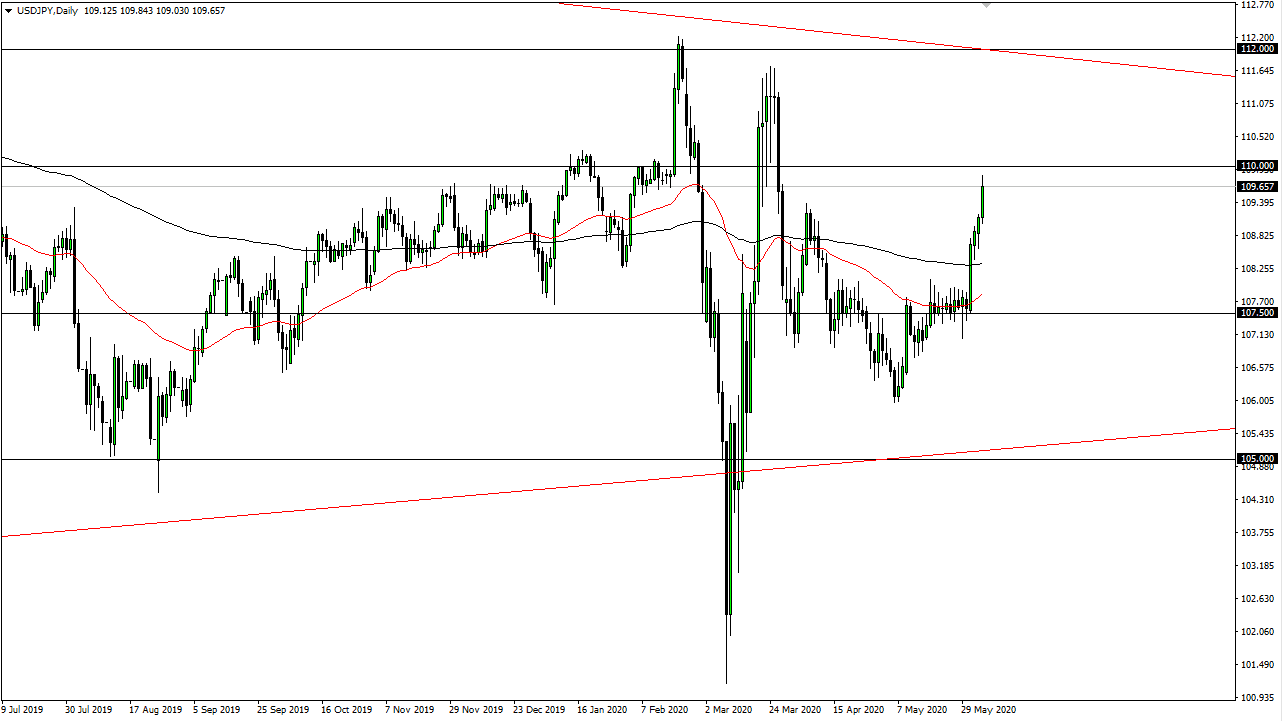

The US dollar has rallied significantly during the trading session on Friday, as it is a continuation towards the ¥110 level, which is a large, round, psychologically significant figure. That being said, it is an area that is going to be a bit resistance. If we can break above there, then it is likely that the pair goes looking towards the ¥111 level. That is an area that has also sold off the pair yet again. On the other hand, if the market turns around and breaks down below the bottom of the candlestick for the Friday session, that would be an extremely negative sign. That could send the market down towards the 200 day EMA, and perhaps even to the ¥108 level.

Keep in mind that the pair has rallied significantly during the trading session on Friday due to the fact that the jobs number was much better than expected. As we ended up seeing an addition of 2 million jobs instead of a loss of 7 million that Wall Street was looking forward. Which, is an extraordinarily bullish sign and it is a major “risk-on” type of scenario. This typically lifts the pair as the Japanese Yen is considered to be a major safety currency, even more so than the greenback.

Looking at this chart, we have seen a massive bullish move, so therefore I think that the volatility will continue to cause quite a bit of confusion, but ultimately you look at the USD/JPY pair, the longer-term charts do suggest that the pair is trying to build a bit of a massive triangle, so therefore it is likely that we are going to see a massive move eventually, but we have not broken out of it yet. That does not happen until we get above the ¥112 level or possibly below the ¥105 level.

Until then, we simply continue to go back and forth and wreck trading accounts from time to time. I suspect that we are eventually going to see signs of exhaustion above that we can take advantage of. These signs would be sold into, just as the signs of a bounce from lower levels could offer buying opportunities. I think it is only a matter of time before we see a turnaround, only because this pair is so volatile in general. On a pullback from the ¥110 level, the ¥108 level is likely to be targeted.