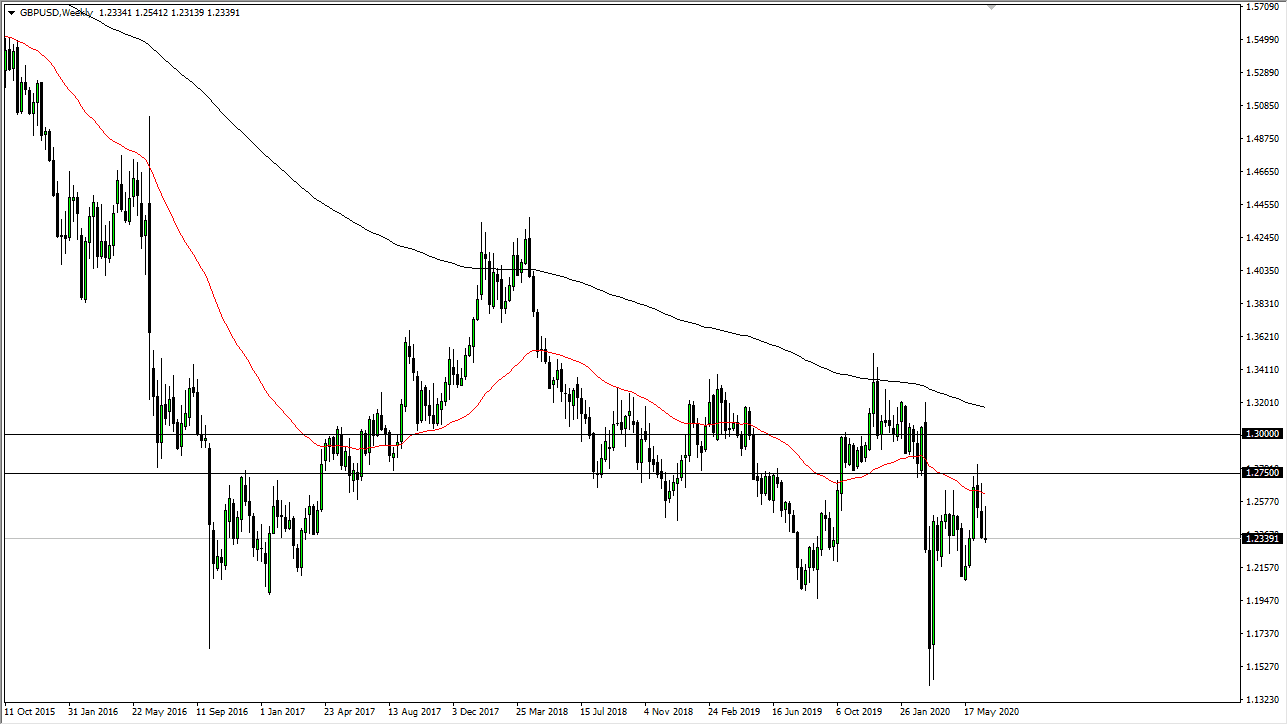

GBP/USD

The British pound initially has rallied during the previous week, but then broke down rather significantly. By forming the candlestick that we have, it tells me that rallies will continue to fade, and then eventually the market could go down to the 1.20 level underneath. At this point, the market is starting to come to the realization that we are in more of a “risk-off” world, and of course, with the Brexit causing issues still, it is likely that we are going to see headlines come in and cause issues from time to time. Fading rallies continue to be the best way forward as the noise is deafening.

