Pakistan delivered its first economic contraction in 68 years, with a 0.38% decrease for the 2019-2020 fiscal year, which ends today. Abdul Hafeez Sheikh, the Advisor to Prime Minister Khan on Finance and Revenue or the de facto finance minister, released the Pakistan Economic Survey. Agriculture remained the bright spot, expanding by 2.7%, while industrial production and service sector activity faced severe disruptions from the Covid-19 pandemic. The USD/PKR remains inside of its resistance zone, and breakdown pressures are rising.

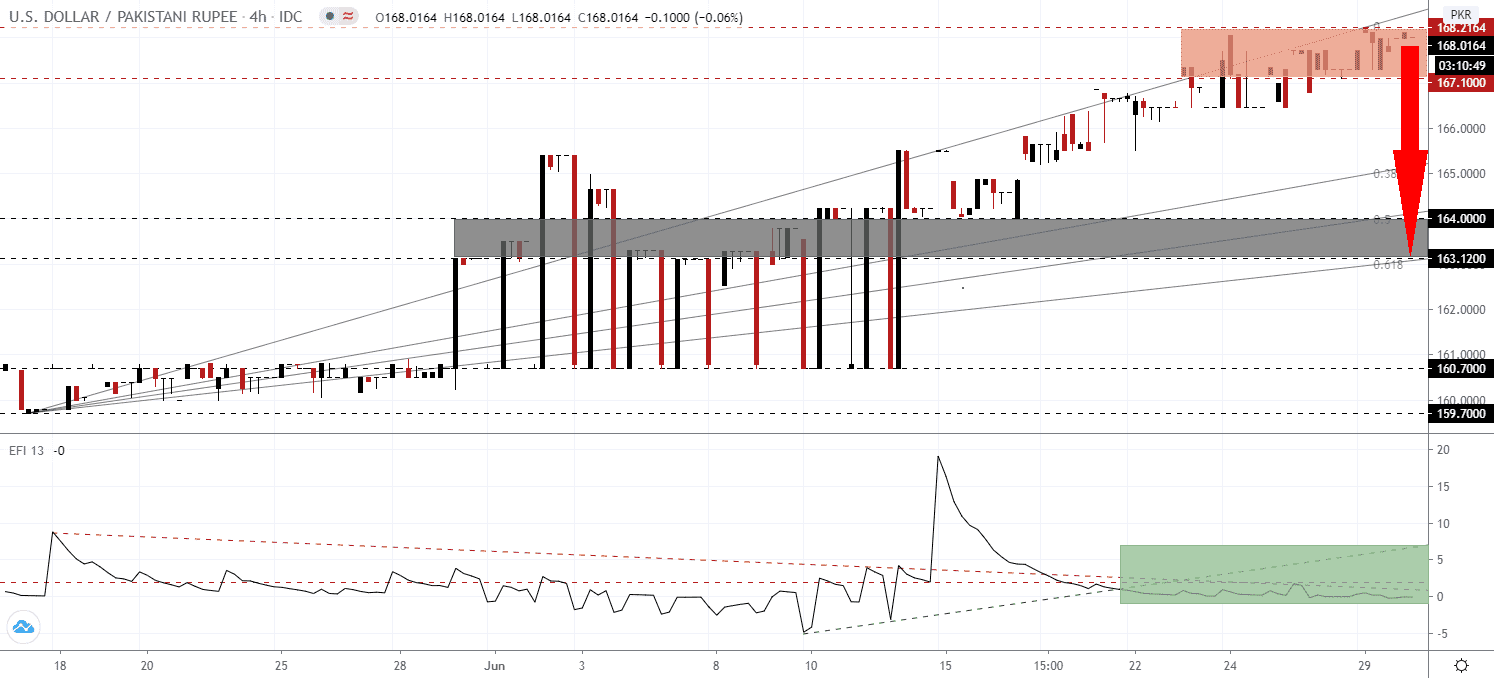

The Force Index, a next-generation technical indicator, confirms the dominance of bearish momentum and maintains its position below the horizontal resistance level. Adding to downside pressures is the descending resistance level, as marked by the green rectangle, while the ascending support level moves farther away. This technical indicator is on the verge of crossing into negative territory, ceding complete control of the USD/PKR to bears.

Despite the GDP contraction, Pakistan recorded an increase of 10.8% in tax revenues. It helped reduce the current account deficit by 73.1% to just 1.1% of GDP. Advisor Sheikh reiterated the government did control expenses and did not borrow from the State Bank of Pakistan during the fiscal year. Rs 3,000 billion to repay loans in the upcoming July-April 2021 period are reserved. It indicates positive progress and adds another bullish catalyst to the Pakistani Rupee. The USD/PKR is under intensifying breakdown pressure inside of its resistance zone located between 167.100 and 168.2164, as marked by the red rectangle.

Foreign currency reserves are on course to increase from $9 billion in August 2018, when the current government of Prime Minister Khan took power, to $18 billion by the end of 2020. The Minister for Economic Affairs Khusru Bakhtiar singled out the total debt of $76.5 billion, a result of the previous two governments, harms Pakistan. Due to underlying bullish fiscal developments, the USD/PKR is well-positioned to enter a profit-taking sell-off into its short-term support zone located between 163.120 and 164.000, as identified by the grey rectangle and enforced by the ascending 61.8 Fibonacci Retracement Fan Support Level.

USD/PKR Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 168.0000

Take Profit @ 163.1500

Stop Loss @ 169.0000

Downside Potential: 48,500 pips

Upside Risk: 10,000 pips

Risk/Reward Ratio: 4.85

A breakout in the Force Index above its ascending support level, serving as resistance, may entice the USD/PKR into a brief price spike to challenge the essential 170.0000 psychological resistance level. Adding a bearish catalyst is the roll-back in the premature reopening process across the US, resulting in ongoing downside pressure on the US Dollar. Forex traders are advised to view any advance as an excellent short-selling opportunity.

USD/PKR Technical Trading Set-Up - Brief Breakout Scenario

Long Entry @ 169.3000

Take Profit @ 170.0000

Stop Loss @ 169.0000

Upside Potential: 7,000 pips

Downside Risk: 3,000 pips

Risk/Reward Ratio: 2.33