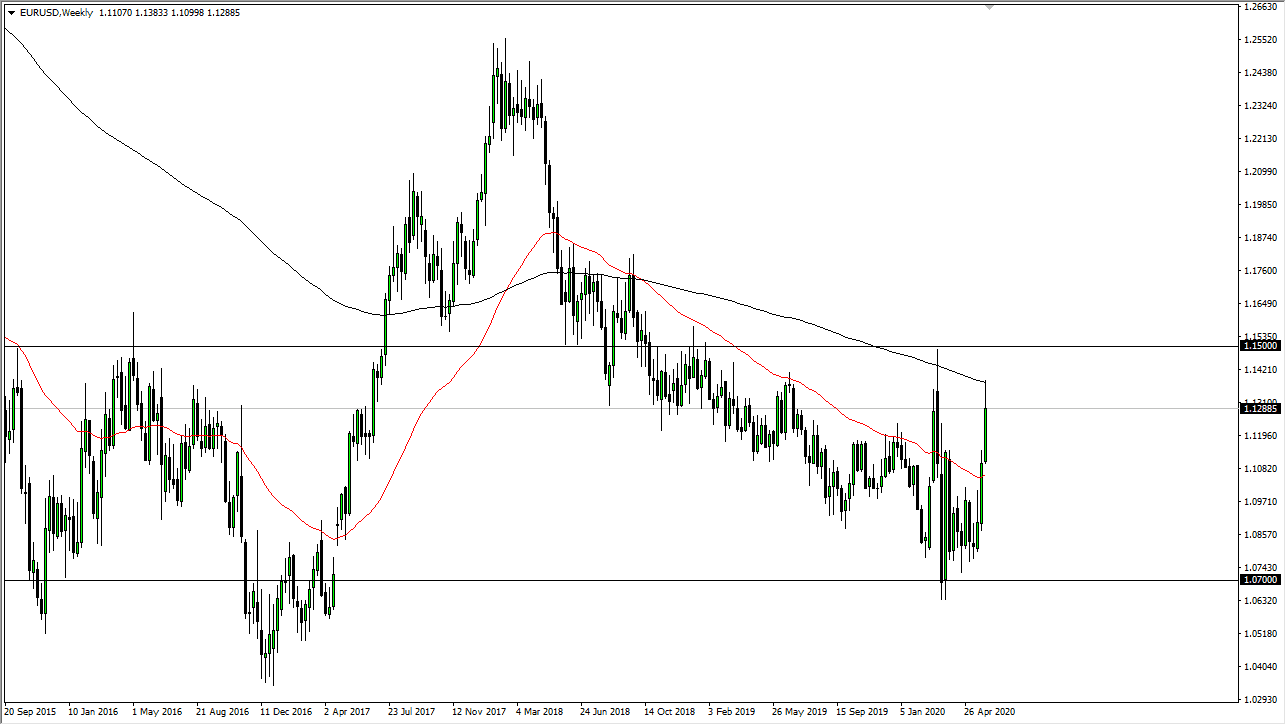

EUR/USD

The Euro has shot straight up in the air during the trading week, and now it looks as if we are starting to get a little bit of exhaustion. The candlestick from the trading session on Friday certainly showed that we may be getting a bit ahead of ourselves, so I think it is only a matter of time before we break back down towards the 1.10 level. Having said that, even if we break above the top of the candlestick for the week, the 1.15 level above would be a bit of a barrier as well, so even if we break out to the upside it is likely that the selling pressure would continue to jump into this market. The jobs market printing a better than anticipated employment situation looks as if it is favoring the US dollar.

