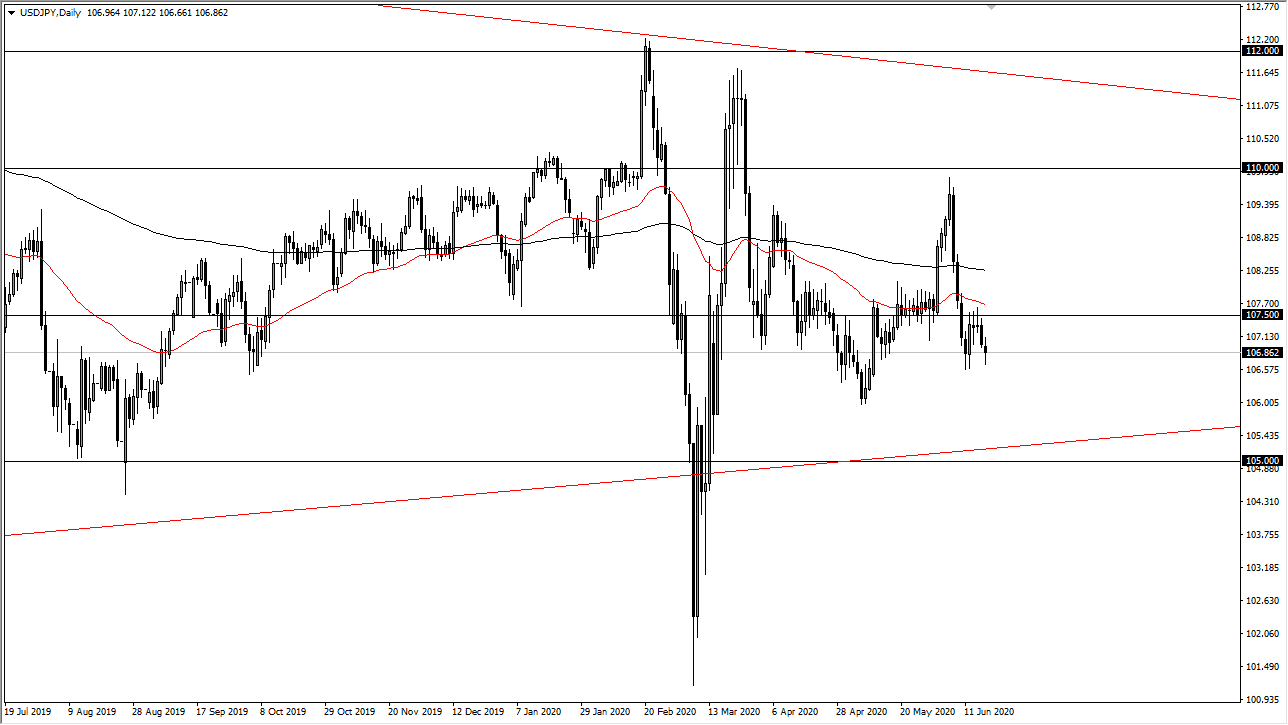

The US dollar has gone back and forth during the trading session again on Thursday, as we simply have nowhere to be when it comes to trading the greenback against the Japanese yen. At this point, the market is likely to see more choppiness, because both of these are currencies that people like to run towards when there are concerns about the global economy as they are considered to be “safety currency.”

To the upside, the ¥107.50 level is an area that is worth paying attention to, as the 50 day EMA is sitting just above there and quite frankly it is likely that the area will continue to be a magnet for price as we have seen it act that way several times. The 107.50 level is an area that I think will continue to be traded towards. I do not see a trade here unless you are willing to sit in front of your computer all day and trade five minute chart, which in that scenario it is quite simple: you just trade back and forth once it gets a little too far from that range.

I have been using this chart as a way to measure what I should be doing with the Japanese yen against other currencies, as the US dollar is a great measuring stick for currencies as far as of relative strength is concerned. If this pair is falling, then typically I will look for shorting opportunities in other currency pairs such as the GBP/JPY pair, AUD/JPY pair, and so on. If it is rising, then I may look to buy those currency pairs depending on what I am seeing out there.

All things being equal we will eventually get some type of explosive candlestick, but right now we do not have it, so it is difficult to get overly excited about anything here. Because of this, this is a market that I think needs to make some type of decision for a longer-term move, and then we will simply follow it. Until then, there is not a lot to do when it comes to trading this market, but eventually we will get an impulsive candlestick that we can follow for several handles. Overall, it is a simple matter of waiting for that trade to set up because this is a market that could take off for larger moves once we finally do get that signal.