As we expected in the previous analysis, the USD/JPY performance of moving in tight ranges for several sessions is awaiting a strong move in one direction or the other and was closer to continue the downtrend as long as it was holding below the 108.00 support. This is exactly what happened, as the pair moved towards the 107.17 support before settling around the 107.24 level at the time of writing. The USD was negatively affected by the American Covid-19 cases surpassing the 3 million mark, with deaths exceeding the 130,000 mark. The US is now in the lead globally in terms of confirmed cases and death toll.

The resumption of economic activity in the country increased the pace of cases. Therefore, the US Administration strengthened testing on a national scale, as it reached 640,000 cases daily on average, from 518,000 daily cases two weeks ago. Daily confirmed cases in the US have exceeded 50,000, which almost smashes world records. The results of these tests showed a significant increase in Positive Outcome percentage, as it is at 27% in Arizona, 19% in Florida and 17% in South Carolina.

On the economic front, and with the lack of important economic data this week, focus today will be on the US weekly unemployed claims. Although it dropped from close to 7 million late March, there is more than 1 million new claims submitted every week. This does not even include workers who applied for the Temporary Federal Relief Program. Economists expect 1.4 million new claims across the U.S for the week from 28th of June to 4th of July. Maybe what is worst is that the number of people receiving aids through all local and federal government programs is close to 30 million person from the first week of May until mid-June, which is called “Continues Claims”.

US employment report, issued monthly, confirmed that the U.S economy recovered 7.5 million jobs in May and June, partially recovering more than 22 million jobs lost during the first 2 months of the epidemic. Other mixed groups of economic indicators refers to more people going back to work.

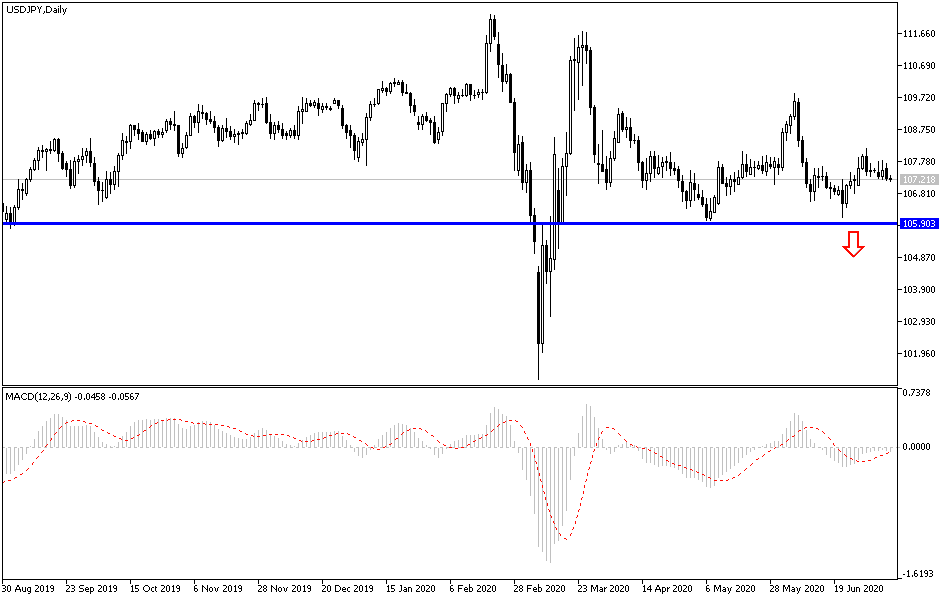

According to the technical analysis of the pair: USD/JPY bearish momentum is getting stronger around the 107.00 support, and any break below that would direct technical indicators to oversold areas, from where currency traders might think about returning to buy the pair. The closest levels for that happening are 106.85, 106.00, and 105.45. Upward, as mentioned earlier, the 110.00 physiological resistance will remain the most important for the bulls control over performance. The general trend continues to be bearish.