After two weeks in a row, during which the Japanese yen managed to achieve strong gains against other major currencies, the price of the USD/JPY currency pair, surged towards the 106.66 support, before it closed last week's trading around the 106.88 level. The pair's recent support levels are good in thinking about profiting from retracement. The US administration is still intent on continuing to open the US economy, despite more than 2 million people being infected with the coronavirus, and nearly 120,000 people dead. With the reopening, the virus appeared to spread through the West and the South. Arizona State reported 3109 cases, just below Friday's number, and 26 deaths. Nevada also reported a new high of 445 cases.

On the other hand, the Japanese economy opens with caution, with far-reaching restrictions amid the coronavirus pandemic. In general, the delicate "natural new" balance that takes place across the world is unstable but necessary for Japan, whose long-stagnant economy needs tourism, exports, and booming small businesses to avoid deeper slides in recessions.

In this context, Yoshimasa Maruyama, chief market economist at SMBC Nikko Securities, said that although the Japanese Coronavirus restrictions have never been as severe as closures in the United States, Europe and some other parts of Asia, the damage is still significant.

The Japanese economy was already suffering from a tax hike last year. Then auto exports to the United States and Europe fell when the outbreak began. Consumer spending is unlikely to recover quickly, and Americans may feel happy and go out after the ban is lifted. But Japan's mindset tends to become more cautious about spending due to uncertainty about the future. He added that a return to pre-epidemic levels of economic activity is not expected for Japan until 2023, a year after the potential recovery in the United States.

Japan's exports and imports have decreased. The world's third-largest economy has shrunk for two consecutive quarters and is already in a formal recession. The Tokyo Olympics, a symbol of great hope for economic support, was put off until next year, which has cost the capital billions of dollars, although the exact amount has not been revealed. The Japanese government announced a stimulus package of 230 trillion yen ($2 trillion), including helping local businesses and 100,000 yen ($930) cash assistance for every adult to persuade consumers to spend.

With about 1,000 deaths associated with coronavirus, Japan has survived the massive death tolls of Italy, Spain, the United States, Brazil, and Russia. But critics fear that the government's push to reduce loosening restrictions relates to the economy's preference over health concerns. This includes stimulating dying tourism. The government is considering reopening travel to and from countries where coronavirus cases are relatively limited compared with Japan, such as Australia, New Zealand, Vietnam, and Thailand.

The number of visitors to Japan in May was 1700, which is 99.9% lower than a year earlier, according to the Japan National Tourism Organization, the lowest number since the government started following statistics in 1964. Japan has attracted nearly 30 million visitors from abroad in recent years, most of them from South Korea and China.

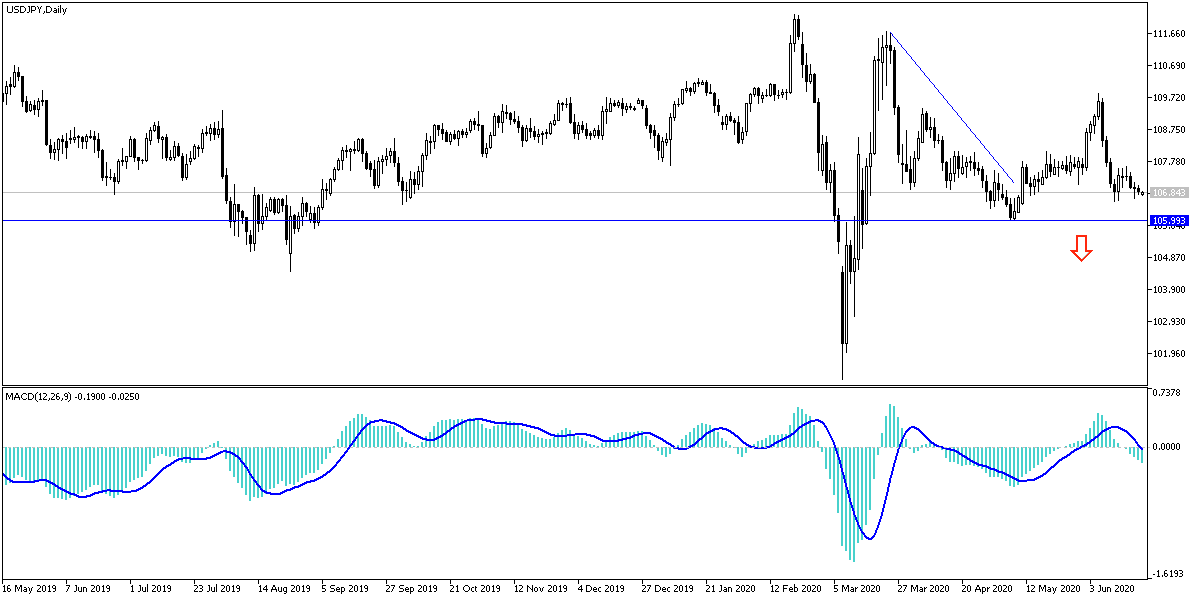

According to the technical analysis of the pair: Technical indicators of the USD/JPY performance, reached strong oversold areas, and therefore, investors may consider entering into long positions to profit from the bounce and the upward correction. The closest support levels for the pair are currently at 106.60, 105.90 and 104.80, respectively. On the other hand, returning to the bullish channel path will require the pair to return to breach the 108.55 resistance. All in all, I still prefer buying the pair from every lower level.

Today's economic calendar is relatively calm and the pair will react more investors’ risk appetite.