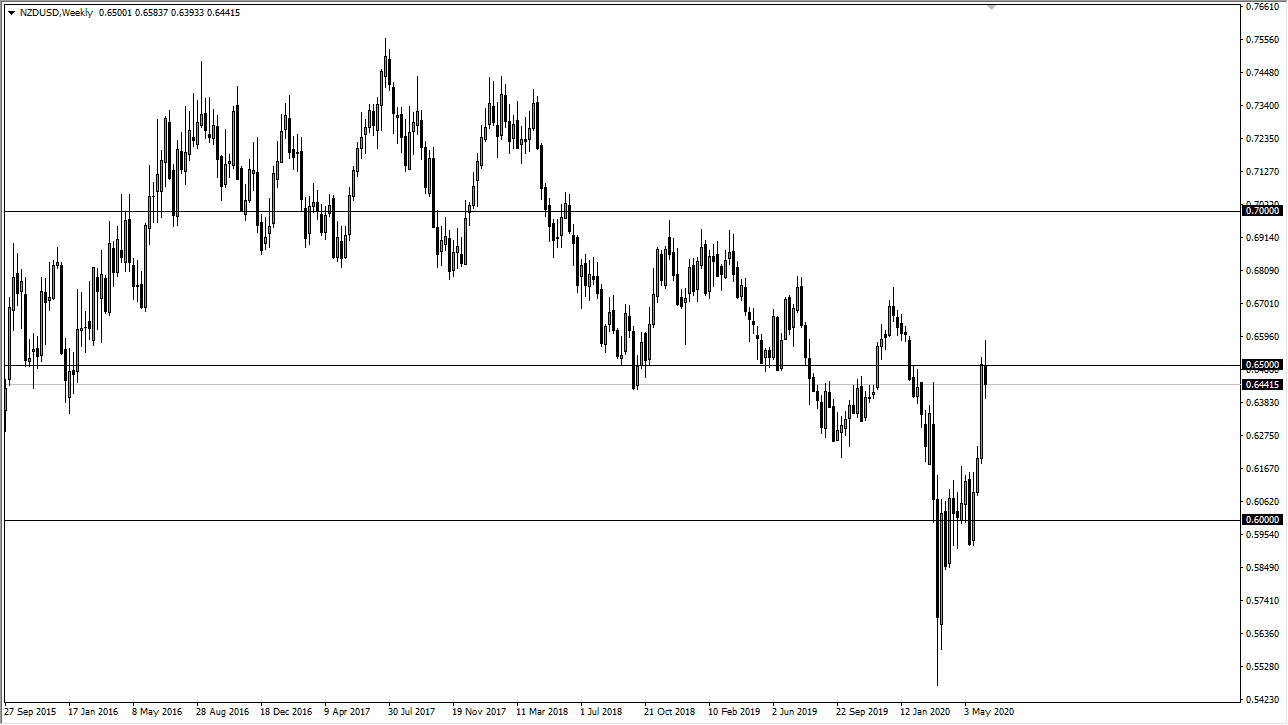

NZD/USD

The New Zealand dollar initially tried to rally during the week but found a lot of selling pressure above the 0.65 handle. This is a market that I think continues to find sellers in that region and if we break down below the bottom of the weekly candlestick, somewhere near the 0.6390 level, the market will then break down moving towards the 0.62 handle. On the other hand, if we break above the high of the week, which is basically the 0.66 handle, then the market will move towards the 0.68 level above.

