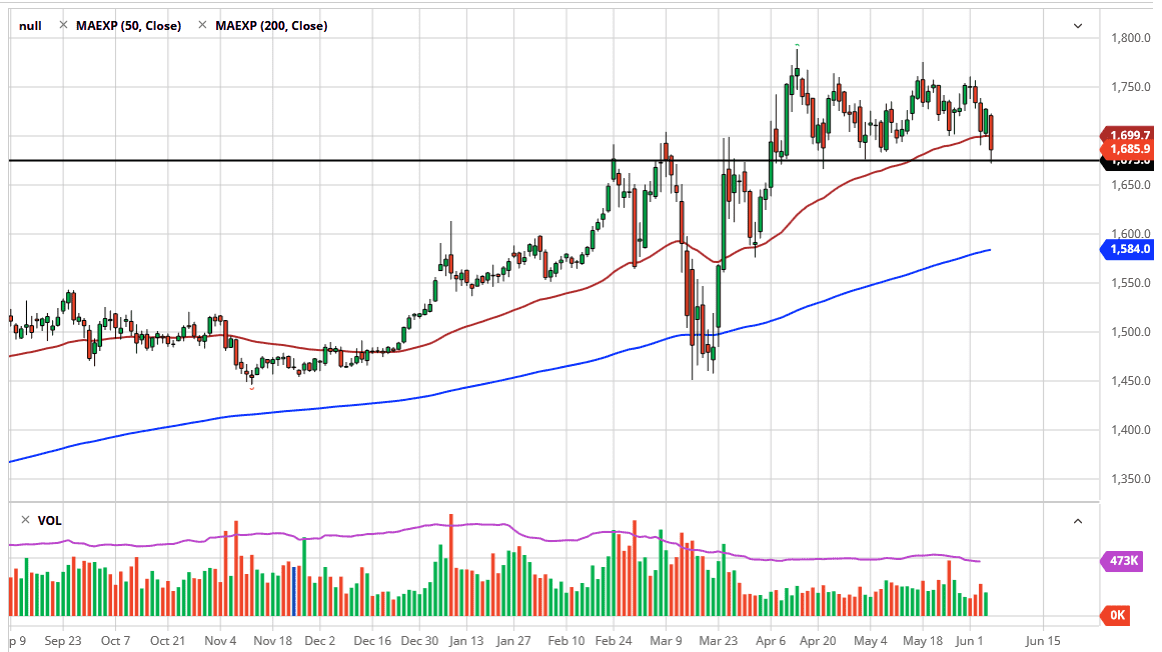

Gold markets broke down significantly during the trading session on Friday as the job number came out much better than anticipated. The selling of gold in times of “risk-on” is quite common. The $1675 level of course is an area where we have seen both buyers and sellers, so the fact that we bounced from there should not be a huge surprise. However, it looks as if we are closing below the 50 day EMA, which is the first time we have done that for some time. These moving averages are an area, not necessarily pinpoint accurate.

To the upside, the market reaching towards $1750 level would make sense, because it would simply be the market going back and forth in this overall range. This is a market that I think goes back and forth due to the fact that there is so much volatility in the market and a lot of confusion as to which direction we are going to go longer term as far as risk is concerned. Having said that, we are in an uptrend and I do believe the market will continue to find the trend worth following.

If we break above the $1760 level, it is likely that we then will go looking towards the $1800 level. A break above that level then opens up the possibility of a move to the 2000 level, which is a longer-term target of mind. Ultimately, this is a market that I think continues to grind to the upside, as we have been in a longer term uptrend for multiple reasons, not the least of which would be the central banks around the world printing currency as fast as it can. Furthermore, there are a lot of potential problems out there that could cause gold to go higher, such as the many potential economic headwinds in the form of coronavirus, and of course, global demand slowing. That being said, in the short term it looks like people are giving it a bit of a rest, but it seems as if gold continues to find more reasons to go long than anything else. Even if we broke down from here, I believe that the market will find plenty of support near the $1600 level which is where the 200 day EMA is.