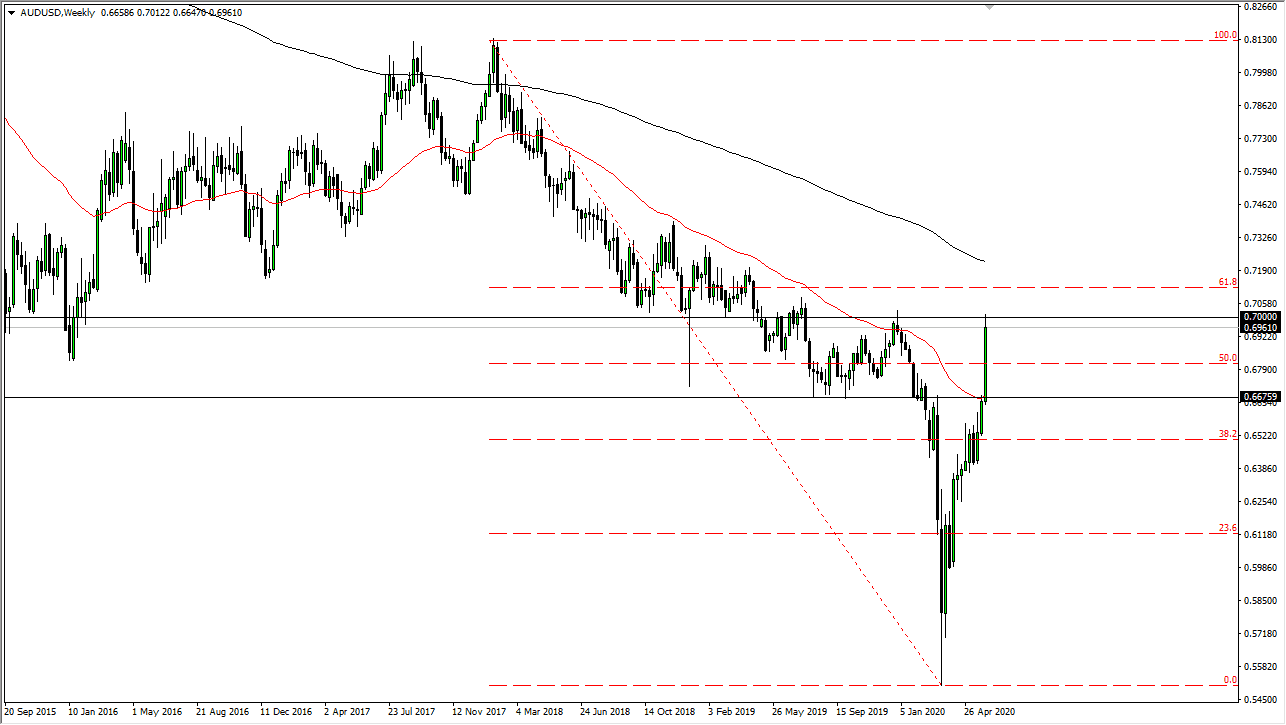

AUD/USD

The Australian dollar has exploded to the upside during the week as well, but the 0.70 level is an area where we have seen a lot of selling in the past, and the fact that we ended up forming a shooting star on Friday suggests that we could very well pull back from there and go looking towards the 0.6675 level. I do think that it is only a matter of time before this market breaks back down, but if we were to break above the 0.71 level, then it becomes a “buy-and-hold” type of situation.