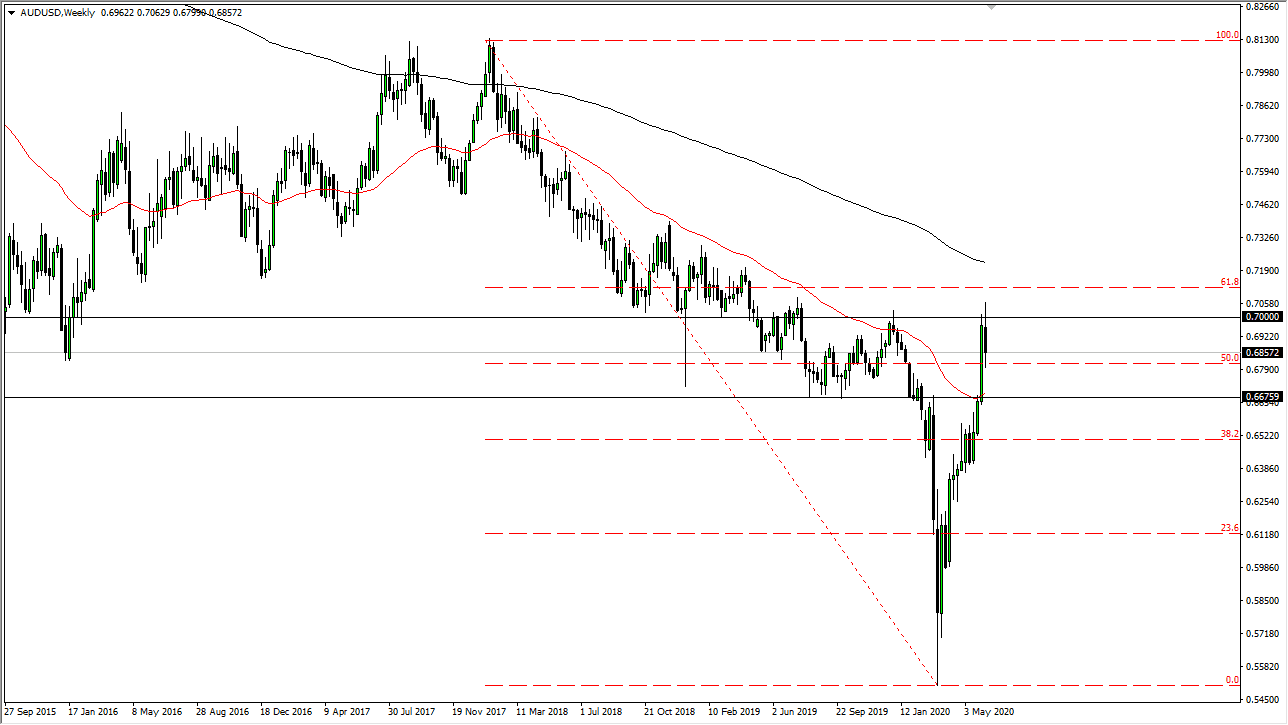

AUD/USD

The Australian dollar has rallied initially during the week but found enough resistance above the 0.70 level to cause problems again. Ultimately, I think that the market is likely to pull back, and short-term rallies will probably start to show signs of exhaustion. The 0.6675 level underneath is possibly a target the people will be looking to reach towards. The 50 day EMA is in the same area, as a result I think that is probably a reasonable target. However, if we break above the 0.71 handle, the market is likely to go looking towards the 0.72 handle but being that the Australian dollar has been parabolic for quite some time.

