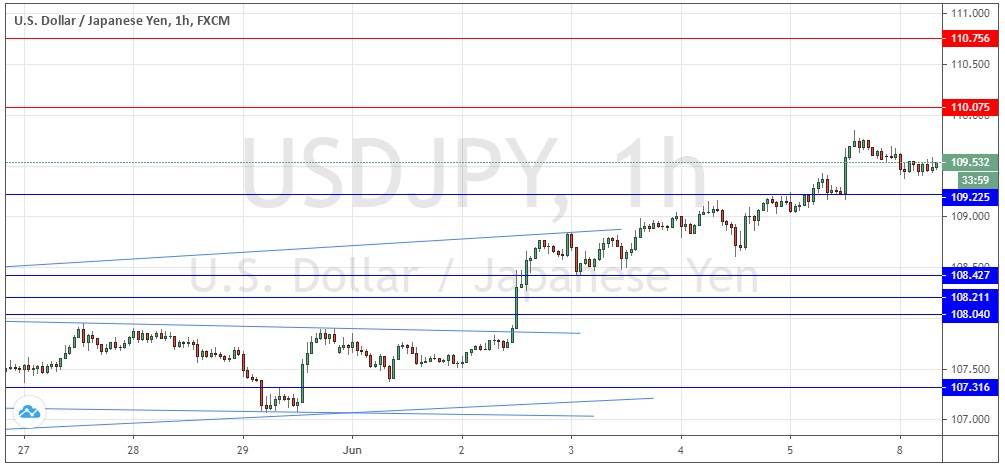

USD/JPY: New 50-day high close

Last Thursday’s signals were not triggered as the bullish price action took place slightly below 108.80.

Today’s USD/JPY Signals

Risk 0.75%.

Trades must be entered from 8am New York time Monday to 5pm Tokyo time Tuesday.

Short Trade Ideas

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 110.08 or 110.76.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 109.23 or 108.43.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Analysis

I wrote last Thursday that if the price could get established above 109.25, especially above 110.00, that would be a very bullish sign. I was looking for a long trade from support.

This was a good call as the price broke above this resistance level during the Asian session, and this was the start of a small but significant bullish move higher which produced a new 50-day high closing price as the week ended, which is typically a bullish sign.

The USD has been showing long-term weakness for several days, so this pair is bucking the trend – what this tells you is the real story is weakness in the Japanese Yen, which acts as an important safe haven these days. As stock markets continue to rise, this pair as a risk barometer should also tend to rise. Yet note that as it’s the Dollar rising, it probably will not go very far very quickly. Traders might do better being short of the Yen against riskier currencies such as the AUD or GBP in this “risk on” environment.

The price looks somewhat likely to rise today, as long as it can stay above the flipped resistance to support at 109.23. I will take a long trade if we get a bullish bounce at that level later.

There is nothing of high importance due today concerning either the JPY or the USD.