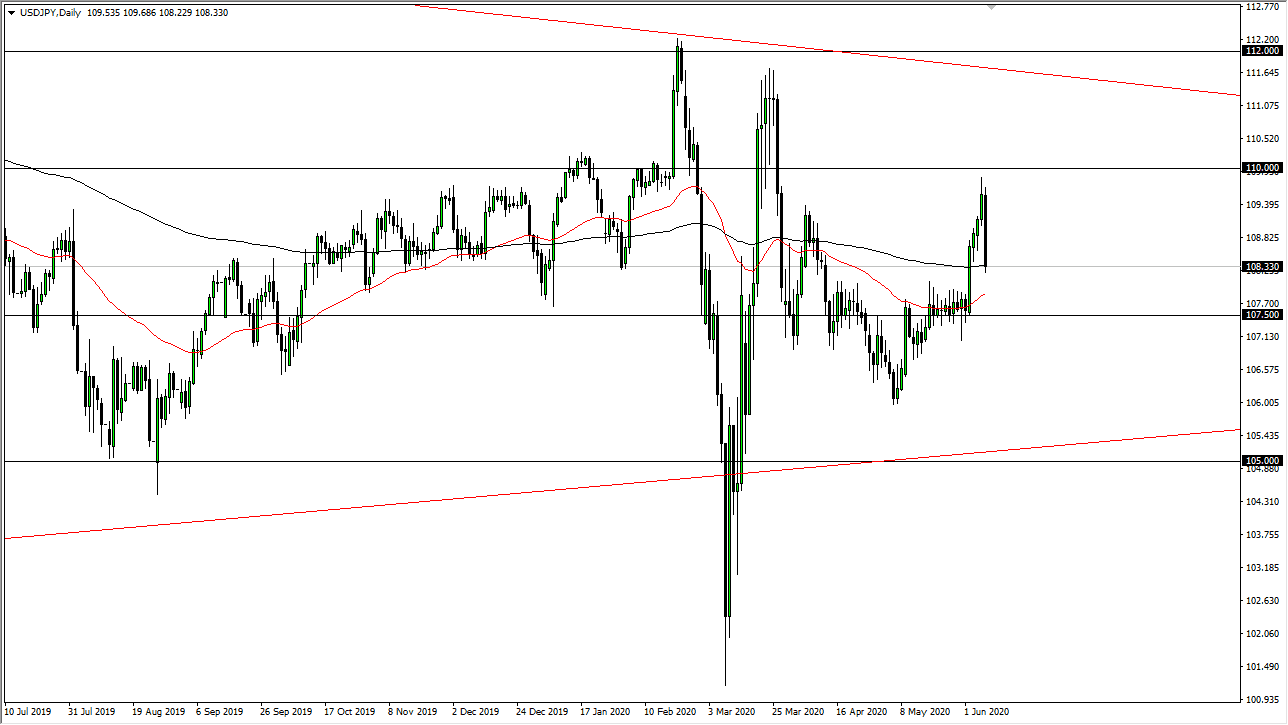

The Japanese yen has strengthened quite a bit against the US dollar during trading on Monday, as traders brought the pair back towards the 200 day EMA. This is a very negative candlestick, and it suggests to me that we will probably continue to see bearish pressure. The US dollar against the Japanese yen is quite often used as a proxy for risk, which is a bit ironic considering that typically it will fall as the stock markets go higher. We have seen the exact opposite during the session on Monday, which of course is something to pay attention to.

The 200 day EMA currently resides at the ¥108.30 level, which is basically where the market is closing for the session. If we get a bit of a bounce from here, and that would be well within the range of normalcy, the ¥110 level above becomes a massive barrier that I doubt this pair gets through anytime soon. The size of the candlestick is something to pay attention to as well, because when you get these massive candlesticks typically it means that there is a bit of follow-through. I do recognize that the ¥107.50 level was significant support as of late, so if we reach that area, I would anticipate that the buyers will step in and try to support this market.

On the upside, if we bounce again, I believe that the ¥110 level is going to be targeted. That is an area that has been important more than once so do not be surprised at all to see that level hold. After all, this pair does like to go sideways and bounce around in general, so we may very well be trying to carve out some type of new range between ¥107.50 and ¥110. Keep in mind though, that this pair is typically highly correlated with the risk appetite of traders around the world, which is kind of ironic because we have broken away from that correlation as of late. Longer-term, it does tend to be the case so keep an eye on stock markets and the like to see how risk appetite is, because that will give you an idea as to whether or not this market will climb. If risk appetite is poor, quite often people will look towards the Japanese yen for a bit of safety.