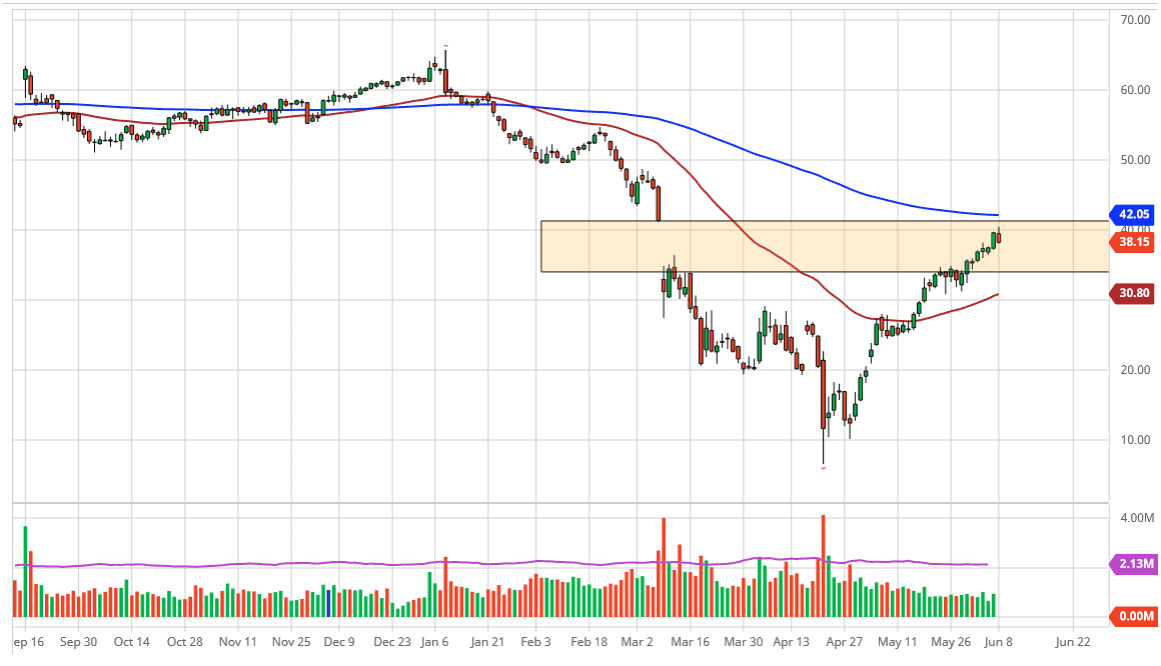

The West Texas Intermediate Crude Oil market has initially tried to rally during the trading session on Thursday but gave back the gains to form a negative candlestick. At this point, I do not necessarily like to think that we are suddenly going to turn around or break apart, but I do think that a little bit of a pullback is necessary. That pullback more than likely will be looking towards the $35 level underneath. At that level, I would anticipate seeing a lot of buying pressure, mainly due to the fact that the level is the bottom of the gap, and of course a large, round, psychologically significant figure. Furthermore, the 50 day EMA is reaching towards that area, and that is an area that I think is going to have too many different things meeting up at the same time to ignore.

If we did turn around a breakthrough the 200 day EMA that will obviously be a very extraordinarily strong sign, but at this point, I think it is very unlikely to happen. With that in mind, I think that more likely than not we will pull back in order to try to find enough momentum to go higher. Looking at this chart, I think it would make sense for the pullback simply because it gives the traders that have missed out on the opportunity to go along with crude oil, an opportunity to trade. However, if we were to break out to the upside, I think the market probably goes looking towards $49.

Underneath, the $30 level is the absolute “floor” in the market, and we could be very well trying to form some type of range, something that this market likes to do. All things being equal, the $50 level above would be a massive bellwether for where the market was going. At this point, the market is likely to see a lot of back and forth action, because quite frankly, we have gone higher and it almost straight line. This is a lot like the stock market, overbought and has been a bit ridiculous. There have been talks about OPEC extending cuts, but you have to wonder whether or not there is going to be enough demand going forward. I do not necessarily think that is going to be the case, but one has to keep an open mind as the market has completely ignored fundamentals for some time, not just in oil but in everything else.