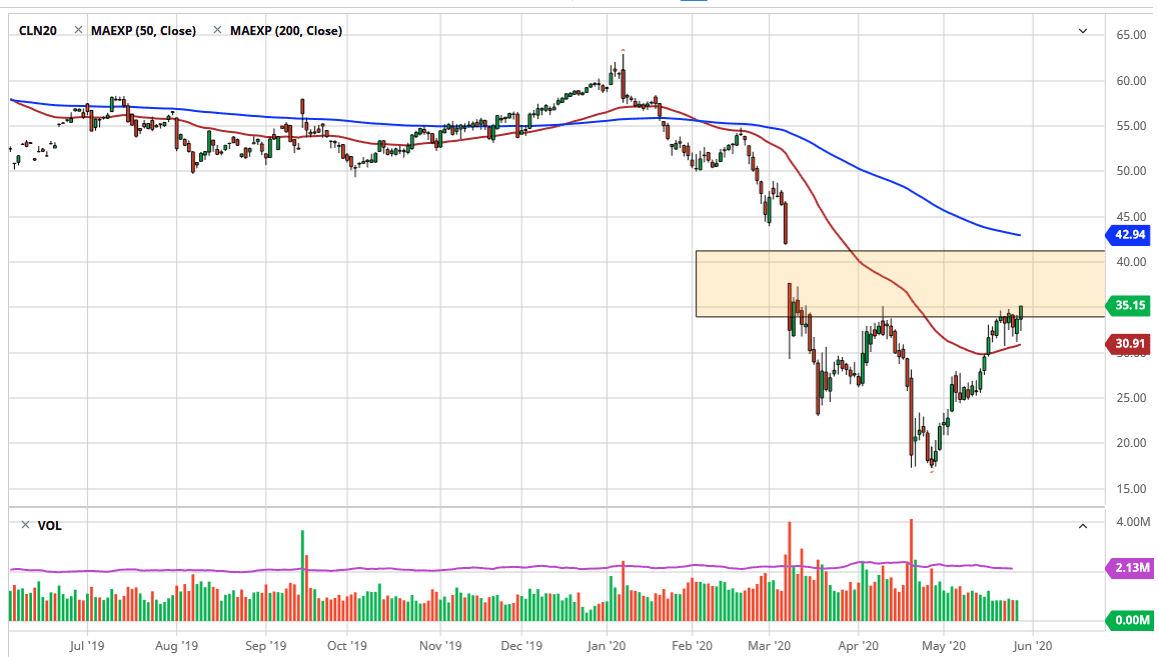

The WTI Crude Oil market has rallied after initially breaking down during the session on Friday. Ultimately, the market looks likely to continue to look at the gap above with interest, due to the fact that the market typically will fill gap given enough time. That being said, I do not know whether or not we see this market simply shoot straight up in the air or if we get the occasional pullback in order to build up the necessary momentum. I would suggest that we are more likely than not to see several pullbacks in order to build of that momentum, as it could give us a better chance of reaching all the way to the top of the gap, which is at the $41 level.

Once we get to the $41 level, it is likely that we will see the 200 day EMA come into play and it should cause some significant resistance as well. Keep in mind that the oil markets are heavily oversupplied, but there are multiple reports of a lot of rigs being closed, so that of course helps bring down some of the oversupply. That being said, it is highly likely that we will see quite a bit of volatility, but I do think that short-term pullbacks will continue to offer value the people will take advantage of.

The 50 day EMA underneath should offer support, and it is likely that buyers will look at that as an opportunity to go long again. However, if we were to break down below that level, and the $30 level which is just below there, then the market is likely to break down rather significantly. Having said that though, I do not expect that happen in the current environment, so it is likely that we are going to see an attempt to fill the major gap above. This does not mean that it is going to be easy, but it clearly looks likely to happen based upon what we have seen over the last several attempts to break this down. All of that being said, if we were to break above the 200 day EMA that would be an extraordinarily bullish sign and could send this market much higher. I doubt that happens though due to the fact that the global economy simply is not going to be pushing demand any higher.