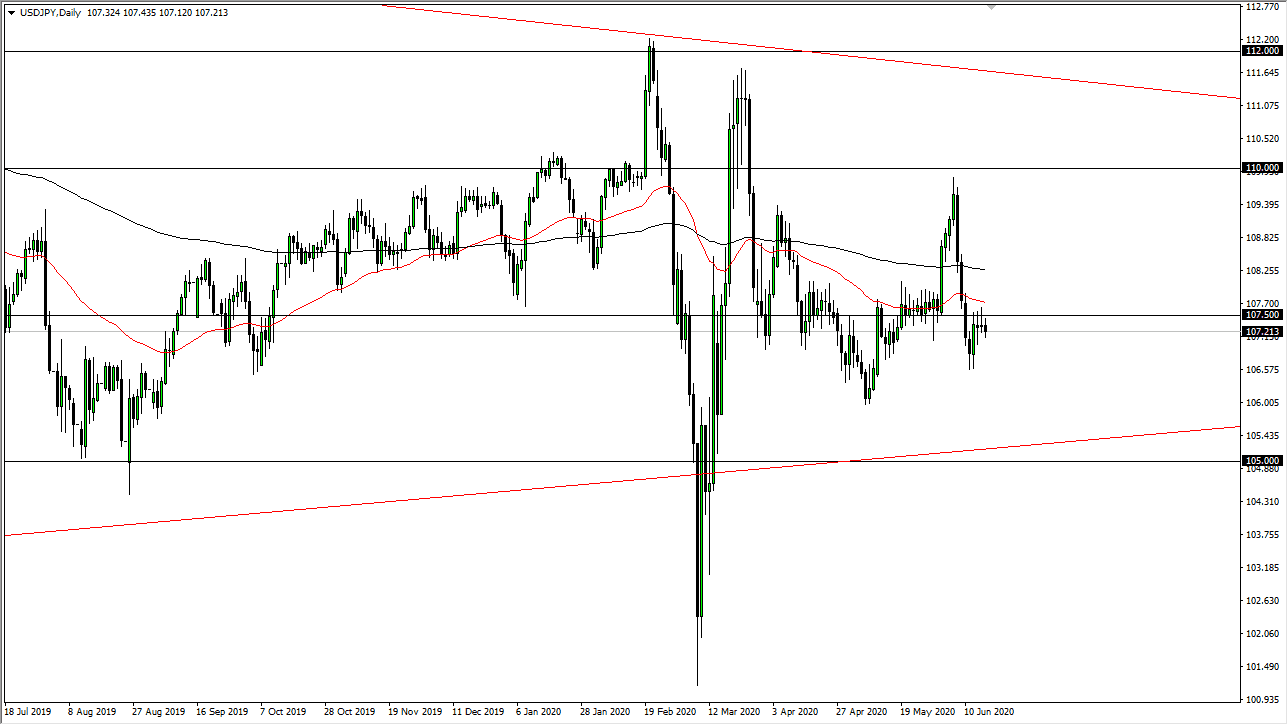

The US dollar has initially tried to break above the ¥107.50 level but then pulled back a bit to show signs of exhaustion. Ultimately, the 106.50 level underneath is massive support. I think that this market continues to go sideways and do nothing, as we have seen the 107.50 level be a bit of a magnet, and therefore I do not really expect too much to happen here. If anything, we would pull down towards the 160 and level, and then possibly even down to the ¥105 level. However, I do not even necessarily believe in that move, or think that it is going to be a major one.

To the upside, the ¥108 level is a significant amount of resistance, so if we were to break above there that it is likely we could go higher. However, this is the type of market that can put you to sleep, so I think that is probably going to continue to be more of the same. This is a market that will make a move, but until we get some type of massive impulsive candlestick, it is difficult to imagine that the market is going to take off for anything worth hanging onto.

However, I will use this pair as a barometer on the Japanese yen itself, and therefore trade other currencies depending on which direction this market is moving. For example, if the Japanese yen is starting to strengthen, then I might short NZD/JPY, GBP/JPY, or something along the lines of that. Obviously, on the other hand if this pair does take off to the upside then it means that the Japanese yen is going to lose strength against multiple currencies around the world, all things being equal. Because of this, it is likely that the market simply drifts back and forth and therefore you can look at other currencies than then check this market as a bit of a barometer as to which direction you could be moving. I do not have any specific trades set up here, because the pair has been such a dud as of late. It is almost as if we are going to be in a “holding pattern” when it comes to this market, so that is something worth paying attention to and therefore I am simply going to let the market tell me which way to go but we need to see a large candle in order to get excited about anything.