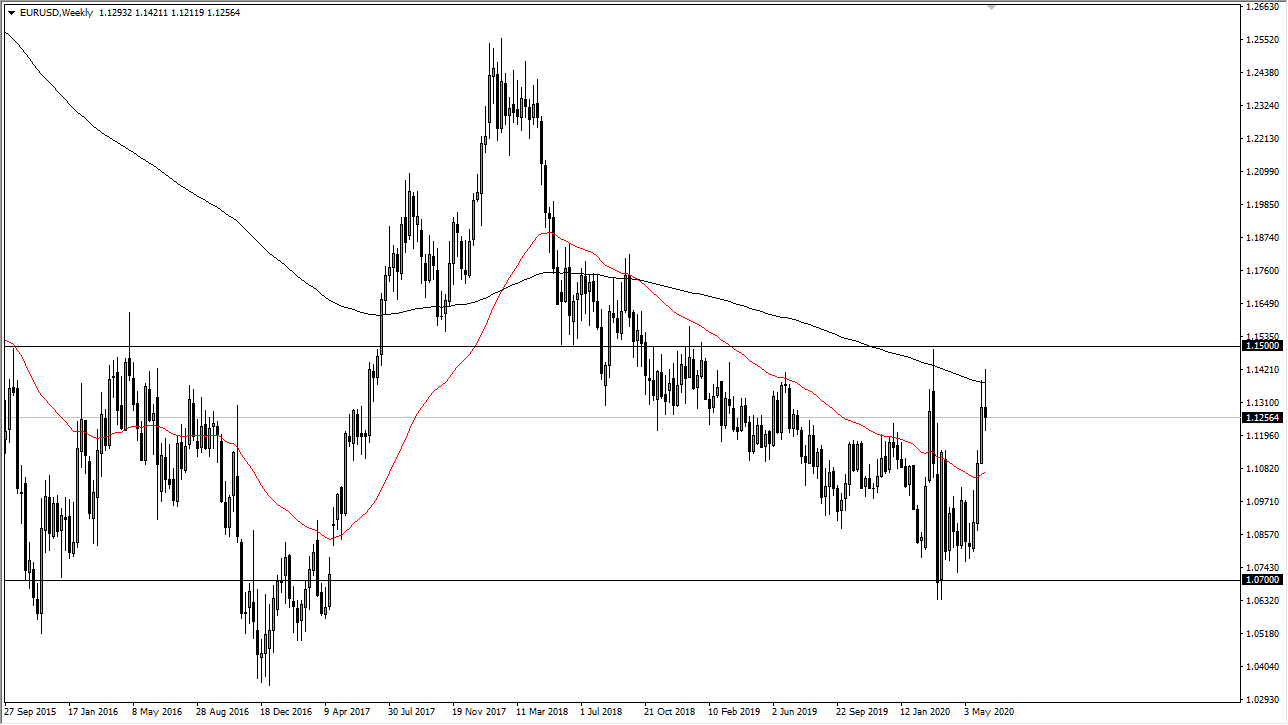

EUR/USD

The Euro initially tried to rally during the week but found trouble near the 200 week EMA. By pulling back the way it has, we have ended up forming a massive shooting star. Ultimately, the market is likely to continue to see bearish pressure, so I am looking for rallies to sell as the shooting star suggests that there is a lot of the selling pressure still up there. I am looking to take advantage of rallies in the Euro to drift lower. If we do break down, I believe that the 1.10 level underneath would be a target.

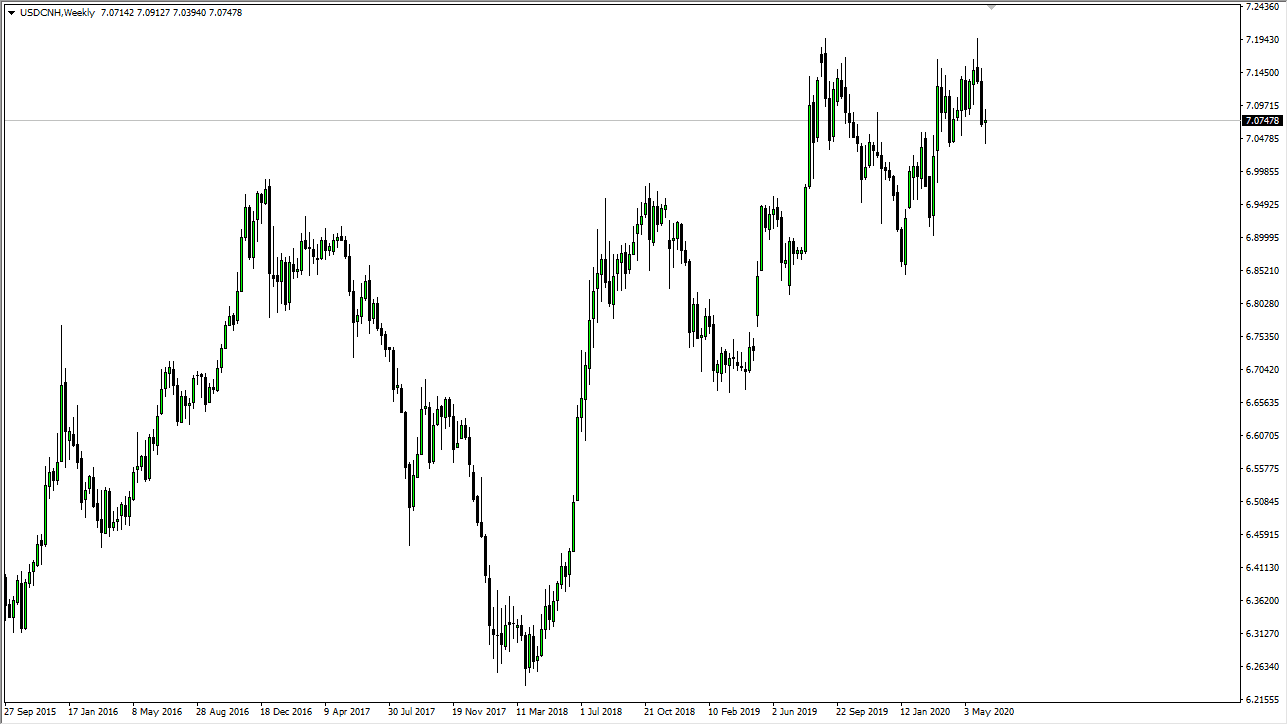

USD/CNH

The US dollar broke down significantly during the trading week but then turned around to show signs of life at the 1.05 handle. By forming a hammer, it suggests that the United States dollar will rally a bit, perhaps reaching towards the 7.15 level. This is a sign of “risk off”, if it does in fact happen, and you should be watching this pair. It is a bit difficult to trade at times because the market is not as free-flowing as many other currencies, but it is worth paying attention to in order to trade other pairs.