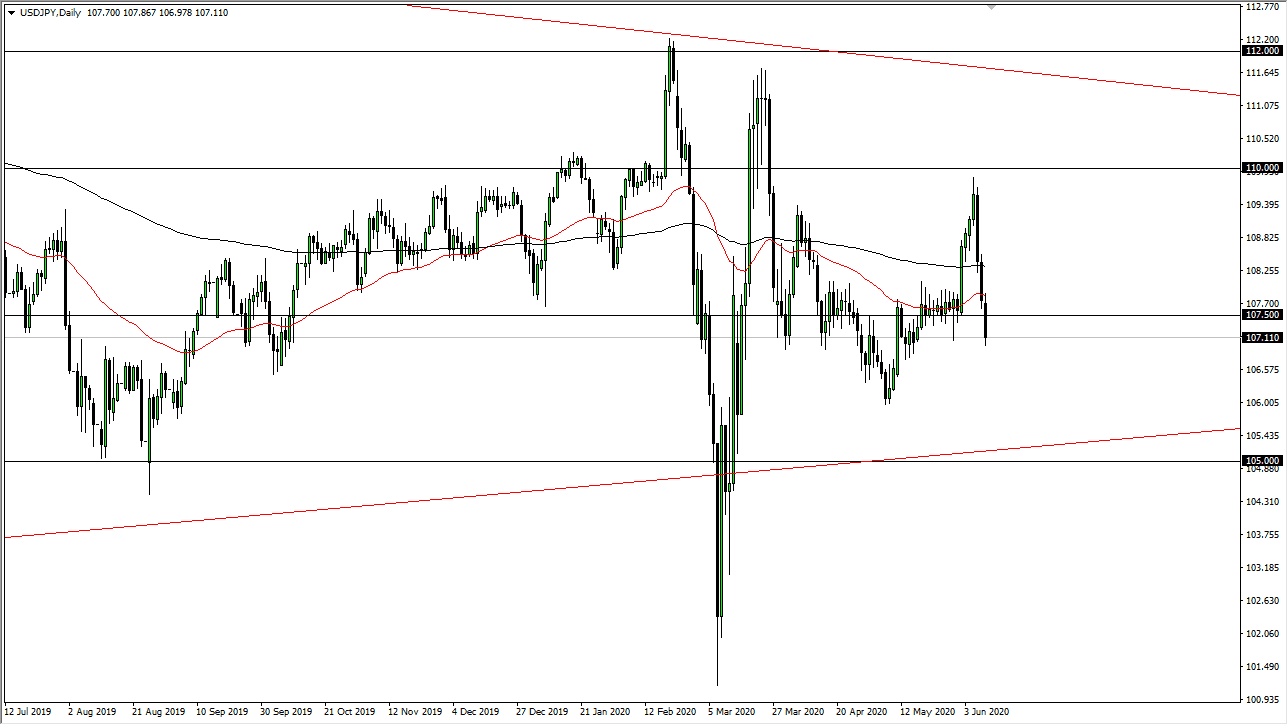

The US dollar has broken below the ¥107.50 level to reach towards 107 yen level. If we break down below there, then it is likely that this pair will continue towards the 160 and level. The Federal Reserve has reaffirmed its desire to support the economy, and that of course means that they are trying to kill off the dollar. If that is going to be the case, and quite frankly they did have a somewhat cautious tone, that could drive money towards the Japanese yen even further.

If we turn around a break above the ¥108 level, then it is likely that the market will go looking towards the ¥110 level again. That being said though, this is a market that has a lot of correlation to risk, so it will be interesting to see how this plays out. After all, the Japanese yen is considered to be the ultimate safety currency, and therefore a lot of times traders will pile into that if they are not sure what is going on. Having said that, the selling of the US dollar has made this a little bit different in relation to other yen related pairs.

At this point, when you look at the longer-term chart you can make out a massive triangle in this pair, which tells me that there is something major coming, but we do not know which direction it will ultimately break. In the short term, it is obvious that this is a market that is going to continue to be very volatile, as seems to be the case with most other markets worldwide. Because of this, I think that the market is going to continue to be a lot of back-and-forth trading, but it appears that we are trying to carve out some type of range. We certainly have not done it quite yet, but as soon as I can make sense of this, I will let you know. In the meantime, I am sitting on the sidelines and waiting for a bit of clarity in this pair. In the short term, this is probably driven more by the US dollar than it is the Japanese yen, so that is worth paying attention to. You can use this pair more or less as an indication of what is going on with the Japanese yen itself, or the US dollar, but as far as trading it directly, it still a bit early to do so.