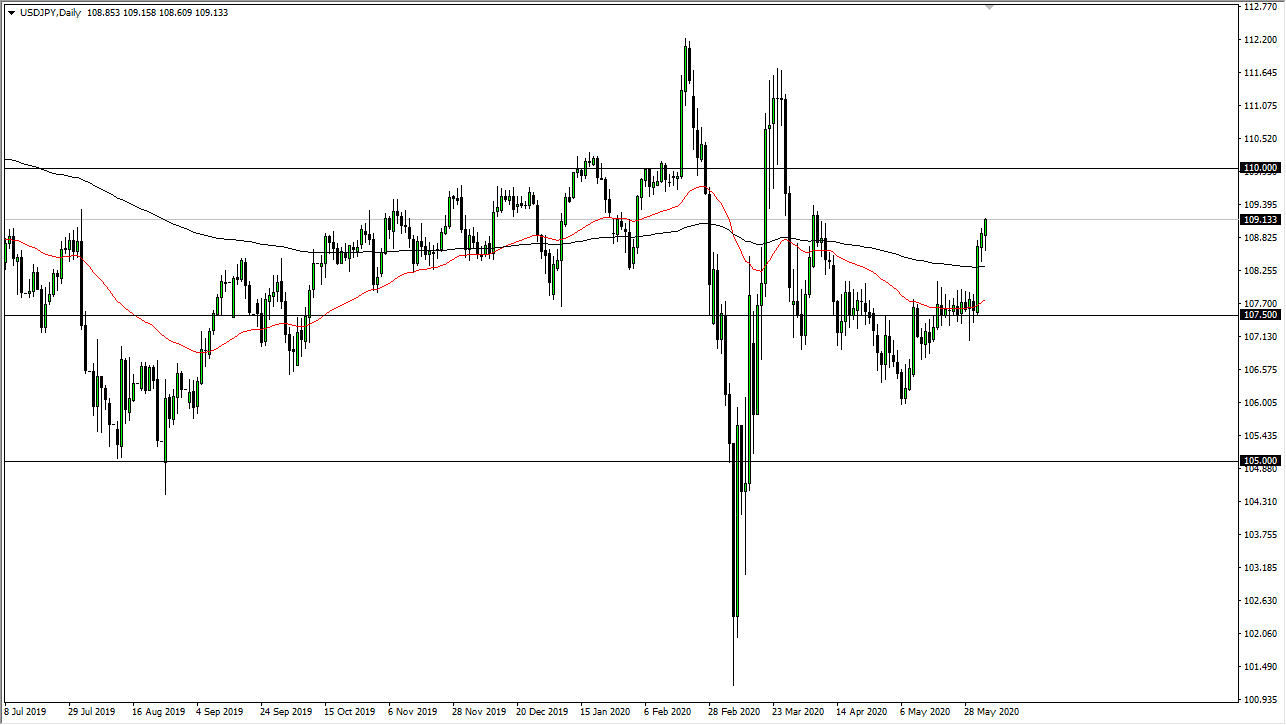

The US dollar has rallied a bit against the Japanese yen during the trading session on Thursday, breaking above the ¥109 level. At this point, the market is likely to see a little bit more pressure in the pair, especially considering that the jobs numbers coming out on Friday. The Non-Farm Payroll figures are massively influential would it comes to this pair, so do not be surprised to see some type of big move at one point or another during the day.

If we do break above this little area just north of the candlestick, it is likely that the dollar will go looking towards the ¥110 level. This is more or less a “risk on” type of trade, so having said that it will be interesting to see how the stock markets behave. They are clearly a lot of headwinds for the stock market right now, but it seems to continue to climb higher regardless. With that being the case, it is likely that we will simply grind away to the upside. However, if we break down below the bottom of the candlestick for the trading session on Thursday, the market is likely to go looking towards the 200 day EMA, which should be supportive. If we break down below there, then it opens up the door to the ¥107.50 level.

I think this is a market that is probably a bit too difficult to put a lot of money into this pair, but after the jobs report we will probably continue to see noise and then eventually some type of clarity. For that, I would be more willing to put money to work after the weekend and of course we get through some of the potential headlines risks that are going to be out there. Monday morning will be an interesting trend, so pay attention to my analysis at the end of the day on Friday as it could give a decent signal, but right now trying to trade this into the nonfarm payroll number is simply gambling. The Japanese yen is considered to be “safer” than the US dollar, so it really comes down to the risk appetite and whether or not Wall Street is going to look past a horrific jobs report, which so far it has been able to. It is because of the potential “knee-jerk reaction” that I am cautious about doing anything ahead of the figures.