The crude oil markets initially dipped slightly during the trading session on Wednesday, reaching lows of the previous session before turning around and showing life again. This may have been exacerbated by the fact that the inventory number was much more bearish than anticipated, and therefore would drive the price of oil lower from a supply and demand perspective. However, the Federal Reserve continues to step on the gas, so we have seen risk appetite expand into other markets such as crude oil again.

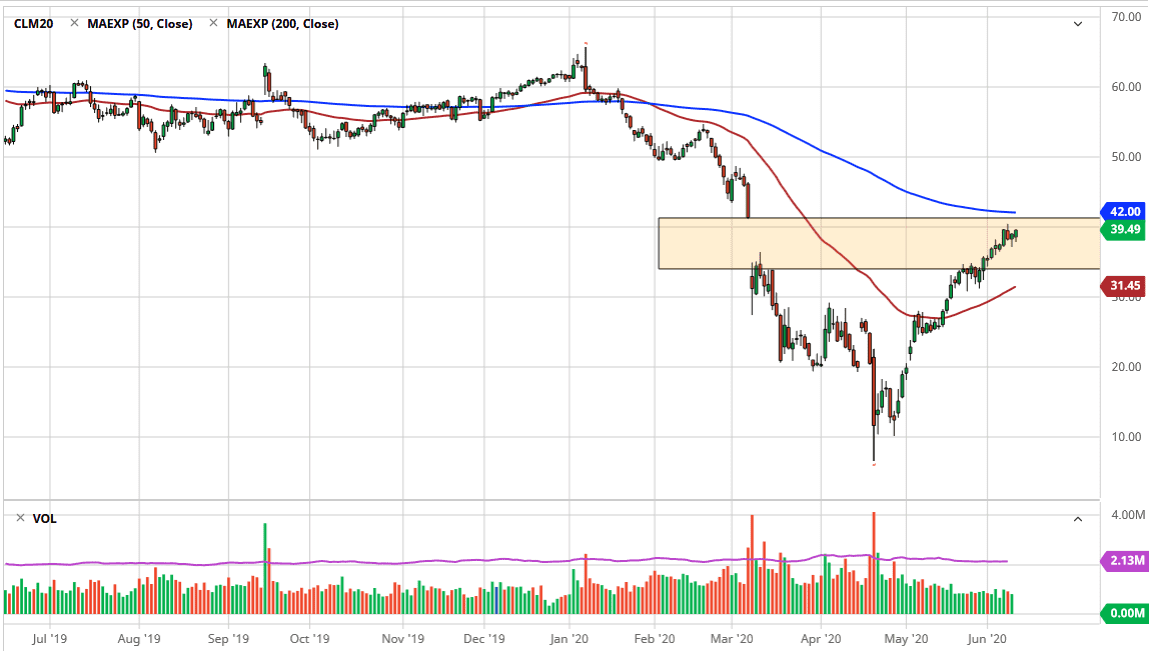

From a technical analysis standpoint, the $41 level is an area that should be paid attention to, as it is the top of a gap, and gaps do typically get filled given enough time. Ultimately, this is a market that should continue to see upward pressure until we can fill the gap, reaching towards that $41 level. Furthermore, the 200 day EMA is sitting at the $42 level and flattening out. This should offer plenty of resistance as it grinds lower, and therefore I think we are at about the top of the overall range. That being said, I think that we could pull back towards the $35 level.

I am not a huge fan of crude oil, but we did get a little nugget of good news for buyers in the inventory report, stating that production was at 20 month lows. That supply is finally shrinking a bit but we are a long way away from that being the case, and the demand is not there. Because of this, it is likely that we will continue to see a lot of choppy back-and-forth trading, but I think it is only a matter of time before supply in the market overcomes demand and therefore, we roll over again. All of that being said, if we were to get a daily close above the 200 day EMA you would have to assume that the market is going to go looking towards the $45 level, perhaps even the $50 level above which is a large, round, psychologically and historically important figure. That is not my base case, but it is something that I have to keep in mind as the market has been all over the place as of late. The markets have defied logic in various asset classes, so one would have to assume that the crude oil markets will be any different anytime soon.