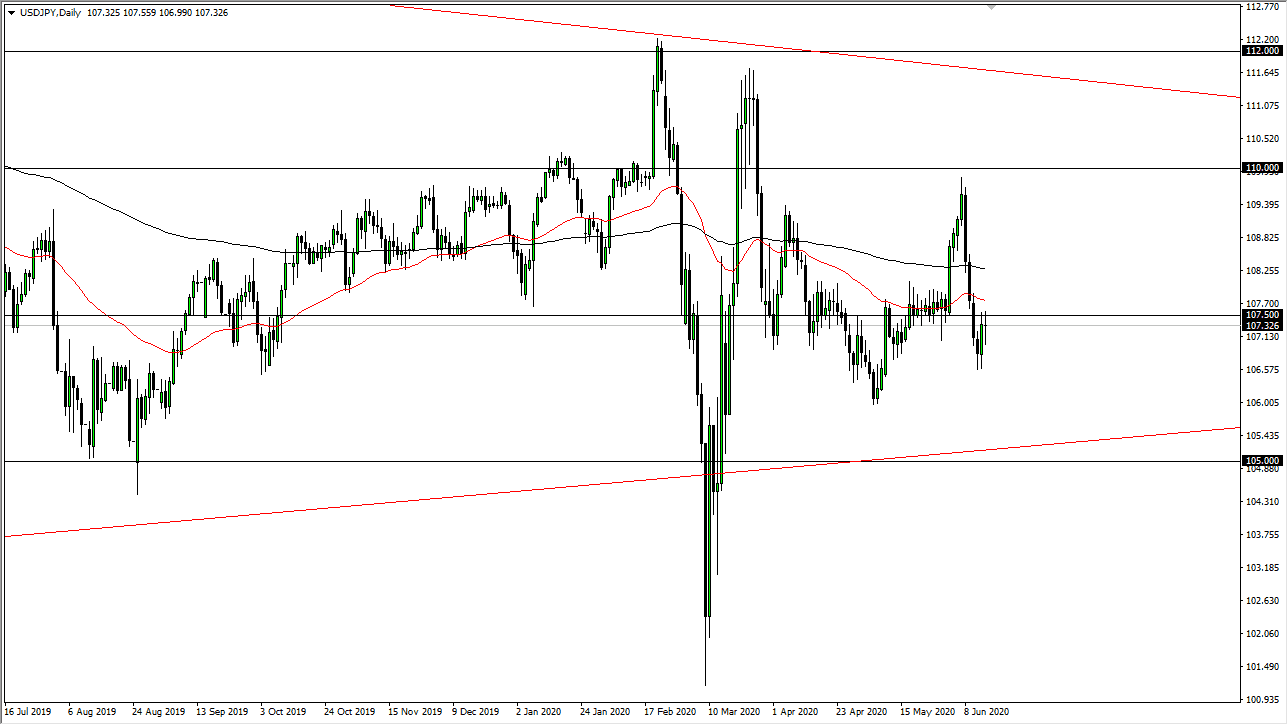

The US dollar has gone back and forth during the trading session on Monday, as markets still have no idea what to do with themselves. The ¥107.50 level continues to be crucial, as it is an area where we have seen both buyers and sellers more than once. With that being the case, the market is likely to see a lot of volatility, as both of these are considered to be safety currencies, and of course they react to people showing signs of fear. With that in mind, this is a market that will continue to be very choppy and volatile, and quite frankly I do not think we break out anytime soon.

The 160 and level underneath is massive support, followed by the ¥105 level. To the upside, if we can break above the ¥108 level, then we could very well go looking towards the ¥110 level. The 50 day EMA and the 200 day EMA both look very sideways right now, and therefore it shows any real lack of momentum. I think at this point it is unlikely that this market takes off with any type of real assertion, as when you look at the longer-term charts, we are forming a massive triangle. Because of this, this is a short-term back-and-forth type of trading environment, so unless you have the ability to micromanage every trade you put on, this is not going to be the market for you. I do not use it to actually trade anymore.

This for me is a relative strength chart for the Japanese yen. If the pair is rallying quite significantly, I start looking for trades in the GBP/JPY pair, AUD/JPY pair, CAD/JPY pair, and so on. If this pair rises, I am looking to buy one of those pairs. However, this pair rolls over, then I am looking to sell one of those pairs as it shows the Japanese yen strengthening against the greenback, which is the basic measuring stick of almost all currencies. Beyond that, I do not have much use for this market, at least not until we break out of the range that we have been in. I do not see any signs of that happening in the short term, so with both of the central banks liquefying the markets as much as they can, I think this will continue to be a fight back and forth without any clarity.