Besides risk appetite, there were better than expected results for the US economic figures, which motivated the USD/JPY in completing the bullish path with gains reaching to the 109.00 resistance, its highest level for nearly two months, where it is stable around in the beginning of Thursday’s trading. American companies lost 2.8 million jobs in May, far below the expected 9.3 million jobs. The ADP survey reported that US companies shed 22.6 million jobs combined since March, with most layoffs occurring in April, as the Covid-19 forced employers to close offices, factories, gyms and schools, while demand for gasoline, clothing, airline tickets, hotel rooms and restaurant meals quickly disappeared.

Commenting on the results, Mark Zandi, chief economist at Moody's Analytics said, in the absence of a second wave of disease outbreak and with some additional government support, the COVID-19 recession seems to have only lasted three months. "It will be the shortest period of recession ever, but it will be among the most severe recessions," Zandi told reporters.

The damage to the American labor market was concentrated in two sectors. As manufacturers cut 719,000 jobs in May, the trade, transport and utilities sectors gave up 826,000. Other sectors that suffered a loss of 19.6 million jobs in April saw a sharp slowdown in layoffs. The entertainment and hospitality industry - which includes hotels and restaurants - lost 105,000 jobs last month, down from a revised loss of 7.7 million in April.

The announcement of these results comes two days before the announcement of official monthly job numbers from the US Department of Labor. Economists expect Friday's report to show a loss of 8 million jobs in May as the unemployment rate approaches 20%.

On the other hand, the US services sector shrank for the second month in May, as the Coronavirus pandemic caused closures and layoffs across the country. But activity has risen from last month's levels that we have not seen since the recession. Accordingly, the Institute of Supply Management announced that the ISM service sector index had reached 45.4 last month, slightly higher than the April reading of 41.8. As is well known, any reading below the 50 level indicates that a slowdown in the services sector, where the majority of Americans operate, is in contraction. The April drop broke a chain of more than 10 years of growth in the services sector.

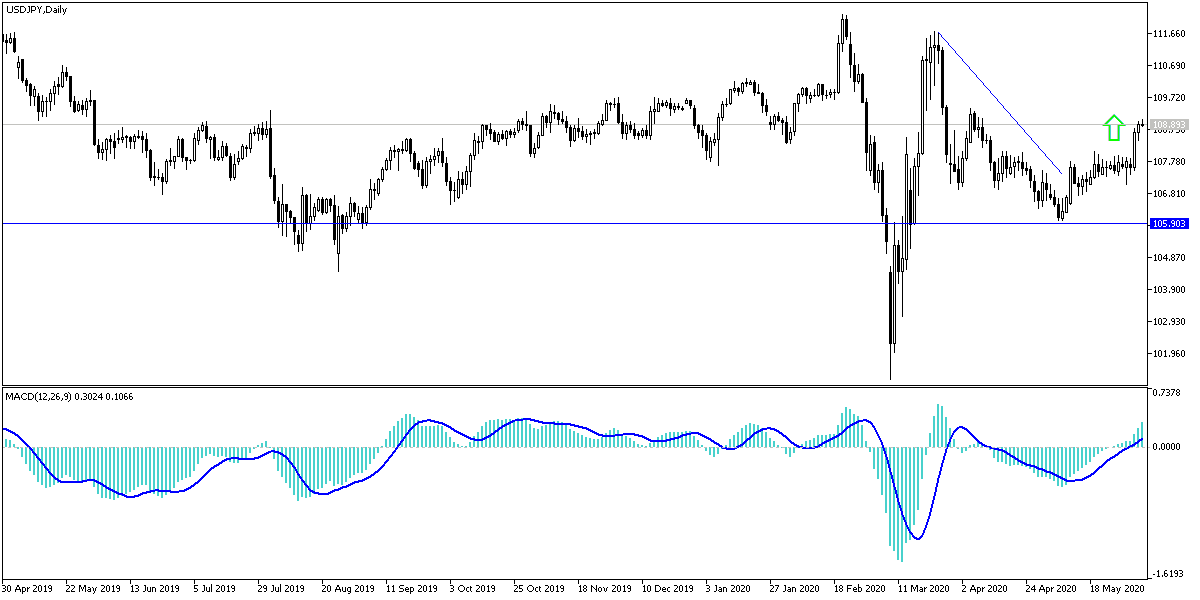

According to the technical analysis of the pair: the bullish reversal of the USD/JPY pair increases strength and stability above the 109.00 resistance, which will push the bulls to move towards the following psychological resistance at 110.00, which confirms the strength of the general trend change that was dominated by the bears until the beginning of May trading. This shift will monitor developments between the world's two largest economies and the continued investors’ risk appetite. Despite the opening up of global economies, there are still fears of a new wave of the epidemic, and in that event, it will collapse the recent investors’ hopes. Any movement below the 108.00 support level will end the current bullish outlook.

Today, the pair will react to the release of the US economic data, jobless claims, trade balance, non-farm productivity and unit labor costs.