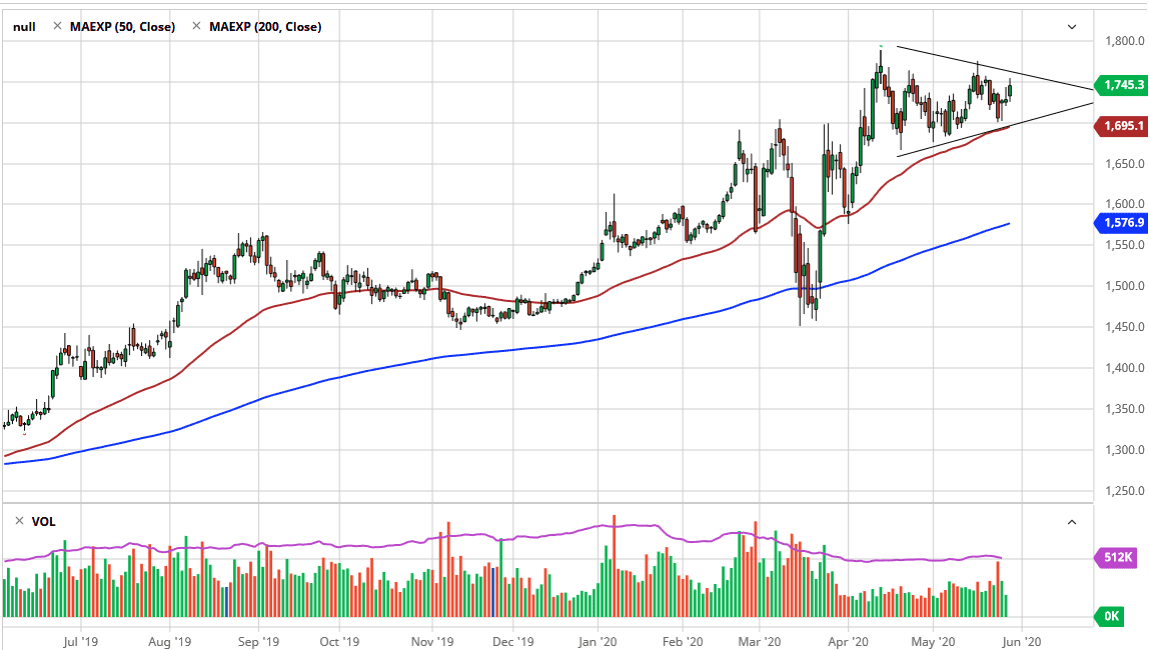

Gold markets have rallied significantly during the trading session on Friday, breaking above the top of the shooting star from the Thursday session. That being said, we still see a significant amount of resistance in the region of $1750, extending all the way to the $1760 level. If we can break above there, then the market is likely to go looking towards the $1800 level. The $1800 level was near the recent highs, so it will of course attract a certain amount of selling, but at this point in time I think that is the target in the short term.

Between now and then, I believe that short-term pullbacks are probably going to attract a lot of attention, especially as the uptrend line sits just above the 50 day EMA. Gold will continue to get a bit of a lift due to the printing of currency by central banks around the world, and of course the fear trade which is stronger than ever. Ultimately, the markets have been grinding back and forth for a while, and now it looks like we are going to see some type of resolution. If we can break out of this triangle, then the market is likely to go much higher, and fairly quickly once we break out of this squeeze.

I do not have any interest in trying to short gold, because there are far too many reasons out there that are going to continue to push this market higher. The fear of economic destruction will continue to push gold higher, as the gold markets are most certainly a safety haven. At this point, you also have to keep in mind that central banks are printing currency as fast as they can. I do not see any of that changing anytime soon, so it does make sense that when we see pullbacks in the gold market, it is likely that we will find plenty of buyers based upon value.

If we did break down below the 50 day EMA, it is likely that the $1600 level underneath will be supported, due to the fact that the 200 day EMA is sitting just below it as well. Ultimately, this is a market that I think has plenty of pressure underneath so at this point in time it looks likely to continue to offer plenty of opportunities. Breaking above the $1800 level then opens up the door to the $2000 level.