AUD/USD

The Australian dollar has had a wild week, rocketing to the upside, and reaching towards the 0.70 level. That is an area that is significant in its importance. The 0.70 level extends to the 0.71 level above, and therefore it is likely that we will see a lot of sellers in that area. However, we have been repulsed from there several times and ended up forming a shooting star candlestick after a relatively negative candlestick during the previous week. The market is at the very least overextended, so I think in the short term we are going to go back and forth but I recognize that the market is likely to continue to find sellers on short-term rallies.

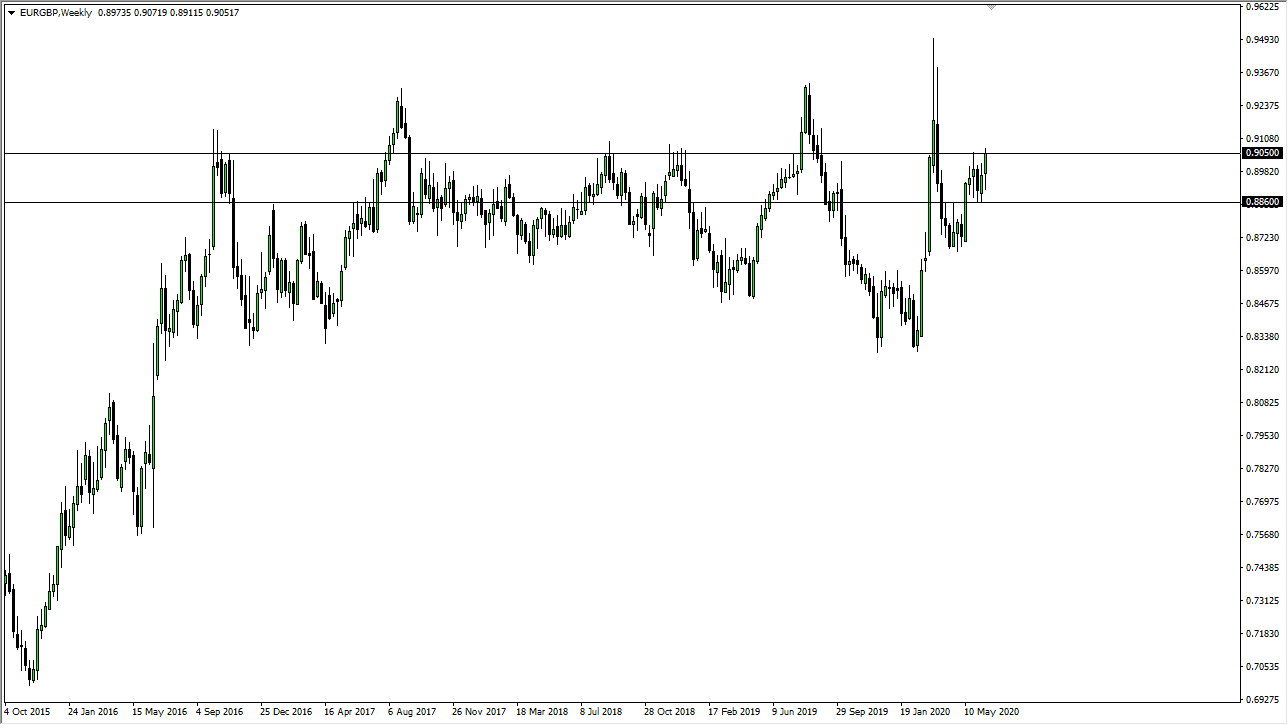

EUR/GBP

The Euro spent the first part of the week pulling back against the British pound, but as you can see, we ended up shooting higher, and breaking above the 0.9050 level. If we can break above this candlestick for the week, think we will continue to go looking towards the 0.92 level, but it may take a bit of time. Quite frankly, the Euro and the British pound both look as if they are starting to soften up against the US dollar, but obviously the British pound has been sold off quite drastically. I like buying pullbacks in this pair going forward.