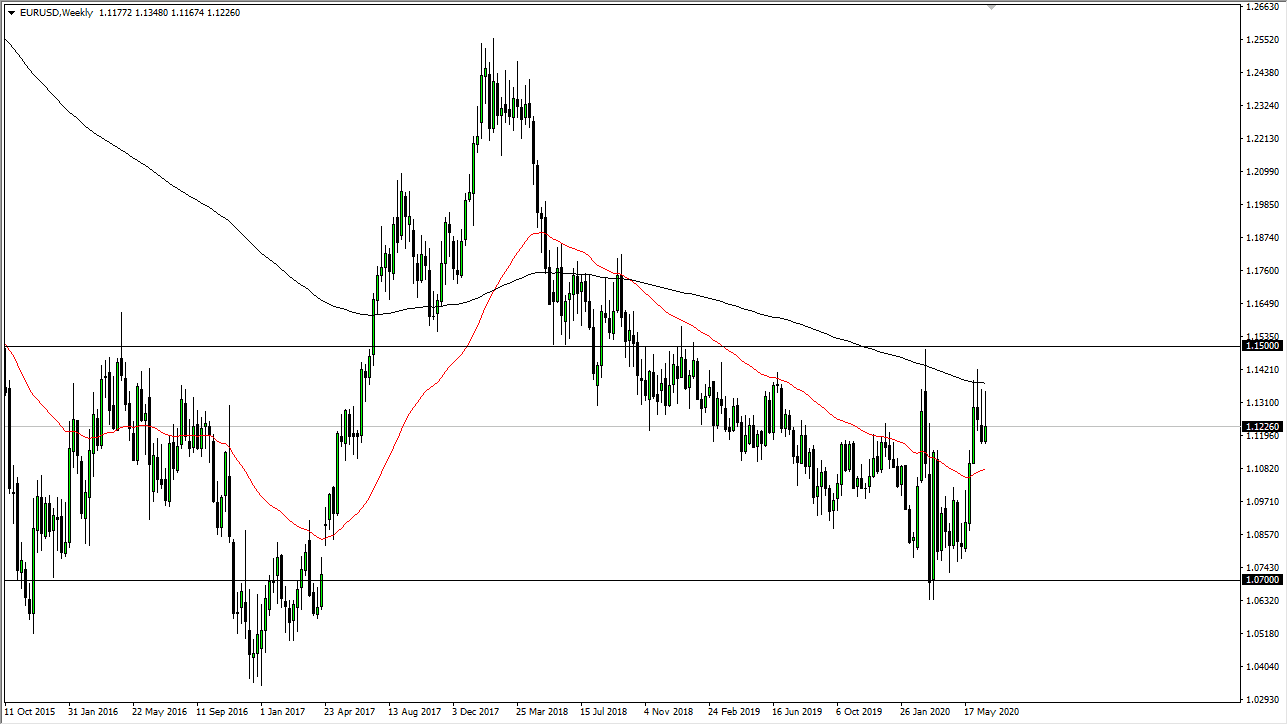

EUR/USD

The Euro rallied significantly during the week, reaching towards the 1.1350 level before pulling back yet again. We have formed three shooting stars in a row, and it does suggest that we will continue to have a “fade to rally” type of scenario. If we break down below the bottom of the candlestick for the week, that will unleash more selling, perhaps down to the 1.10 level. It is not until we break above the 1.15 level that I would be a buyer of the Euro, as it would be a major trend change. Regardless, most of the headlines out there continue to be negative so I think it is only a matter of time before we break down.

