After four straight bearish sessions for the USD/JPY last week, the pair collapsed to the 106.56 support, the lowest level for a month. Last Friday’s session was the first bullish correction attempt, as the pair rose to the 107.55 level. With renewed buying of the USD as a safe haven, the announcement of new Covid-19 cases after the world economies reopened, the second wave of infections, and the threat to the global economy - the pair is stable around 107.20 at the time of writing.

According to a report from Johns Hopkins University, the number of coronavirus cases worldwide has risen to more than 7.5 million, while the death toll is over 421,000. The United States continues to have the largest number of confirmed cases in the world, followed by Brazil, Russia, India and the United Kingdom. With fears mounting about the second wave, US Treasury Secretary Stephen Munchin rejected the need for a second closure even if new cases increased.

On the economic side, a report from the University of Michigan showed a continued recovery in US consumer confidence in June. The preliminary report showed that the June consumer confidence index rose to 78.6 from 72.3 in May and 71.8 in April. Economists had expected the index to rise 75.0.

The US central bank kept the interest rate at a record low from 0 to 0.25% and indicated that it plans to keep it unchanged until 2022. The Federal Reserve Board also said that it will continue to purchase billions of dollars of treasury and mortgage-backed securities to support the financial markets. This week, Fed Chairman Jerome Powell will testify before the congressional committees for two days, starting on Tuesday, on the new report. Lawmakers are expected to ask Powell to explain how the central bank plans to continue supporting the economy during what is expected to be the most severe economic downturn in the past seventy years.

Powell predicted last week that recovery would likely be slow, with millions of Americans unable to return to their old jobs.

Economic expectations have shown that the US central bank's key interest rate, which the central bank lowered in March to a record low near zero, is expected to remain as is until the end of 2022 with only two of the fifteen Fed officials expected the rate to be higher than 0 by late 2022.

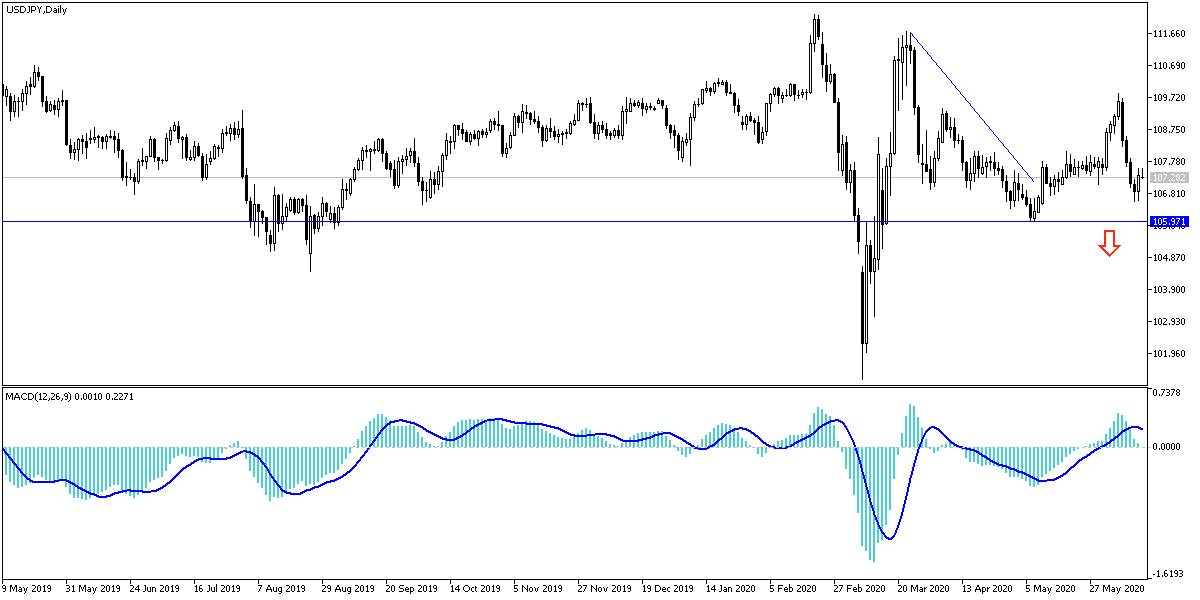

According to the technical analysis of the pair: On the daily chart, the USD/JPY is still under downward pressure since it gave up stability above the 108.00 resistance, and it may remain under downward pressure if it attempts to move towards the 106.56 support reached last week. Despite the recent collapse, I still prefer buying the pair from every lower level, as the technical indicators are currently pointing towards oversold areas. Investors may go long, rather than anticipate further drop, especially with the focus on the USD, with renewed Corona cases. The closest support levels for the pair are currently 106.85, 106.10 and 105.45, respectively, and there will be no control of the bulls again without achieving strong gains such as that recorded in the week before last.

Today, the pair is not expecting any important data announcements, whether from Japan or the United States.