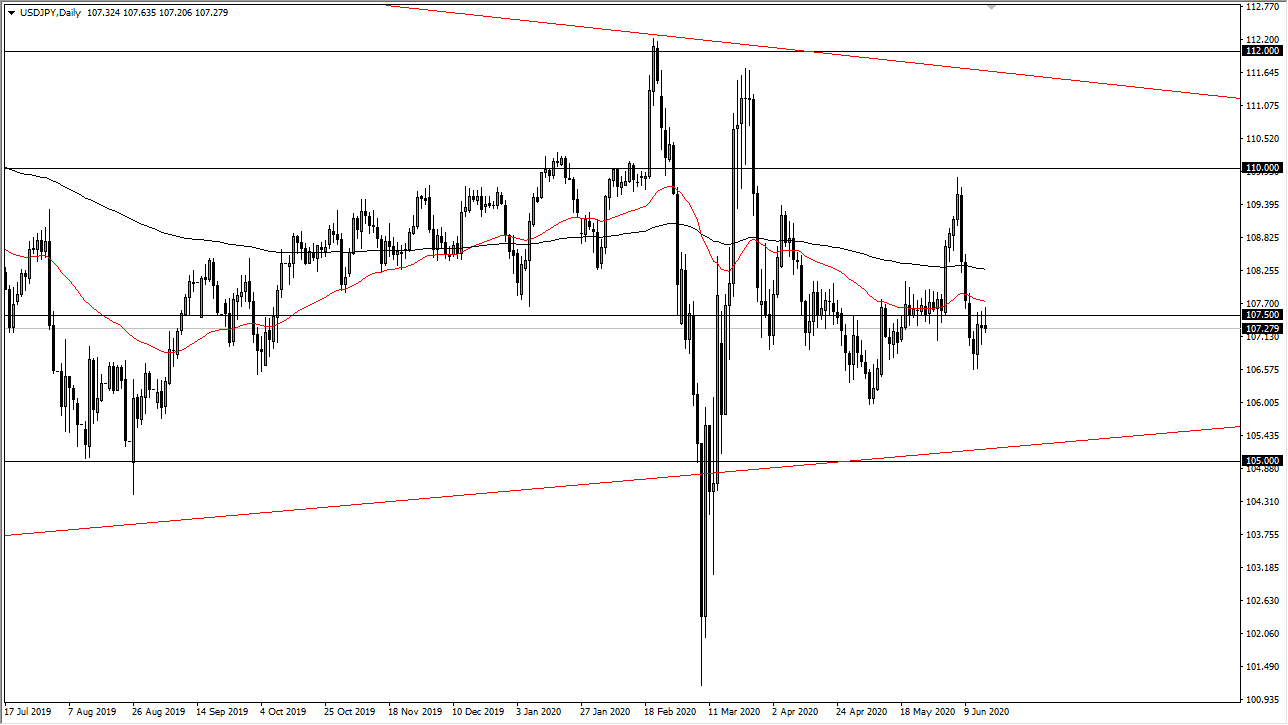

The US dollar rallied a bit during the trading session, reaching towards the ¥107.50 level. However, we have found selling at that level yet again, and therefore ended up forming a bit of an exhaustive candlestick. That suggests that we could pull back a bit, but it seems as if every time we get too far away from the ¥107.50 level, traders come back and push it towards that level. With that in mind, I believe that we probably have a situation where if we break down a bit, it probably ends up being a buying opportunity. However, keep an eye on the ¥106.50 level, because if it gets violated to the downside that would be a very negative sign indeed, perhaps opening up an attempt at the ¥105 level.

The 50 day EMA and the 200 day EMA both are going sideways, and that tells you just how pointless the longer-term trading of this pair has been. Having said that, it is a short-term trading type of market, so if you have the ability to trade short-term back-and-forth markets, then it could be an opportunity to trade this pair. Otherwise, it simply becomes yet another relative strength indicator when it comes to the Japanese yen.

Typically, what I do is I pay attention to what is going on over here, and then look at other currencies against the US dollar. For example, if this pair starts to fall a bit, it shows signs of strength in the Japanese yen. Simultaneously, if the AUD/USD pair is starting to fall, then I use this as a signal to start selling the AUD/JPY pair. You can say the same thing about other currency pairs such as the EUR/USD pair, GBP/USD pair, and the like. In other words, I use this as part of a triangulation plan as the momentum itself simply is not enough here to make any decent trades. That being said, if we do break above the 200 day EMA then it is likely that we go looking towards the ¥110 level. On the other hand, if we were to break down below the ¥106.50 level, then it opens up the possible move down to the ¥105 level. With this being the case, we have to be patient if we want to trade a position in this market for anything more than a quick scalp, but that does not make the chart useless.