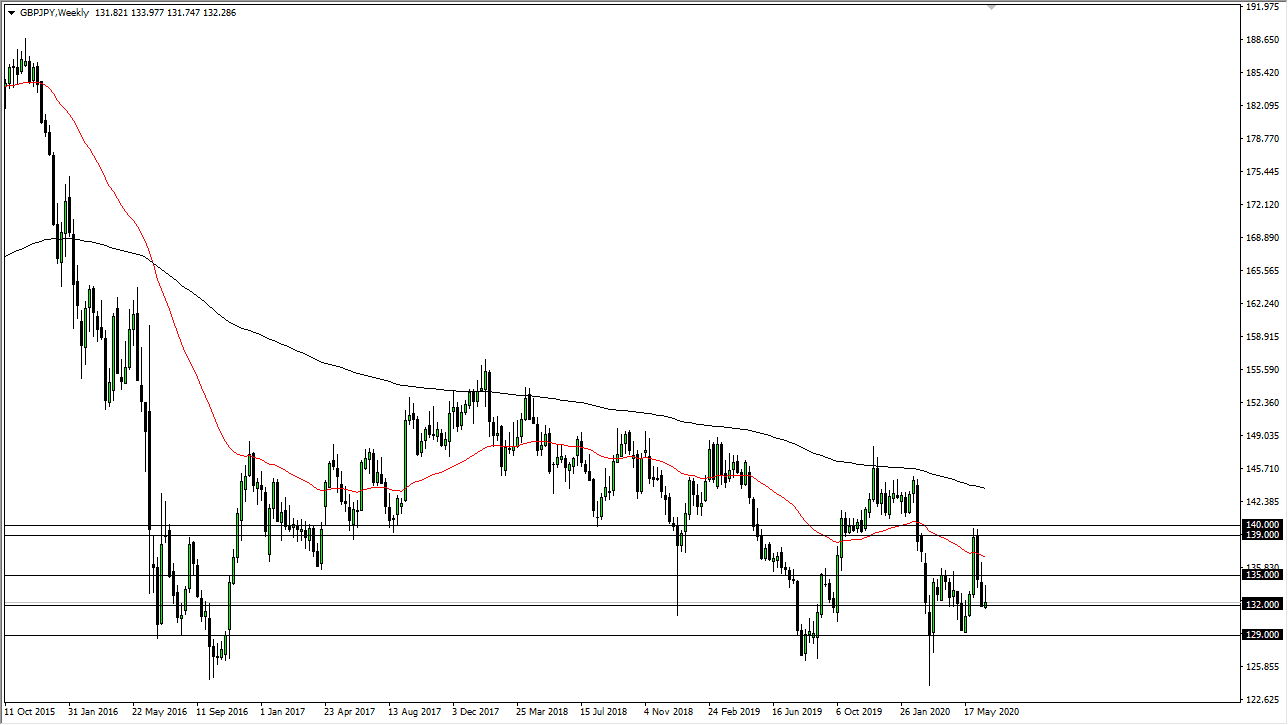

GBP/JPY

The British pound initially rallied during the week, showing signs of strength, but then rolled over to reach down towards the ¥132 level. This is a major level that will attract a lot of attention. If we break down below the bottom of the candlestick for the week, then it is likely we go down towards the ¥129 level. Rallies at this point will more than likely continue to be faded, as it is more of a risk-sensitive type of marketplace. The fact that we ended up forming this candlestick suggests that we are going to go lower.

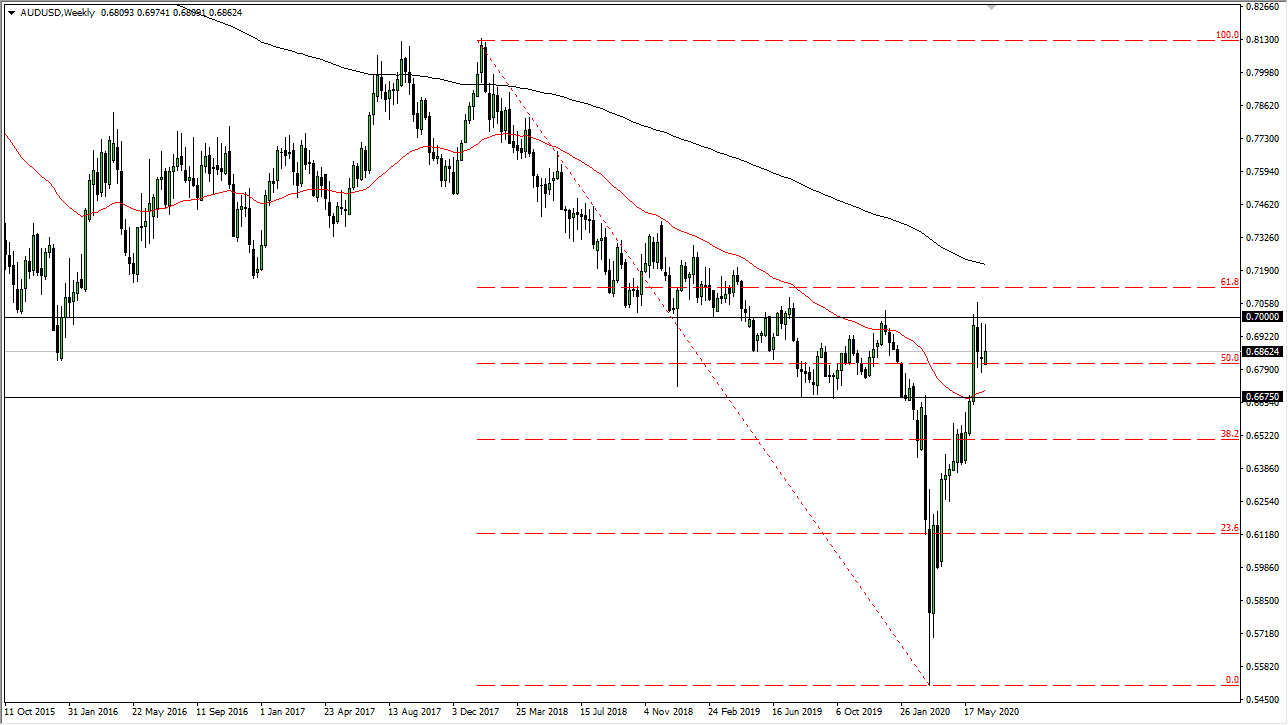

AUD/USD

The Australian dollar rallied during the week as well, forming a shooting star after breaking back down. The 0.70 level above continues to be crucial resistance that extends its resistance all the way to the 0.71 handle. I think there is a ton of resistance off there still, and the candlestick for the week has shown itself that we are more than likely going to set up US dollar strength across-the-board.