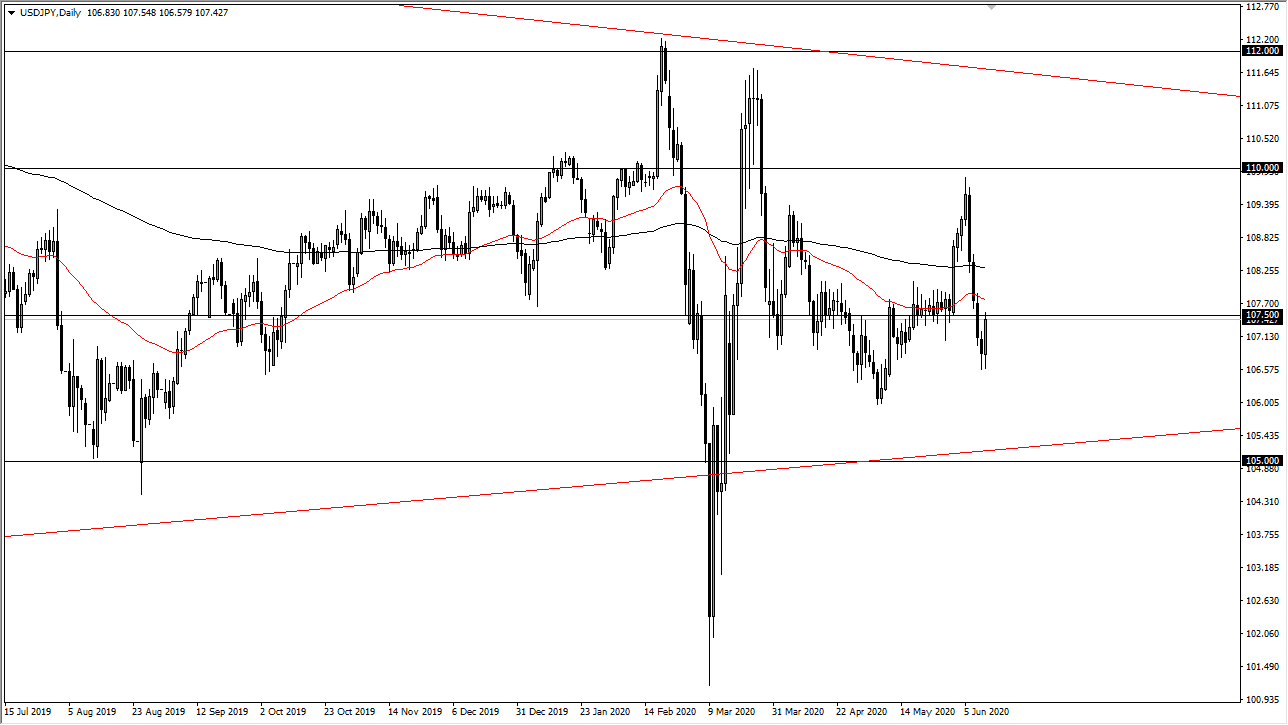

The US dollar has rallied nicely against the Japanese yen during the trading session on Friday. It was a bit of a “risk on” move initially, but we started to see a lot of US dollar strength overall, for other reasons. Ultimately, I think that this market is simply trying to reassert the range that it has been in for some time, with the 160 and level underneath being massive support, and then the ¥110 level above being massive resistance. Between here and there, there are multiple levels that could be an issue, but the most important one is the ¥107.50 level.

The ¥107.50 level has been a bit of a magnet for price, and it does seem like the market keeps looking at that level to settle. The 50 day EMA is sitting right in that area, so I think what we are more than likely going to see is volatility going forward, as markets are all over the place. Looking at this chart, we have crashed right back into the ¥107.50 level, which is something that you probably would have had to expect sooner or later, but the 50 day EMA is just above, and that could cause a bit of a problem as well.

Looking at the chart though, the 50 day EMA and the 200 day EMA are both relatively flat, so that tells you that the market really has nowhere to be right now. I think we simply go back and forth between the two big figures of ¥106 and ¥110 and therefore being patient and playing the range is probably about as good as this gets. Recently, I have been looking at the pair as more or less a way to gauge either Japanese yen strength or weakness. I translate that to other pairs such as the AUD/JPY pair, the NZD/JPY pair, or other such markets. This pair is a little noisy, so it is difficult to get overly aggressive, but a small position trading back and forth in this range makes quite a bit of sense. Using a small position and then playing the range is essentially all you can do going forward. If we do break out of this range, then it could lead to a bigger tray but right now we are nowhere near that trade set up.