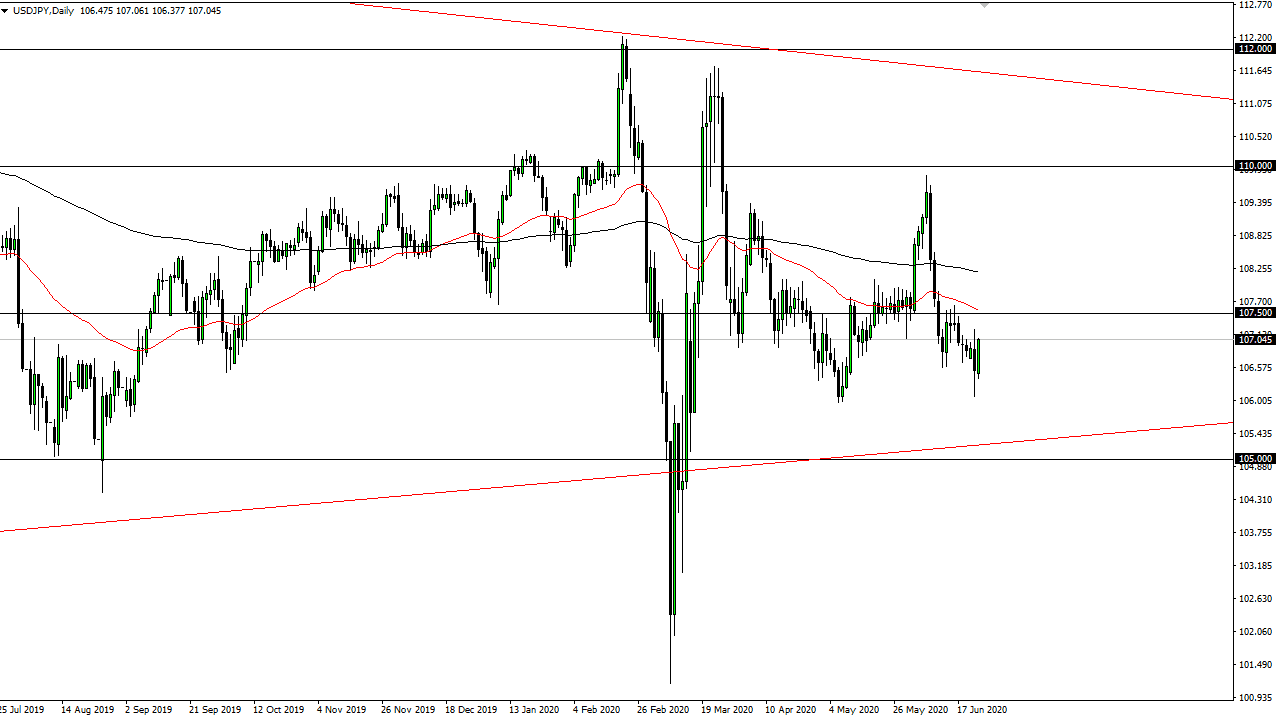

The US dollar has rallied during the trading session on Wednesday, taking back the losses from the Tuesday session. This suggests that we could go looking towards the ¥107.50 level still, where the 50 day EMA is sitting. At this point, the market is likely to see a lot of volatility, but I do think that there is going to be a general push higher. I do not believe that the market will suddenly take off to the upside, but we are starting to see some real money to move into the US dollar overall.

The US dollar is probably going to continue being very strong against the other G 10 currency, but the Japanese yen is also a safety currency so I think it will not be as strong over here. Given enough time, we could go looking towards the ¥108 level which is where we see the 200 day EMA. The 200 day EMA and the 50 day EMA are both sloping lower though, so I think what happens is eventually we get some type of fear out there that makes people look for the Japanese yen overall, so that also will cause a little bit of negativity over here. The real money will probably be made shorting GBP/JPY and other markets like that.

If we do break above the 200 day EMA, it is likely that we will go looking towards the ¥110 level, but I think that is about as far as we go. If we do break above the ¥110 level and we are still concerned about the global situation that is a very negative connotation because it means the US dollar will explode against everything. About the only good thing about that will be that it allows for the trading of FX to be relatively simple as we will simply by the US dollar against almost anything that moves. On the other hand, if we were to break down below the ¥106 level, it opens up a move down to the ¥105 level. I think this pair is going to continue to be very choppy in general, and therefore I do not see a path for a longer-term trade, at least not quite yet. Stay tuned though, this pair could start moving rather rapidly given a chance.