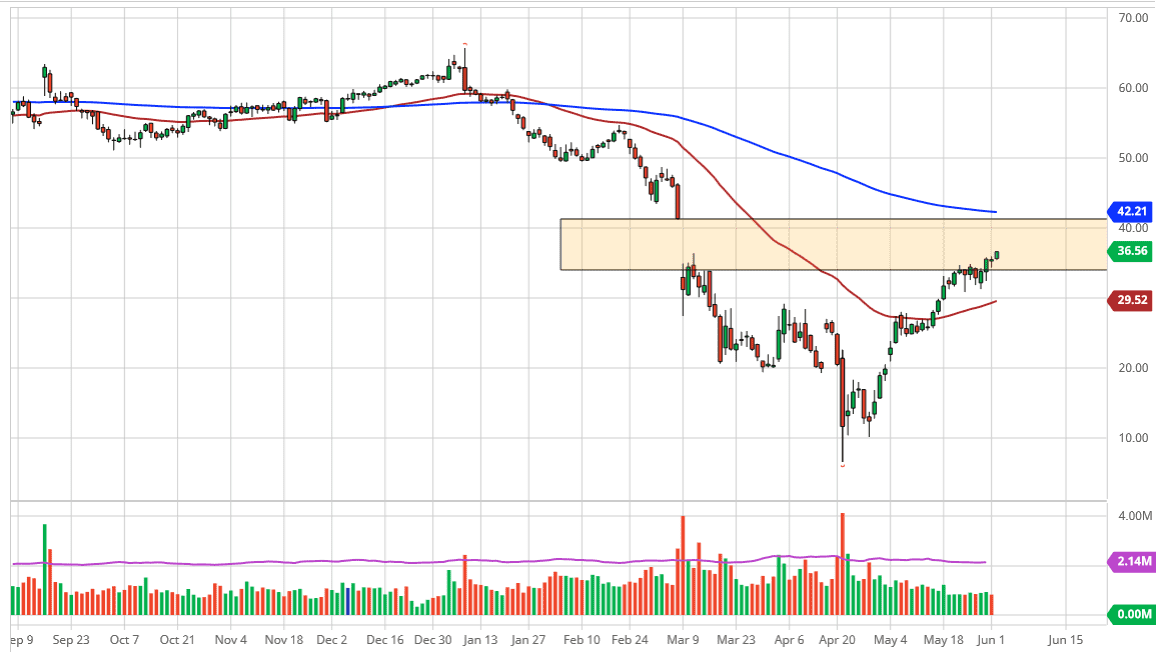

The West Texas Intermediate Crude Oil market has rallied a bit during the trading session on Tuesday, finally entering the gap and thereby looking highly likely to fill that gap over time. With that in mind, the $41 level would be the target based upon that bigger gap getting filled, and of course the technicality of filling these gaps. I do not necessarily believe that the market is likely to break through there, so I think it is only a matter of time before we sell off near the area. Furthermore, the 200 day EMA is just above the $41 level and I think that exhaustion will probably come into play as a nice selling opportunity.

Looking at the supply and demand, we have seen a lot of production destruction around the world, but at the end of the day there is the question as to whether or not we are going to see enough demand. Ultimately, I do not think that the demand will warrant some type of move above the 200 day EMA and I believe that we will find a reason to pull back from it. On the other hand, the $30 level underneath should be massive support so if we were to turn around a break down below there, something that we will not see very soon, and that could be a very negative sign as it would not only break a large, round, psychologically significant figure but it also breaks down below the 50 day EMA. Ultimately, I think it is much easier to buy this market on short-term dips than anything else as we continue to grind higher.

Recently, we have seen the US dollar take it on the chin, so that is helping crude oil as well. If the US dollar continues to get hurt, then it is possible that we will see this market get a bit of acceleration going as well. We have inventory figures later in the week obviously, and that can drive the market much quicker as well. If we pull back, I anticipate that the $30 level should continue to offer a lot of buying pressure in less something drastic happens. At this point, to me it looks like we are going to fill the gap, if for no other reason than to do the technical move of filling the gap as most traders see that as a necessary function of the market.