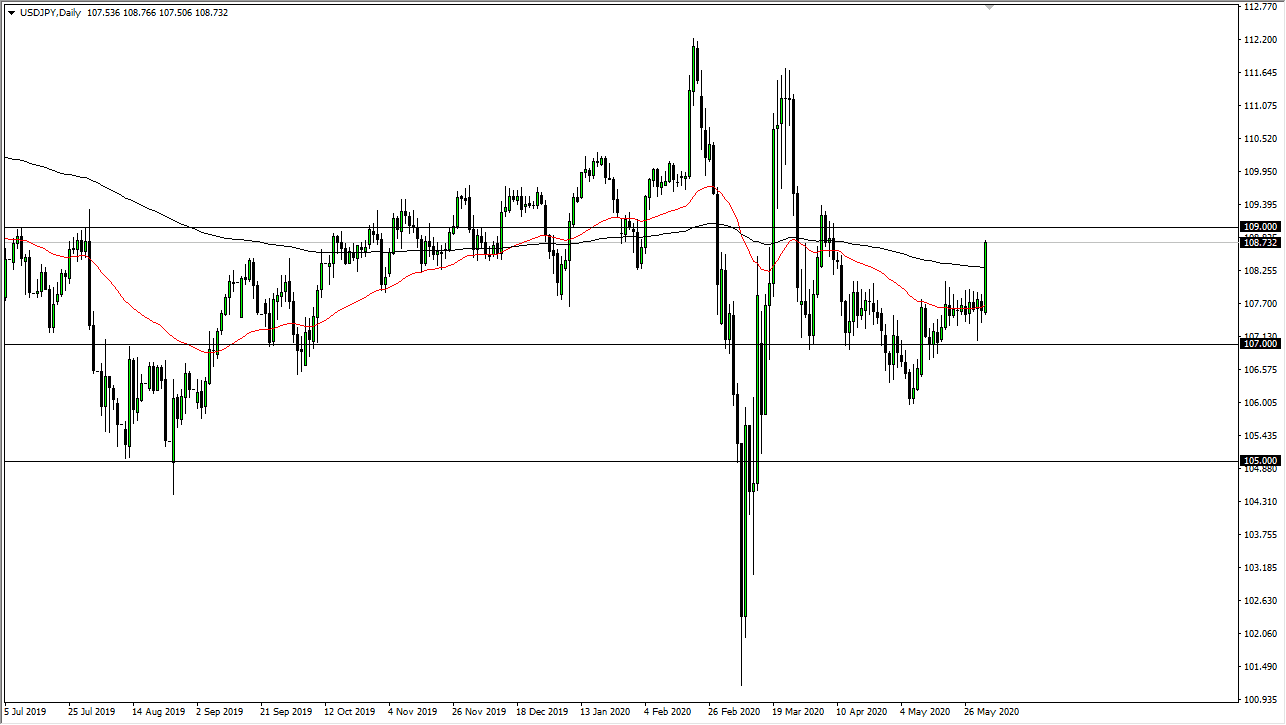

The US dollar has exploded to the upside during the trading session on Tuesday against the Japanese yen, slicing through the tight range that we have been in for some time. In fact, we even broke above the 200 day EMA which is in and of itself a somewhat bullish sign, but I also see that the ¥109 level as major resistance. That is an area that we have seen sellers previously, but we have also seen buyers there as well. Quite frankly, think this market will continue to be very choppy and therefore exceedingly difficult. With that in mind, I think that you need to be overly cautious about putting too much money to work.

Having said that, the candlestick is very bullish, and therefore it does suggest that we should get a little bit of follow-through. After all, you do not close at the very top of the large candle without at least attracting some attention most of the time. If we were to break above the ¥109 level, then it is likely that we could go all the way to the ¥111 level. To the downside, if we rolled right back over then it is likely that the market will go looking towards the ¥108 level.

The Japanese yen got hammered against a lot of different currencies, and therefore I think it is only a matter of time before somebody gets involved in pushes this thing in one direction or another. I think you need to be cautious and therefore trade more of a short-term back-and-forth style on short-term time frames. I think that this pair continues to be more or less a significant indicator for the Japanese yen strength or weakness. For example, the AUD/JPY pair and the GBP/JPY pair would have been much easier trades during the day as the US dollar has been soft. This simply is a reordering the “weakest safety currency” out there, switching from the US dollar to the Japanese yen. Ultimately, it looks as if we will continue the downward pressure against the yen, unless of course we get some type of major shift in risk appetite out there, which could send this market right back down to where we were and going nowhere again. Noise is probably what we are going to see more than anything else, even though we have had a nice impulsive candlestick.