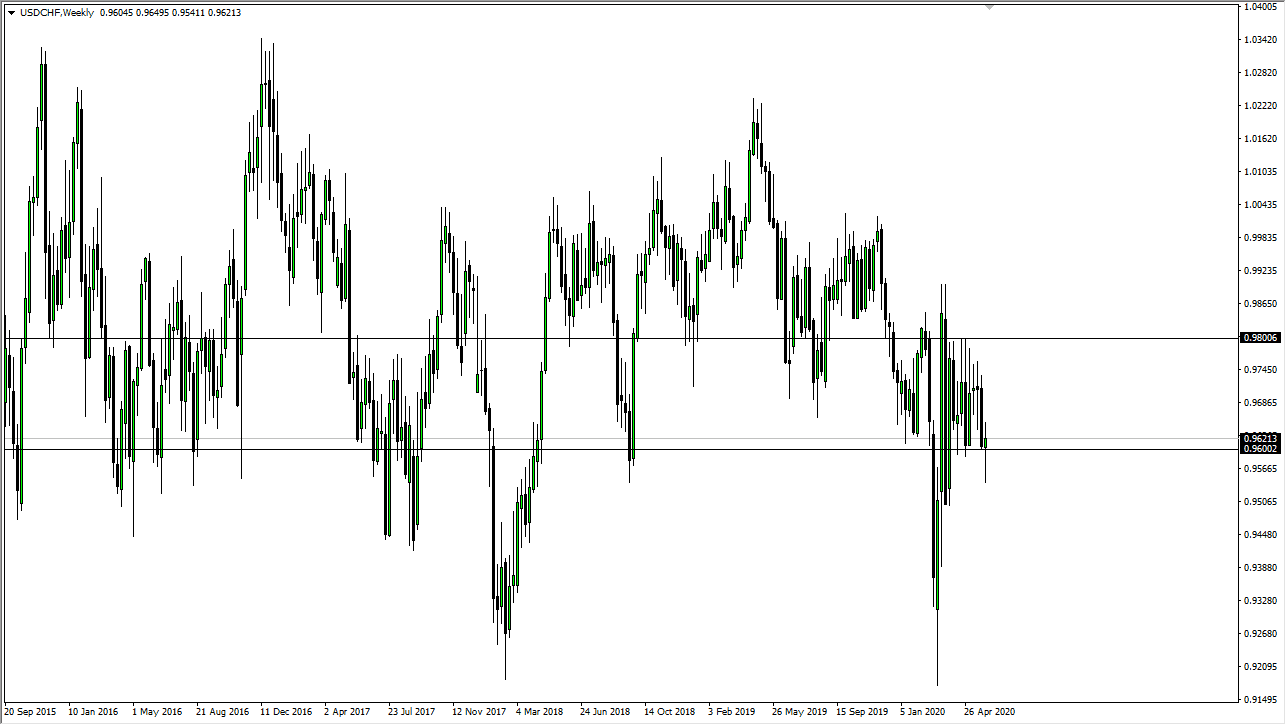

USD/CHF

The US dollar has gone back and forth during the course of the week, but ultimately ended up breaking back above the 0.96 level on Friday, which is how end up making a hammer. That is a good looking candlestick, so I think that we are highly likely to see this market try to grind towards the 0.9750 level given enough time. However, if we were to turn around a break down below the bottom of the candlestick for the week, then we could be looking at a move towards the 0.95 handle.

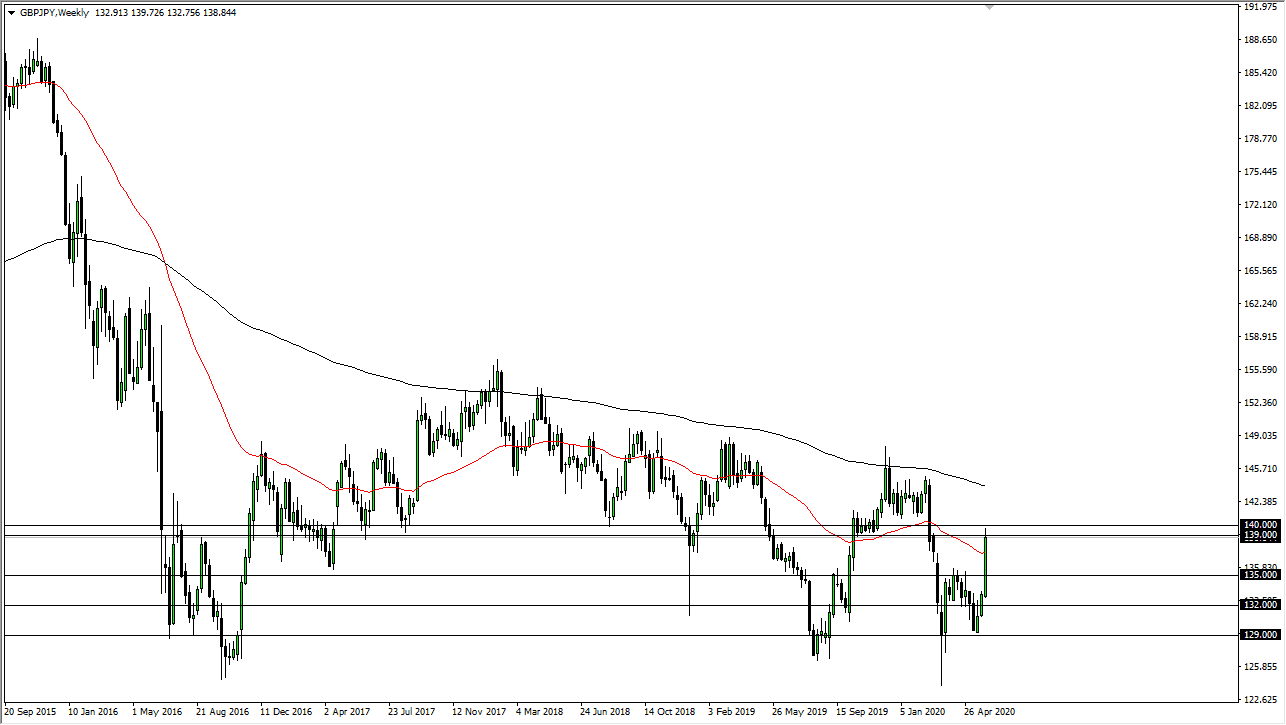

GBP/JPY

The British pound shot straight up in the air against the Japanese yen during the week but ran into a little bit of trouble near the ¥139 level. The market is likely to see a lot of noise between there and the ¥140 level. We did give back some of the gains, especially on Friday so I think we are starting to run out of momentum. Oddly enough, even though the jobs number was so strong on Friday, by the time we closed out the week it looks as if there may be some trouble over the horizon, so I would watch this pair.