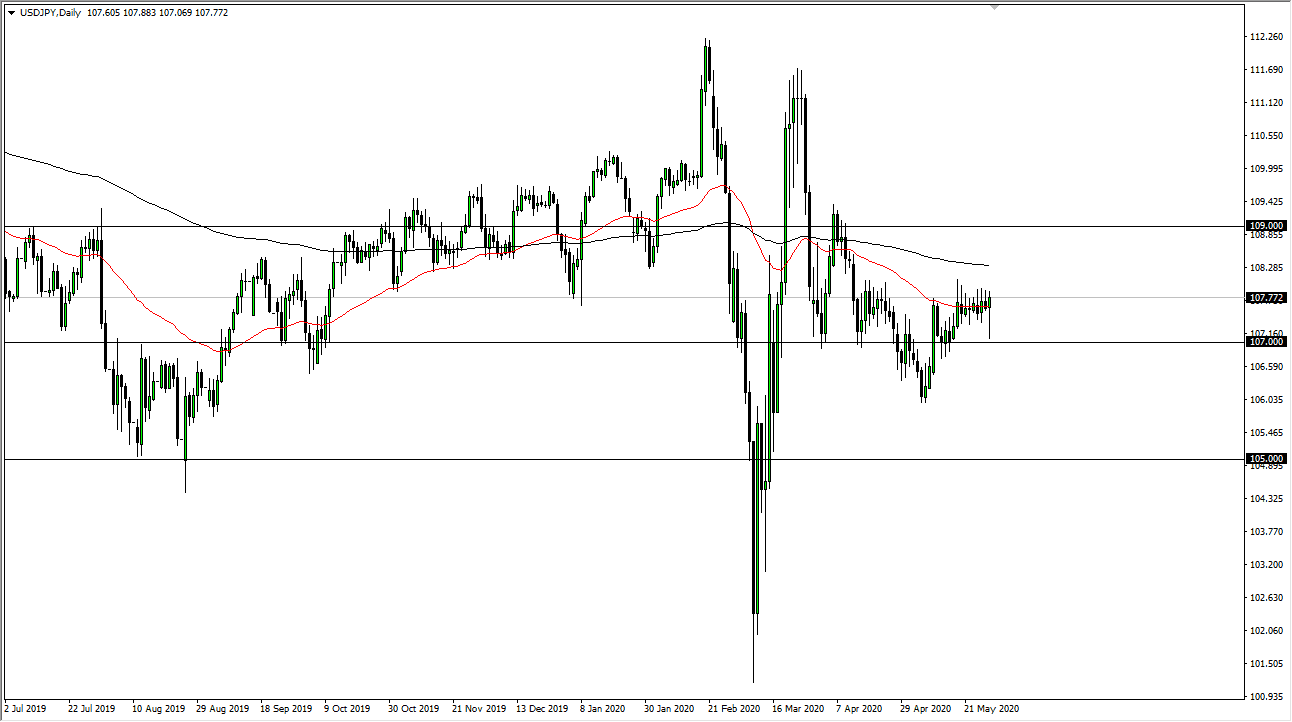

The US dollar initially fell during the trading session on Friday to reach down towards the ¥107 level. That is an area that has been massive as far as support is concerned for some time. We bounced hard from that level and then shot towards the ¥108 level, an area that has been massive resistance. It is worth noting that the candlestick is a massive hammer, so it looks like we are going to continue to try to break to the upside. If we can break above the ¥108 level, the 200 day EMA comes into focus almost immediately, so even a breakout at this point is probably going to be less than spectacular. Above there, then we have to deal with the ¥109 level, an area that has seen a lot of selling.

To the downside, it is quite possible that we may see a lot of support just below the ¥107 level so I think it is can it take a while to break down through there. If we do, then it is likely that the market then will go looking towards the ¥106 level, where we have bounced from previously. I think choppiness will continue to be the order of the day so it would not surprise me at all to see a bounce from there even if we did get the breakdown that people may be looking for.

The market does not necessarily look overly compelling at the moment as we have been compressing for some time. I believe that we are going to continue to see a lot of back and forth and that makes sense considering both of these currencies are considered to be “safety currencies.” Because of this, I like the idea of simply trading back and forth on short-term charts, and not a lot more than that. There may come a day when this changes, but right now we are nowhere near it, so I am not looking for much. That being said, if this pair does start to grind higher, then I might look to go long some other pairs like the GBP/JPY, AUD/JPY, etc. Of course, the exact opposite could be true if we break down then I might be looking to short the GBP/JPY, etc. as this pair could be used as a barometer for Japanese strength or weakness when it comes to the currency markets.