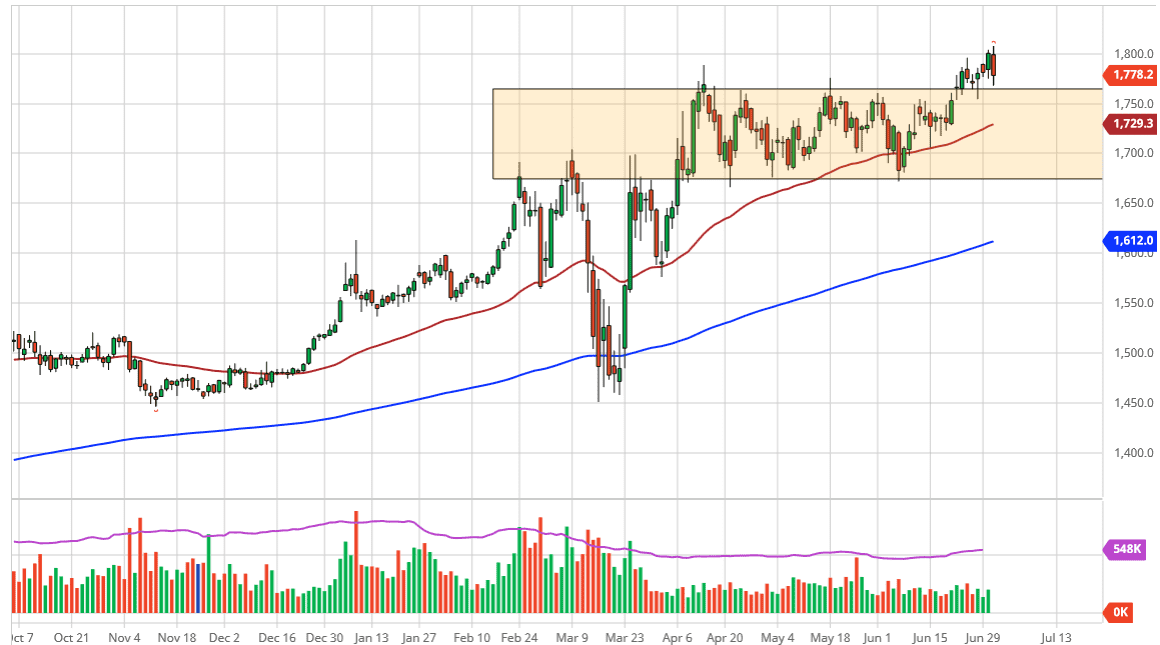

Gold markets have initially tried to rally during the trading session on Wednesday, but they have pulled back a bit moving towards a major value level. The $1775 level is an area that should be rather supportive, just as the $1750 level will as well. Even if we break down below there, it is likely that the market finds even more support down at the 50 day EMA which is closer to the $1730 level. Looking at this chart, it is an obvious uptrend and we have found massive amounts of supply at the $200 level, but it is only a matter of time before that gets left behind.

Looking at the candlestick, it is somewhat negative but the fact that we bounced a bit later in the day does help. With that, I like the idea of buying these dips although they may be somewhat short-lived, unfortunately. This means that we may not be able to pick up massive amounts of value, but clearly adding a core position to the upside should make quite a bit of sense. This will be used as a way to defend against central bank quantitative easing when it comes to the central banks trying to kill their own currencies. With this being the case, I think that gold continues to be one of the favored ways to combat that, and that has clearly not changed in the blink of an eye. Ultimately, I do believe that the market will continue to see gold try to break above the $1800 level, and the fact that we pulled back from there should not be a huge surprise.

I think at this point there is no real argument to be shorting gold, even though we have had a massive pullback during the day. There are enough moving pieces out there and negative headlines just waiting to hit that I think it is only a matter of time before gold continues to make the breakout. Even if everything goes according to plan, and the economic numbers get better, central banks are hesitant to stop the monetary policy decisions and reverse them. In other words, at the very least we are looking at inflation and that should be good for gold as it is a great way to mitigate the destructive nature of central banks and the way they are going to fight the economic malaise.