After four trading sessions in which the USD/JPY pair attempted an upward correction with gains to 107.88, it returned to stability around the 107.55 level as the global financial markets are still unable to move aggressively towards risk, as the increasing numbers of coronavirus threaten the rest of the global economy. In addition to that, trade and political tensions around the world weaken investor appetite. China has warned on two different occasions recently that unless the United States stops confronting it in many areas and crossing the "red lines", it will not fulfill the Phase 1 trade agreement.

Trade negotiator Liu He delivered that message on June 18, and at around the same time, Yang Jiechi presented it to US Secretary of State Pompeo at their meeting in Hawaii. After that, both US President Trump and Treasury Secretary Manuchin threatened to completely disengage the two largest economies in the world. With Beijing accounts, it achieved less than 20% of import targets in the first five months of the year. However, China reported that industrial profits increased in May (6%) to compensate the state-owned companies for severe losses that extended for four months, as profits decreased by 39.3% in the first five months of the year compared to a decline - 11% in profits of private sector companies.

On the other hand, consumers in Japan went shopping in May. This supported a 2.1% increase in retail sales in May after falling a revised -9.9% in April (initially -9.6%). The decline increased year on year to -12.3% from a revised decrease of -13.9%. Today, Japan will release employment and industrial output figures for May. Unemployment is expected to rise while industrial production continues to contract. The results of the Tankan Survey will be published for the second quarter tomorrow, Wednesday, and sharp declines are expected in the industrial and non-industrial sectors.

Also from Asia, Hong Kong trade figures in May were worse than expected, as exports declined - 7.4% year on year after falling - 3.7% in April. Imports fell - 12.3% in May and - 6.7% in April. The net result was a small trade deficit ($ 13.7 billion vs. $ 23.3 billion). Exports to China increased by 0.3% compared to last year, while exports to the United States decreased by 14.4%. Imports from China decreased by -14.4%, while shipments from the United States decreased by -30% from last year level.

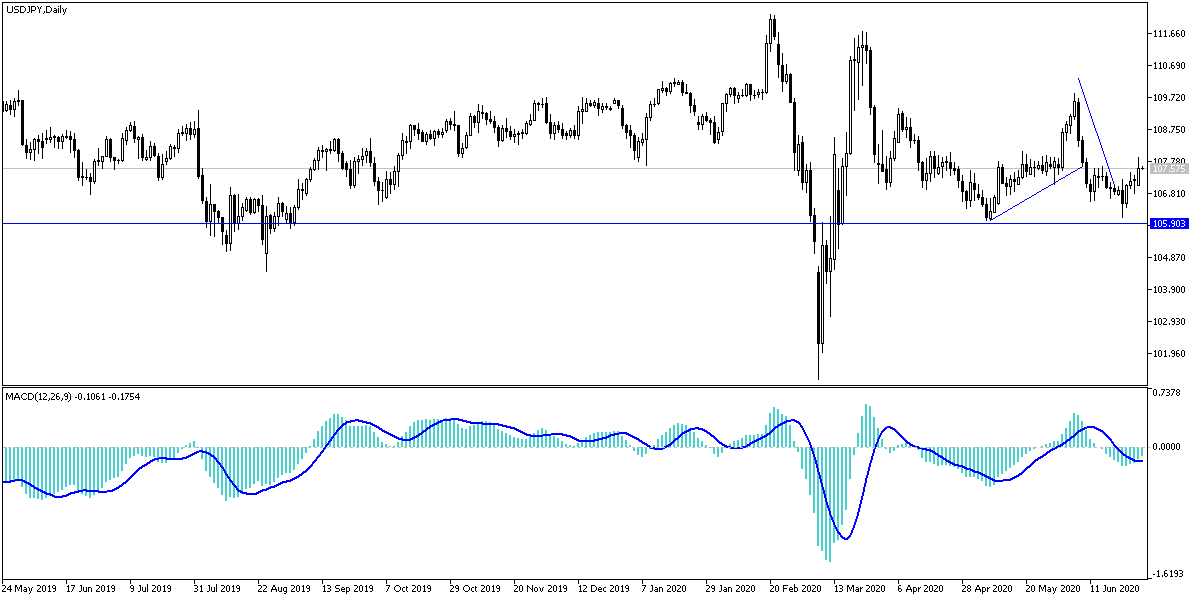

According to the technical analysis of the pair: The USD/JPY pair will not have the strongest opportunity for an upward correction without increased investor’s risk appetite and giving up on safe havens that are in favor of the yen at the expense of the dollar. On the daily chart, we are still waiting for a move above the 108.75 resistance to have an opportunity for a stronger bullish correction. At the moment, stability below 107.00 support will remain supportive for stronger downward control for a longer period. The second wave of the Coronavirus will continue to strongly affect investor sentiment and the of global financial markets performance.

As for the economic calendar data: From Japan, the unemployment rate and the industrial production rate will be announced. From the United States we will have the important Chicago PMI, the American consumer confidence and the testimony of the US Central Bank Governor Powell along with the US Treasury Secretary to clarify the stimulus plans for the largest economy in the world.