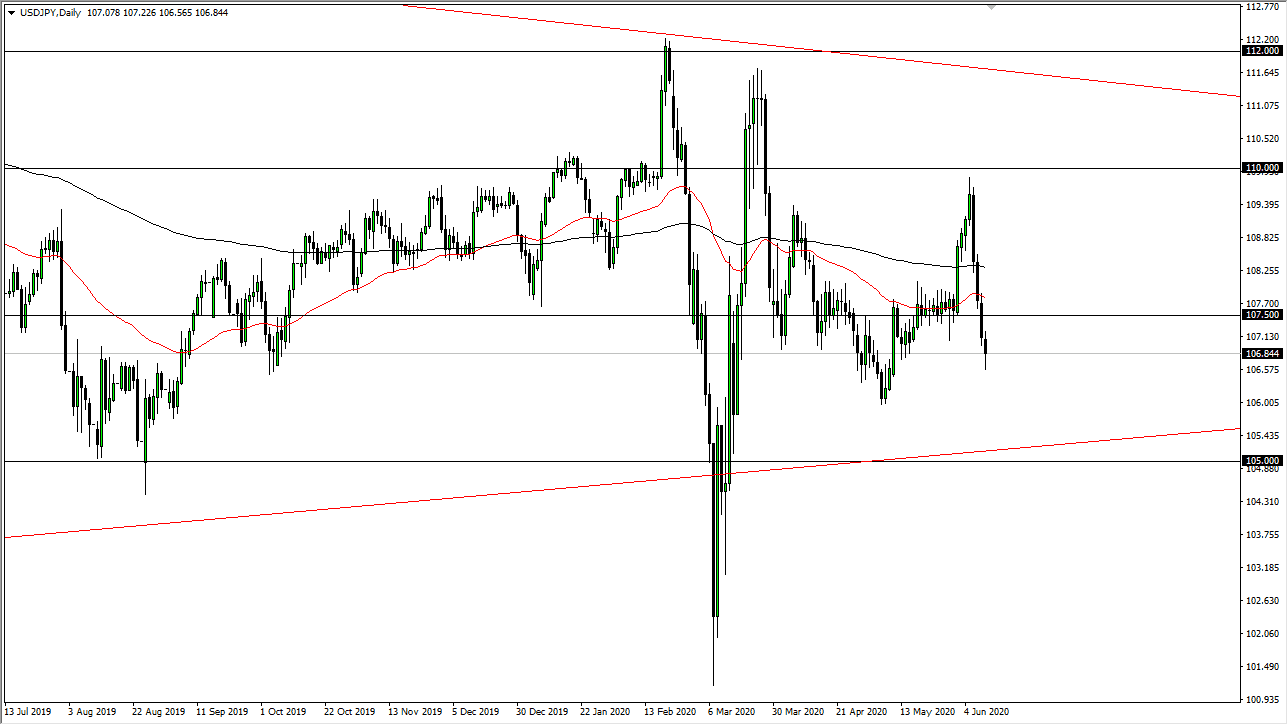

The US dollar has fallen a bit during the trading session on Thursday, breaking below the ¥107 level. We have turned around to show signs of life again and form a bit of a hammer. That of course is a very bullish sign and therefore it is very possible that we turn around and rally towards the ¥107.50 level. If we can break above there, then it is likely that the market could then go to the ¥110 level, longer term. The move to the upside would have several little areas to deal with, in the form of the ¥108 level, the 200 day EMA, and the ¥109 level.

Ultimately, this is a pair that seems to be overly sensitive to risk appetite and if we do turn around it could help the idea of buyers jumping into other riskier assets such as the stock market. That being said, the stock market was absolutely pummeled during the trading session on Thursday, so it does suggest that there could be some issues, but then again that could also be traders out there willing to pick up a bit of value, which could of course help this pair. The Friday session could be rather important, and therefore if the market does turnaround and start rallying, I anticipate that we will see the market grind higher, not only here but in places like the S&P 500, the NASDAQ 100, and others.

However, if we were to break down below the bottom of the candlestick for the trading session on Thursday, then it opens up the door to the ¥106 level. Do not get me wrong, the market is still very tight and the fact that we have sold off so many days in a row suggests that perhaps we may need to turn around and reach higher levels, if for no other reason than to find some sense of equilibrium. The moving averages that are so commonly followed such as the 200 day EMA and the 50 day EMA are both relatively flat, so at this point, I think it shows that we are still looking at the market as somewhat tight and consolidated in nature. When you look at the longer-term chart, there is a massive triangle that the market has been working in, so give it enough time we are going to see a longer-term trend form, but right now we simply are ripping back and forth.