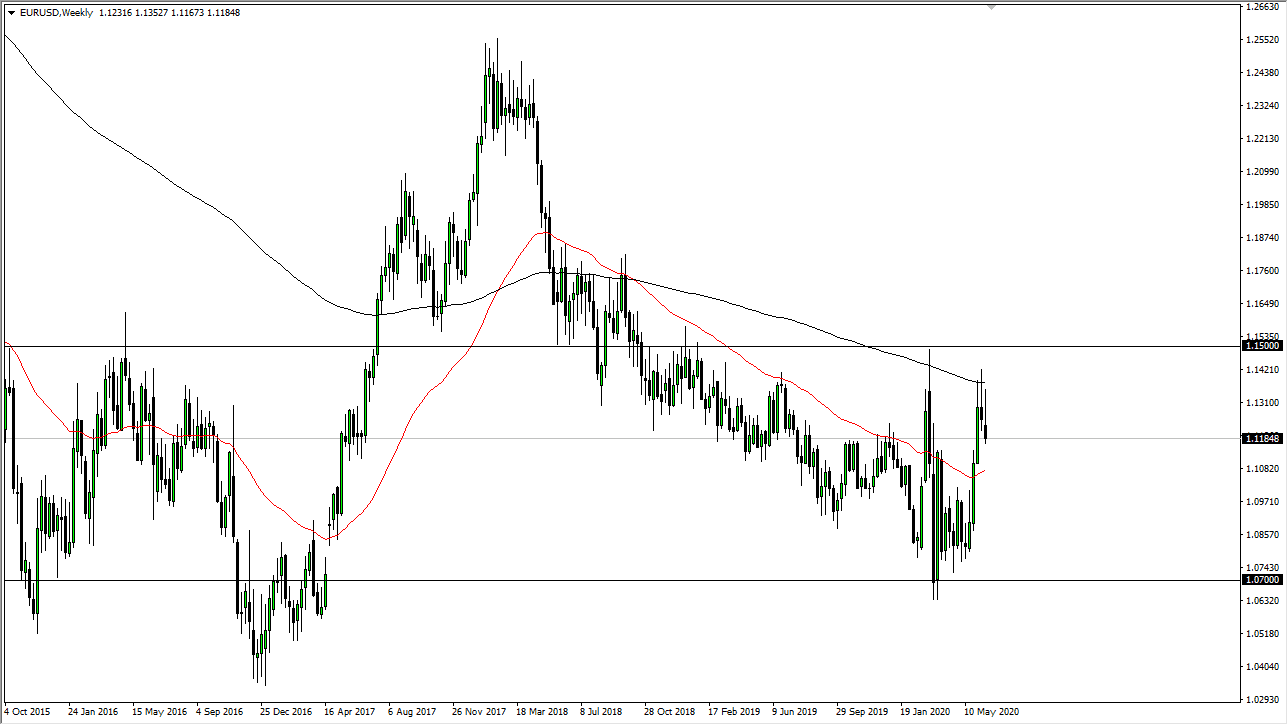

EUR/USD

The Euro gapped lower to kick off the week but then rallied significantly to only find sellers above and breakdown. By the time we finished the week, we have formed a shooting star for the second week in a row and it is likely that we will continue to go lower. At this point, the market is likely to drop towards 1.1050 level, and I will be selling short-term rallies as they occur. Having said that, expect choppy and noisy trading as per usual.

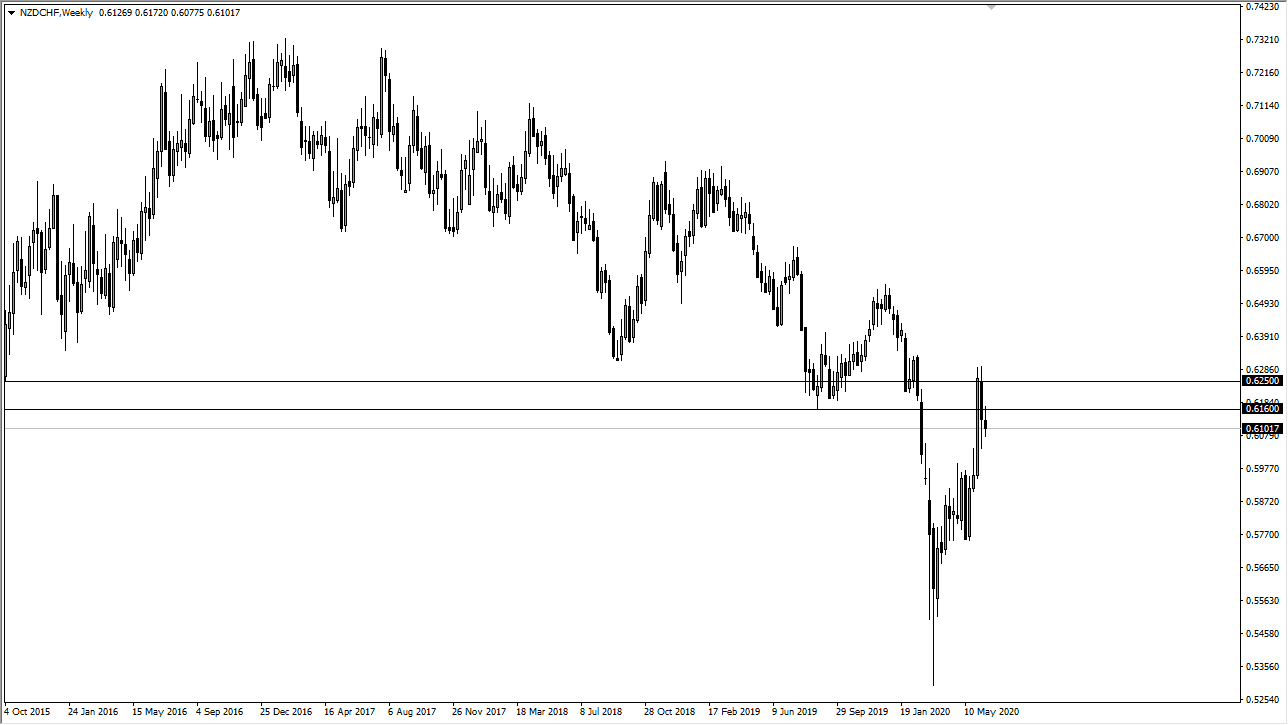

NZD/CHF

The New Zealand dollar initially rallied against the Swiss franc but found enough resistance near the 0.6170 level to turn around and show signs of negativity. At this point, the market is likely to continue drafting lower from here, especially if we get more of a “risk-off” type of attitude around the world. Stock markets should be paid attention to because they can give us a bit of an idea as to where risk appetite is going. If it starts to fall, this pair will follow right along with it.