The risk appetite and the positive US job numbers were a catalyst for the USD/JPY in correcting upwards to the 109.85 resistance, the highest level of for the pair in more than two months, before it closed last week’s trading around the 109.58 level. The return of tensions between the United States and China may push the pair back down again. Besides, optimism about the return of global economies will be offset by the start of the second wave of the Corona epidemic. Until now, the United States of America is still the world leader in terms of infections and deaths, in a very sensitive time for Trump's future as President of the United States of America. The recent turmoil caused by the killing of an African American will shake confidence in the American administration and how many votes Trump will win in November.

On the economic side, the US Department of Labor report showed that employment in the United States unexpectedly showed a significant recovery in May. And that non-farm jobs jumped 2.51 million in May, after falling by 20.69 million in April. The record rise in employment came as a shock to economists, who expected another 8.0 million jobs to be lost after the crash, with 20.5 million jobs originally announced in the previous month.

Employment rose sharply in leisure and hospitality, construction, education, health services, and retail, according to Ministry of Labor figures. Most other sectors also saw a recovery in employment, although government jobs fell by 585,000 jobs, often reflecting layoffs by local governments. The Ministry of Labor claimed that the improvements in the labor market reflected a limited resumption of economic activity that was curtailed in March and April due to the coronavirus pandemic, and efforts to contain the spread of the disease.

James Knightley, chief international economist at ING, described the data as “simply surprising given the slow pace of the reopening and the fact that more than 12 million people filed for new unemployment during the survey period”. With the unexpected recovery in employment, the US Labor Department said the unemployment rate fell to 13.3 percent in May from 14.7 percent in April. Economists had expected the unemployment rate to rise to 19.8%.

The unexpected drop in the unemployment rate came as the household survey found that employment increased by more than 3.8 million people compared to an increase of 1.7 million people in the size of the workforce.

Meanwhile, the report said average hourly employee wages fell by $0.29, or 1.0 percent, to $29.75 in May, after rising by $1.35, or 4.7 percent, to $ 30.04 in April. The annual rate of average hourly wages growth later fell to 6.7 percent in May from 8.0 percent the previous month.

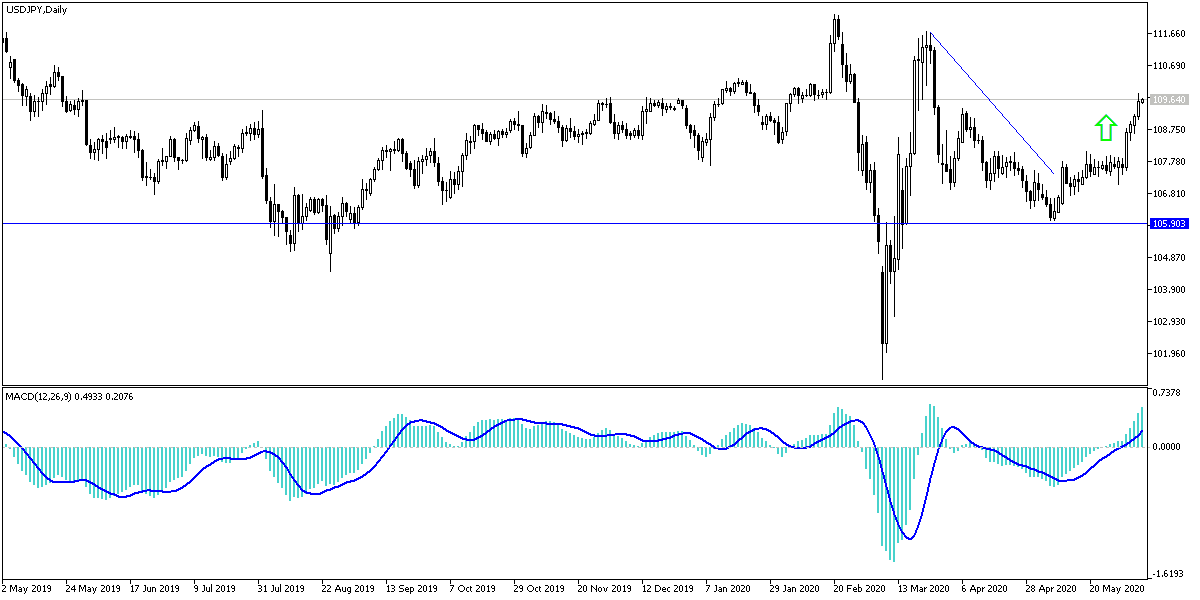

According to the technical analysis of the pair: USD/JPY success in moving towards the 110.00 psychological resistance will continue to support the bulls control, and to reverse the general trend. But at the same time it must be noted that the technical indicators have started to give signals of overbought areas, and investors may think of profit-taking sales if the tensions between the United States and China increase. The pair upward correction efforts might evaporate if the pair returns to the 108.60 support. In light of the absence of important US economic releases, we will expect the pair to perform in a narrow range. From Japan, the GDP growth rate and the current account will be announced today.