For several consecutive trading sessions, the USD/JPY currency pair stabilized in narrow ranges with a bearish bias, which may herald a strong movement coming in either direction. The pair is stable around 107.15 at the time of writing, after its recent losses, which extended to the 106.66 support, and everything depends on the extent of the investor's risk appetite and the recent increase in Coronavirus infections, which threatens the governments’ plans to reopen the global economy. Concerns about a second wave of the COVID-19 pandemic and weak economic data remain the main catalysts in the foreign exchange markets, and may in turn lead to a stronger US dollar as a safe haven. The number of new infections in the US has increased by 15% in the past two weeks. Over the weekend, seven out of 50 states in the United States registered record levels of new epidemic infections.

The Japanese central bank kept its monetary policy items as is at the last meeting, as policymakers hope the global recovery is slowly happening. The bank said it would provide about $1 trillion to help financially strapped companies.

On the other hand, the results of the American economic data witnessed some improvement in conjunction with the reopening of the American economy, by abandoning some terms of the closure policy adopted for months to contain the spread of the virus. Powell, the Federal Reserve Chairman, had a grim message to Congress, warning that the US economy is still in the midst of a deep downturn, with "great uncertainty" over how long the economic recovery will take. Powell added that he does not expect a full recovery until the public is convinced that Covid-19 has been contained.

US states are still reporting more infection cases, threatening current Trump administration plans to reopen the US economy in coexistence with the epidemic until a vaccine is eliminated.

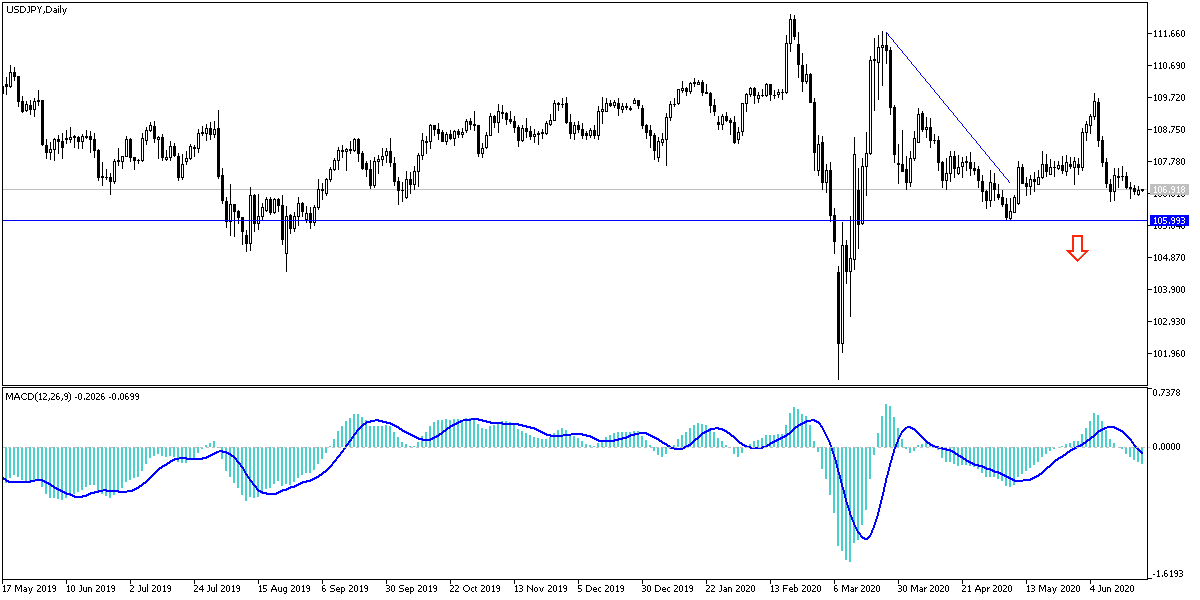

According to the technical analysis of the pair: As we previously expected, a break below the 108.00 support will motivate the bears to push the price of the USD/JPY to stronger support levels, which is what happened in the last trading sessions. However, according to the performance on the daily chart, the pair is on a date with a price explosion in one of the two directions, and it may be a move up with the technical indicators reaching strong oversold areas. The closest support levels for the pair are currently 106.55, 105.80 and 104.90 respectively. I still prefer buying the pair from every downtrend. On the upside, the 108.60 resistance will be key for the awaited bullish rebound strength.

As for today's economic calendar data: The Consumer Price Index and Industrial Purchasing Managers' Index are expected from Japan. During the US session, the Manufacturing PMI and New Home Sales index will be announced, as well as the Richmond Industrial Index reading.