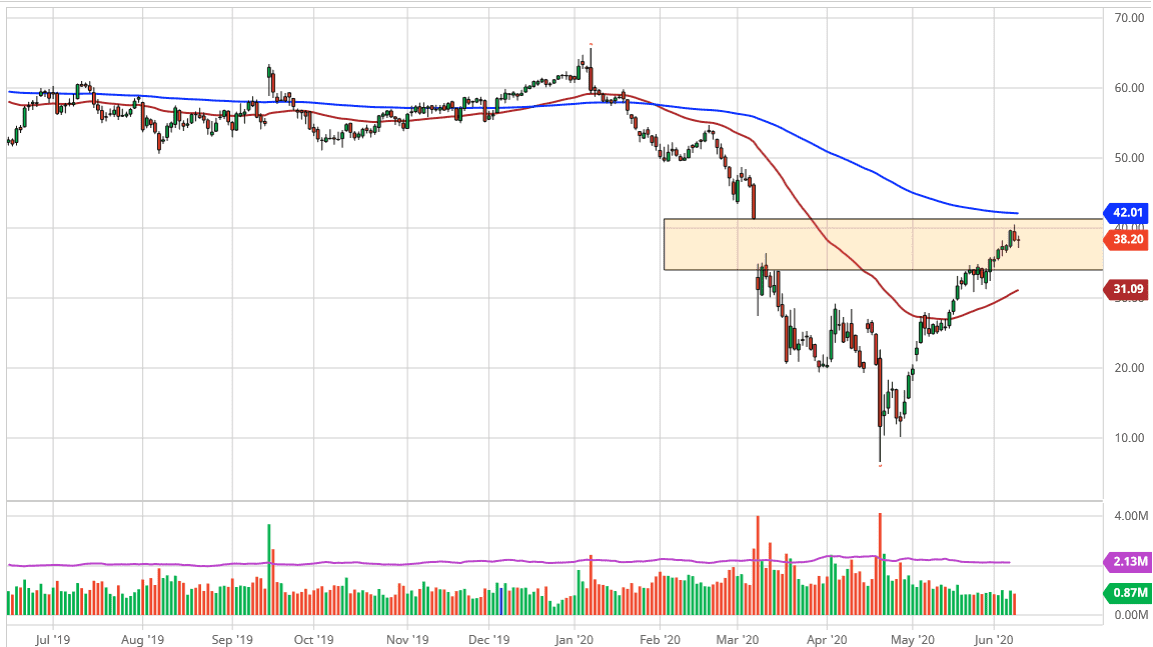

The West Texas Intermediate Crude Oil market has gone back and forth during the trading session on Tuesday, as we are waiting to see whether or not we will continue to go higher, perhaps reaching towards the top of the gap. The $41 level above is the top of that gap, and I do think that the market is going to try to fill it. The 200 day EMA sits just above there, so it makes quite a bit of sense that not only with the gap gold, but it could send the market back down again.

For what it is worth, the crude oil markets do tend to try and find a range from which to trade, and right now I think that is where we are. We are simply trying to carve out a range that we can be involved in and go back and forth from. I believe that the market may try to go back and forth between $30 on the bottom and $40 on the top, but we have yet to prove both sides. With that, I think that the market is likely to be very noisy and bounce around quite drastically over the course of the next several weeks. There are a couple of potential signals out of that range that could come into play.

If the market breaks above the 200 day EMA on a daily close, then it gives you the ability to hang onto a larger move, perhaps reaching towards the $50 level. That being said, I think it will take a significant amount of momentum to make that happen. If the market were to break down below the $30 level, then I think the market really starts unwinding and reach towards the $20 level. All things being equal, I believe that we are going to get a lot of back-and-forth over the next several sessions, but ultimately this is a market that will try and figure out where to go next, meaning that there will be a lot of noisy moves.

Looking for short-term range bound systems to trade this area makes quite a bit of sense, as this market looks to be essentially trying to find its footing after what had been an overshoot to the bottom, preceded by an overshoot to the top.